Debt and equity securities are financial assets that are often traded on public exchanges such as the New York Stock Exchange. As a result, their market value can be observed and, thus, objectively determined. For this reason, generally accepted accounting principles (GAAP) allows some debt securities, and requires equity securities where there is less than a 20% ownership interest to be valued in the accounting records and financial statements at their fair market values.

These securities are classified as follows:

- Trading securities

- Available-for-sale securities

- Held-to-maturity securities

1. Trading Securities

Trading securities are debt and equity securities that are purchased to earn shortterm profits from changes in their market prices. Trading securities are often held by banks, mutual funds, insurance companies, and other financial institutions.

Since trading securities are held as a short-term investment, they are reported as a current asset on the balance sheet. Trading securities are valued as a portfolio (group) of securities using the securities’ fair values. Fair value is the market price that the company would receive for a security if it were sold. A change in the fair value of the portfolio (group) of trading securities is recognized as an unrealized gain or loss for the period.

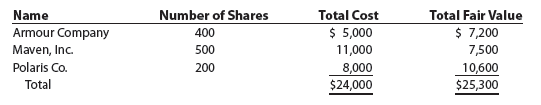

To illustrate, assume Maggie Company purchased a portfolio of trading securities during 2014. On December 31, 2014, the cost and fair values of the securities were as follows:

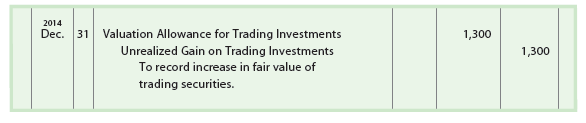

The portfolio of trading securities is reported at its fair value of $25,300. An adjusting entry is made to record the increase in the fair value of $1,300 ($25,300 – $24,000). In order to maintain a record of the original cost of the securities, a valuation account, called Valuation Allowance for Trading Investments, is debited for $1,300, and Unrealized Gain on Trading Investments is credited for $1,300.[1] The adjusting entry on December 31, 2014, to record the fair value of the portfolio of trading securities is shown below.

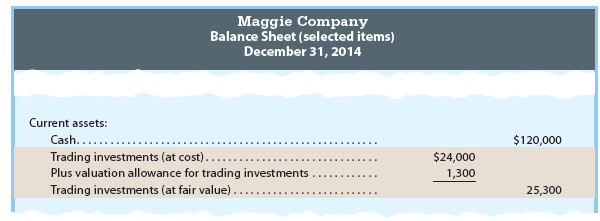

Unrealized Gain on Trading Investments is reported on the income statement. Depending on its significance, it may be reported separately or as Other income on the income statement. The valuation allowance is reported on the December 31, 2014, balance sheet as follows:

If the fair value of the portfolio of trading securities was less than the cost, then the adjustment would debit Unrealized Loss on Trading Investments and credit Valuation Allowance for Trading Investments for the difference. Unrealized Loss on Trading Investments would be reported on the income statement as Other expenses. Valuation Allowance for Trading Investments would be shown on the balance sheet as a deduction from Trading Investments (at cost).

Over time, the valuation allowance account is adjusted to reflect the difference between the cost and the fair value of the portfolio. Thus, increases in the valuation allowance account from the beginning of the period will result in an adjustment to record an unrealized gain, similar to the journal entry illustrated above. Likewise, decreases in the valuation allowance account from the beginning of the period will result in an adjustment to record an unrealized loss.

2. Available-for-Sale Securities

Available-for-sale securities are debt and equity securities that are neither held for trading, held to maturity, nor held for strategic reasons. The accounting for available- for-sale securities is similar to the accounting for trading securities, except for the reporting of changes in fair values. Specifically, changes in the fair values of trading securities are reported as an unrealized gain or loss on the income statement. In contrast, changes in the fair values of available-for-sale securities are reported as part of stockholders’ equity and, thus, excluded from the income statement.

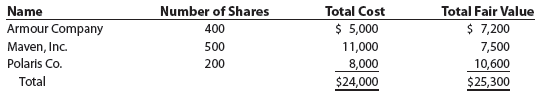

To illustrate, assume that Maggie Company purchased the three securities during 2014 as available-for-sale securities instead of trading securities. On December 31, 2014, the cost and fair values of the securities were as follows:

The portfolio of available-for-sale securities is reported at its fair value of $25,300. An adjusting entry is made to record the increase in fair value of $1,300 ($25,300 – $24,000). In order to maintain a record of the original cost of the securities, a valuation account, called Valuation Allowance for Available-for-Sale Investments, is debited for $1,300. This account is similar to the valuation account used for trading securities.

