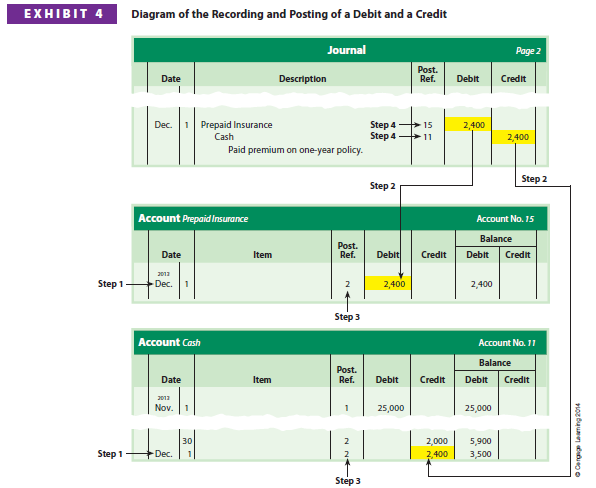

As illustrated, a transaction is first recorded in a journal. Periodically, the journal journalizing and posting of entries are transferred to the accounts in the ledger. The process of transferring the transactions to acc°unts. debits and credits from the journal entries to the accounts is called posting.

The December transactions of NetSolutions are used to illustrate posting from the journal to the ledger. By using the December transactions, an additional review of analyzing and journalizing transactions is provided.

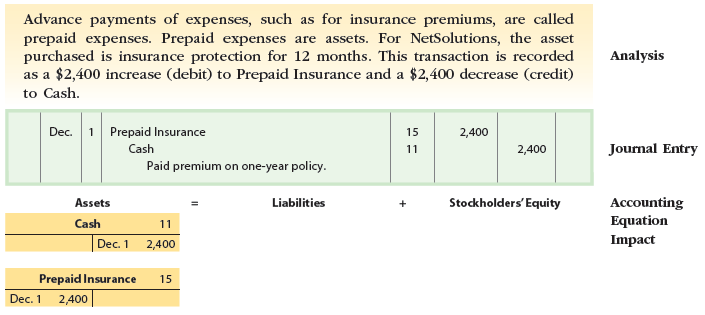

Transaction Dec. 1 NetSolutions paid a premium of $2,400 for an insurance policy for liability, theft, and fire. The policy covers a one-year period.

The posting of the preceding December 1 transaction is shown in Exhibit 4. Notice that the T account form is not used in Exhibit 4. In practice, the T account is usually replaced with a standard account form similar to that shown in Exhibit 4.

The debits and credits for each journal entry are posted to the accounts in the order in which they occur in the journal. To illustrate, the debit portion of the December 1 journal entry is posted to the prepaid account in Exhibit 4 using the following four steps:

Step 1. The date (Dec. 1) of the journal entry is entered in the Date column of Prepaid Insurance.

Step 2. The amount (2,400) is entered into the Debit column of Prepaid Insurance.

Step 3. The journal page number (2) is entered in the Posting Reference (Post. Ref.) column of Prepaid Insurance.

Step 4. The account number (15) is entered in the Posting Reference (Post. Ref.) column in the journal.

As shown in Exhibit 4, the credit portion of the December 1 journal entry is posted to the cash account in a similar manner.