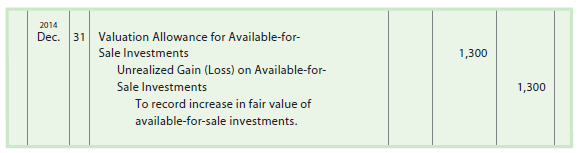

Unlike trading securities, the December 31, 2014, adjusting entry credits a stockholders’ equity account instead of an income statement account.[2] The $1,300 increase in fair value is credited to Unrealized Gain (Loss) on Available-for-Sale Investments.

The adjusting entry on December 31, 2014, to record the fair value of the portfolio of available-for-sale securities is as follows:

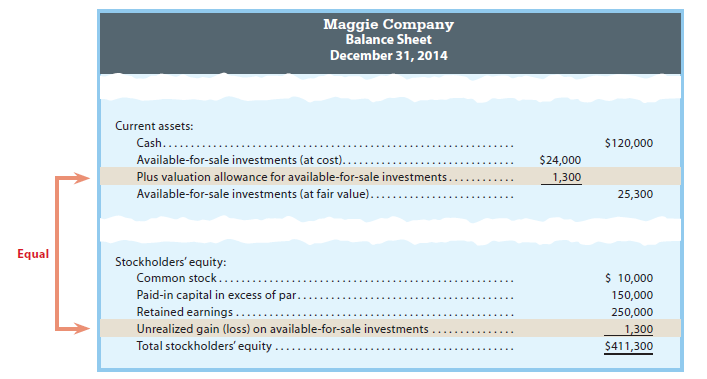

A credit balance in Unrealized Gain (Loss) on Available-for-Sale Investments is added to stockholders’ equity, while a debit balance is subtracted from stockholders’ equity.

The valuation allowance and the unrealized gain are reported on the December 31, 2014, balance sheet as follows:

As shown above, Unrealized Gain (Loss) on Available-for-Sale Investments is reported as an addition to stockholders’ equity. In future years, the cumulative effects of unrealized gains and losses are reported in this account. Since 2014 was the first year that Maggie Company purchased available-for-sale securities, the unrealized gain is reported as the balance of Unrealized Gain (Loss) on Available-for-Sale Investments. This treatment is supported under the theory that available-for-sale securities will be held longer than trading securities, so changes in fair value over time have a greater opportunity to cancel out. Thus, these changes are not reported on the income statement, as is the case with trading securities.

If the fair value was less than the cost, then the adjustment would debit Unrealized Gain (Loss) on Available-for-Sale Investments and credit Valuation Allowance for Available-for-Sale Investments for the difference. Unrealized Gain (Loss) on Trading Investments would be reported in the Stockholders’ Equity section as a negative item. Valuation Allowance for Available-for-Sale Investments would be shown on the balance sheet as a deduction from Available-for-Sale Investments (at cost).

Over time, the valuation allowance account is adjusted to reflect the difference between the cost and the fair value of the portfolio. Thus, increases in the valuation allowance from the beginning of the period will result in an adjustment to record an increase in the valuation and unrealized gain (loss) accounts, similar to the journal entry illustrated earlier. Likewise, decreases in the valuation allowance from the beginning of the period will result in an adjustment to record decreases in the valuation and unrealized gain (loss) accounts.

3. Held-to-Maturity Securities

Held-to-maturity securities are debt investments, such as notes or bonds, that a company intends to hold until their maturity date. Held-to-maturity securities are primarily purchased to earn interest revenue.

If a held-to-maturity security will mature within a year, it is reported as a current asset on the balance sheet. Held-to-maturity securities maturing beyond a year are reported as noncurrent assets.

Only securities with maturity dates, such as corporate notes and bonds, are classified as held-to-maturity securities. Equity securities are not held-to-maturity securities because they have no maturity date.

Held-to-maturity bond investments are recorded at their cost, including any brokerage commissions, as illustrated earlier in this chapter. If the interest rate on the bonds differs from the market rate of interest, the bonds may be purchased at a premium or discount. In such cases, the premium or discount is amortized over the life of the bonds.

Held-to-maturity bond investments are reported on the balance sheet at their amortized cost. The accounting for held-to-maturity investments, including premium and discount amortization, is described in advanced accounting texts.