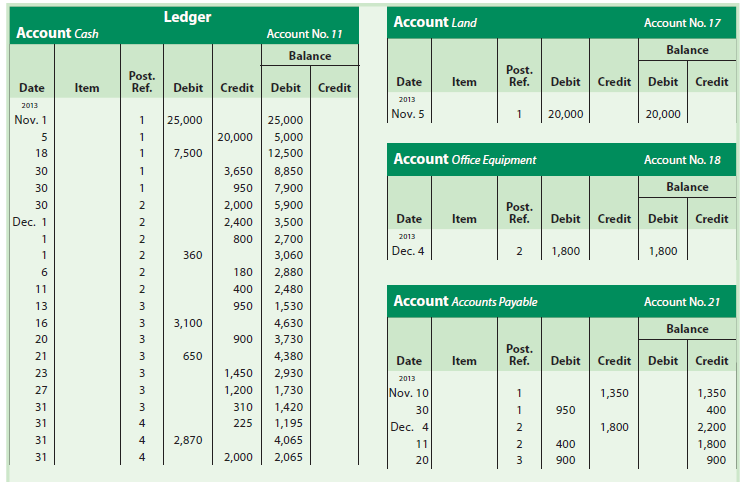

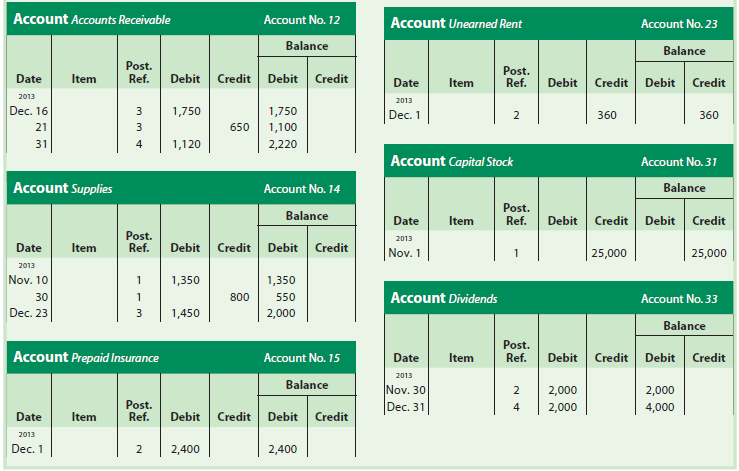

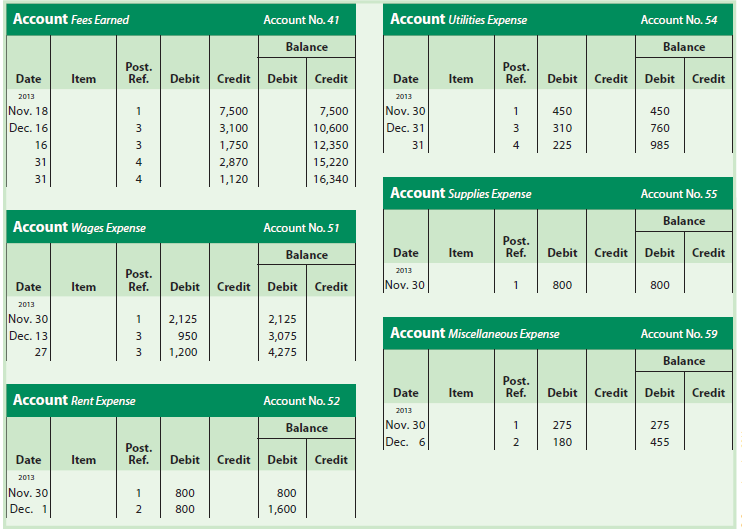

The remaining December transactions for NetSolutions are analyzed and journalized in the following paragraphs. These transactions are posted to the ledger in Exhibit 5 on pages 69–70. To simplify, some of the December transactions are stated in summary form. For example, cash received for services is normally recorded on a daily basis. However, only summary totals are recorded at the middle and end of the month for NetSolutions.

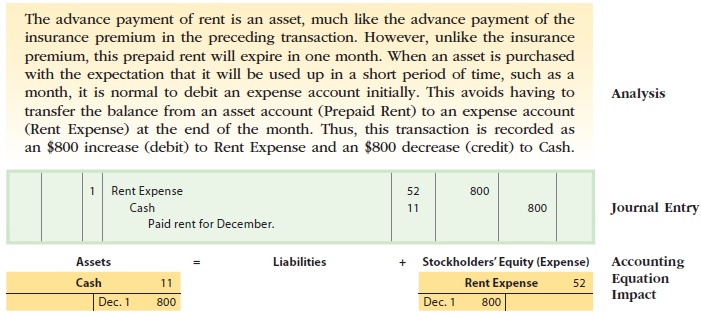

Transaction Dec. 1 NetSolutions paid rent for December, $800. The company from which NetSolutions is renting its office space now requires the payment of rent on the first of each month, rather than at the end of the month.

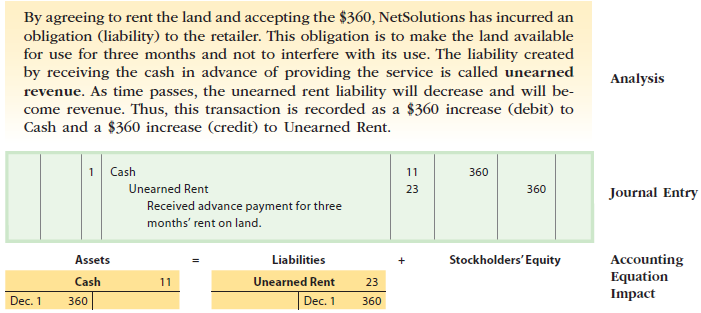

Transaction Dec. 1 NetSolutions received an offer from a local retailer to rent the land purchased on November 5. The retailer plans to use the land as a parking lot for its employees and customers. NetSolutions agreed to rent the land to the retailer for three months, with the rent payable in advance. NetSolutions received $360for three months’ rent beginning December 1.

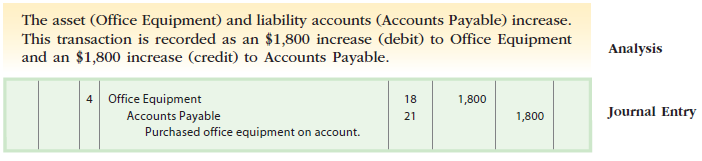

Transaction Dec. 4 NetSolutions purchased office equipment on account from Executive Supply Co. for $1,800.

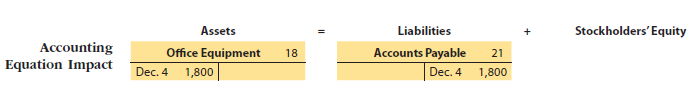

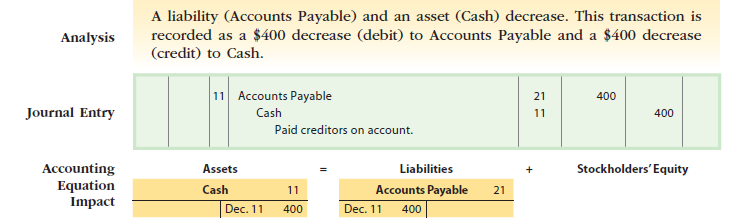

Transaction Dec. 6 NetSolutions paid $180 for a newspaper advertisement.

An expense increases, and an asset (Cash) decreases. Expense items that are expected to be minor in amount are normally included as part of the miscellaneous expense. This transaction is recorded as a $180 increase (debit) to Miscellaneous Expense and a $180 decrease (credit) to Cash.

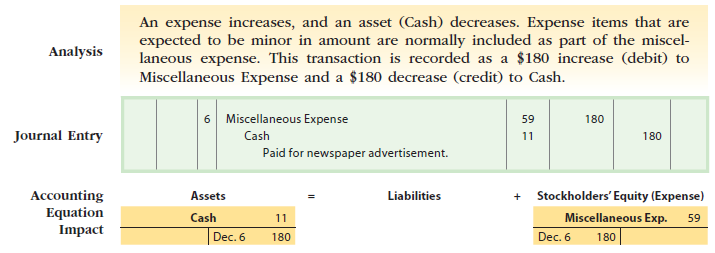

Transaction Dec. 11 NetSolutions paid creditors $400.

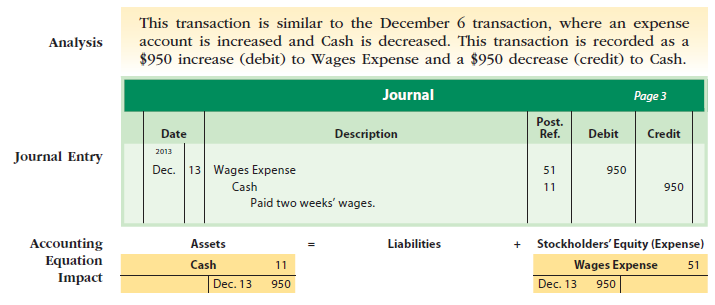

Transaction Dec. 13 NetSolutions paid a receptionist and a part-time assistant $950for two weeks’ wages.