4. Summary

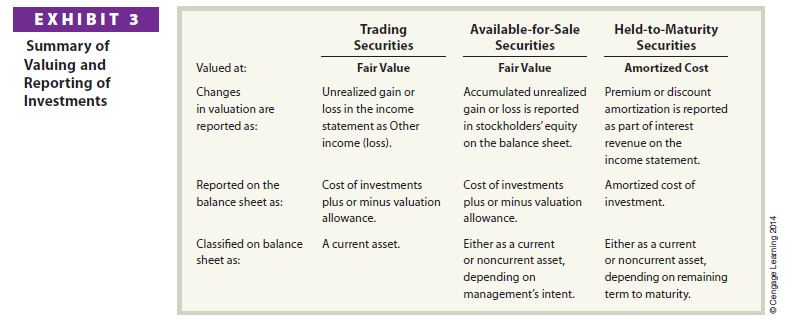

Exhibit 3 summarizes the valuation and balance sheet reporting of trading, available- for-sale, and held-to-maturity securities.

Common stock investments in trading and available-for-sale securities are normally less than 20% of the outstanding common stock of the investee. The portfolios are reported at fair value using the valuation allowance account, while the individual securities are accounted for using the cost method. Investments between 20% and 50% of the outstanding common stock of the investee are accounted for using the equity method illustrated earlier in this chapter. Equity method investments are classified as noncurrent assets on the balance sheet. Moreover, such investments are permitted to be valued using fair values. To simplify, it is assumed that the investor does not elect this option.

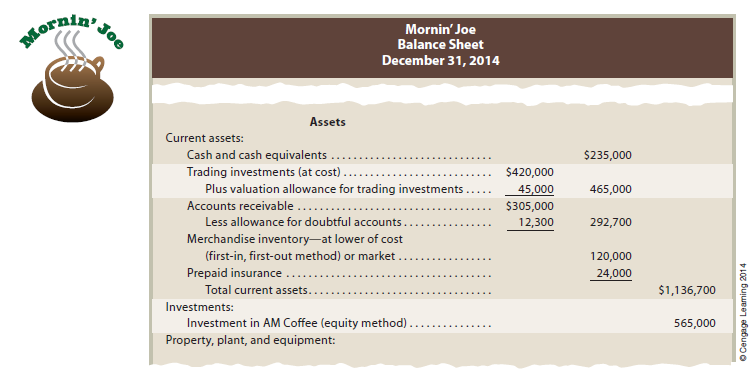

The balance sheet reporting for the investments of Mornin’ Joe is shown below.

Mornin’ Joe invests in trading securities and does not have investments in held- to-maturity or available-for-sale securities. Mornin’ Joe also owns 40% of AM Coffee Corporation, which is accounted for using the equity method. Mornin’ Joe intends to keep its investment in AM Coffee indefinitely for strategic reasons; thus, its investment in AM Coffee is classified as a noncurrent asset. Such investments are normally reported before property, plant, and equipment.

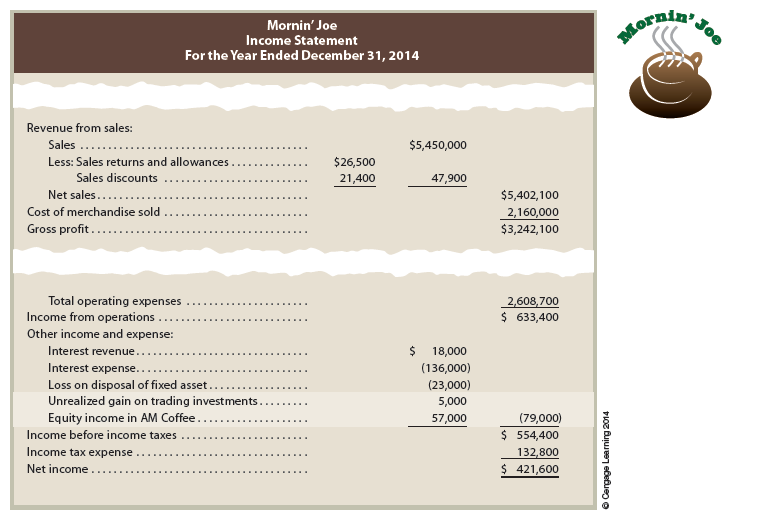

Mornin’ Joe reported an Unrealized Gain on Trading Investments of $5,000 and Equity Income in AM Coffee of $57,000 in the Other Income and Expense section of its income statement, as shown below.

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

Good – I should definitely pronounce, impressed with your web site. I had no trouble navigating through all tabs and related information ended up being truly easy to do to access. I recently found what I hoped for before you know it at all. Reasonably unusual. Is likely to appreciate it for those who add forums or something, site theme . a tones way for your client to communicate. Excellent task.