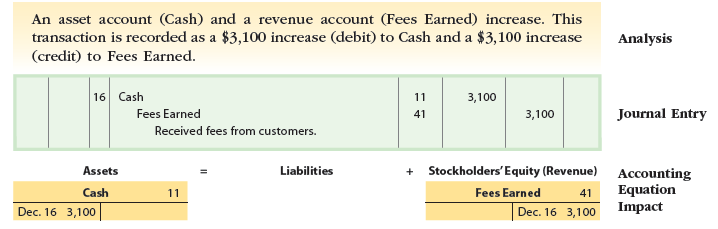

Transaction Dec. 16 NetSolutions received $3,100 from fees earned for the first half of December.

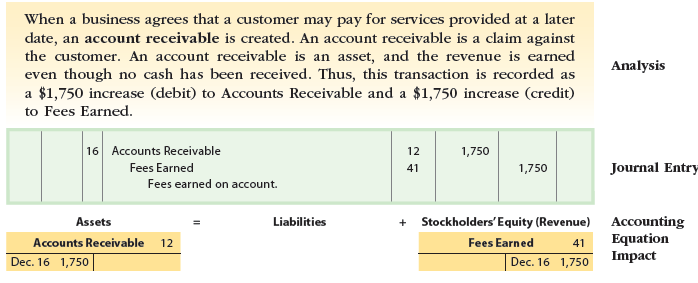

Transaction Fees earned on account totaled $1,750 for the first half of December.

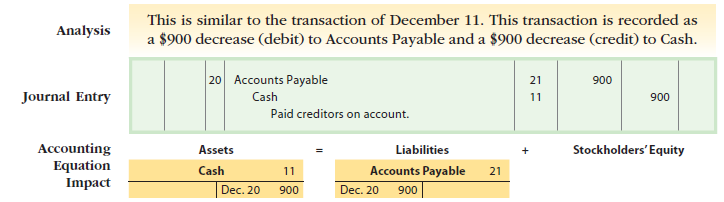

Transaction Dec. 20 NetSolutions paid $900 to Executive Supply Co. on the $1,800 debt owed from the December 4 transaction.

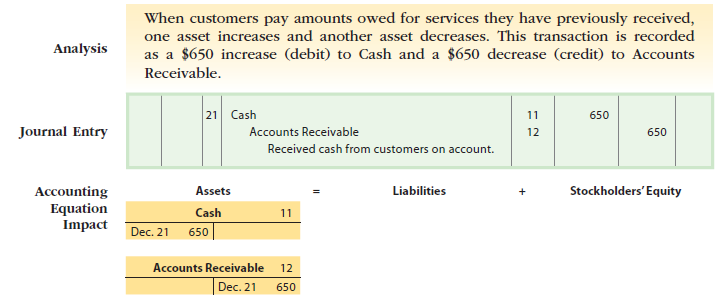

Transaction Dec. 21 NetSolutions received $650 from customers in payment of their accounts.

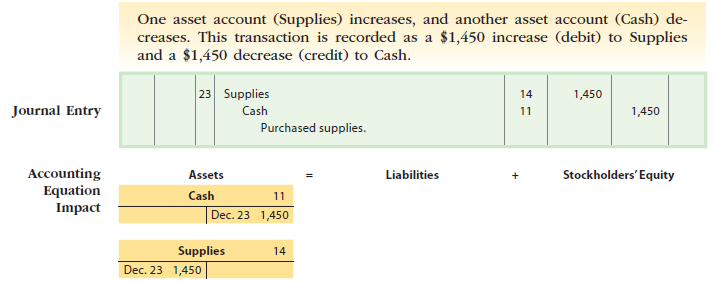

Transaction Dec. 23 NetSolutions paid $1,450for supplies.

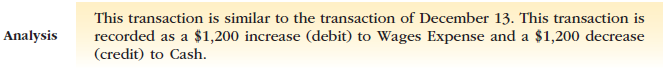

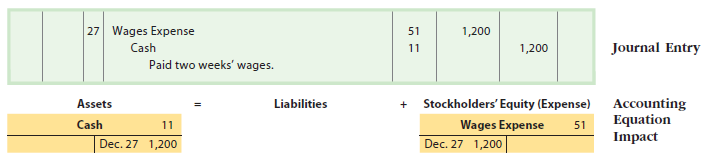

Transaction Dec. 27 NetSolutions paid the receptionist and the part-time assistant $1,200 for two weeks’ wages.

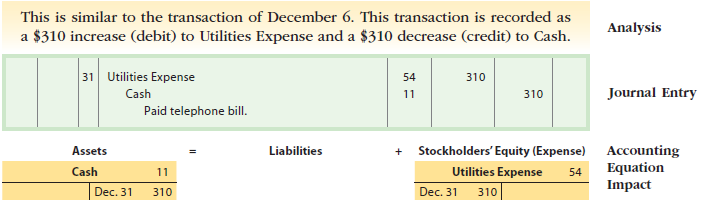

Transaction Dec. 31 NetSolutions paid its $310 telephone bill for the month.

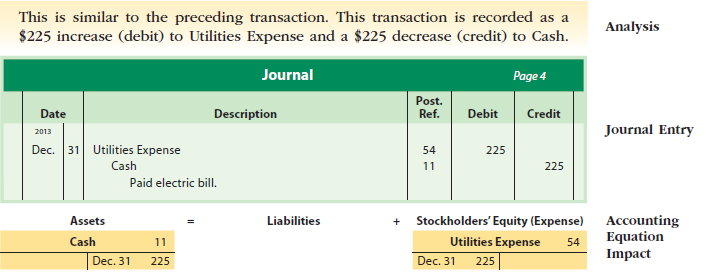

Transaction Dec. 31 NetSolutions paid its $225 electric bill for the month.

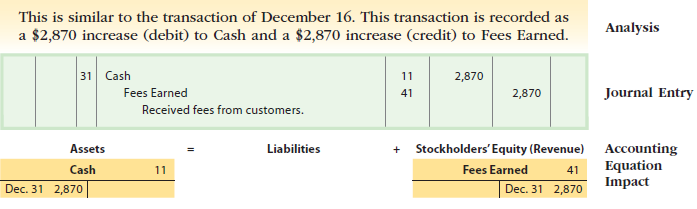

Transaction Dec. 31 NetSolutions received $2,870 from fees earned for the second half of December.

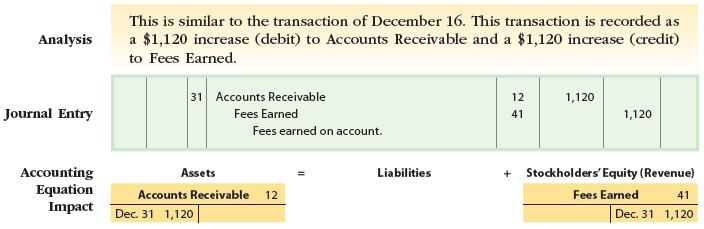

Transaction Dec. 31 Fees earned on account totaled $1,120 for the second half of December.

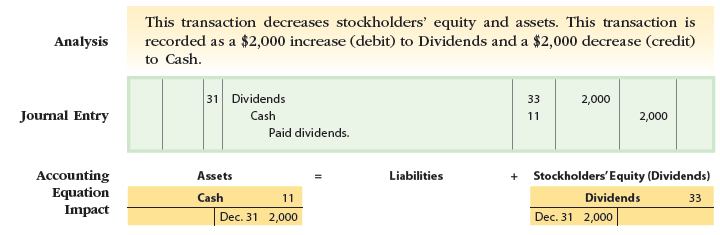

Transaction Dec. 31 Paid dividends of $2,000.

Exhibit 5 shows the ledger for NetSolutions after the transactions for both November and December have been posted.

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

I saw a lot of website but I think this one has something extra in it in it

You’ve been terrific to me. Thank you!

It was really helpful to read an article like this one, because it helped me learn about the topic.

Thank you for writing such an excellent article, it helped me out a lot and I love studying this topic.

Thank you for sharing this article with me. It helped me a lot and I love it.

Thanks for posting such an excellent article. It helped me a lot and I love the subject matter.

Thanks for your help and for writing this post. It’s been great.

You’ve been a great aid to me. You’re welcome!

It?s really a great and useful piece of info. I am satisfied that you shared this helpful information with us. Please keep us up to date like this. Thank you for sharing.