According to Porter, the business of a firm can best be described as a value chain, in which total revenues minus total costs of all activities undertaken to develop and market a product or service yields value.31 All firms in a given industry have a similar value chain, which includes activities such as obtaining raw materials, designing products, building manufacturing facilities, developing cooperative agreements, and providing customer service. A firm will be profitable so long as total revenues exceed the total costs incurred in creating and delivering the product or service. Firms should strive to understand not only their own value chain operations but also those of their competitors, suppliers, and distributors.

Value chain analysis (VCA) refers to the process whereby a firm determines the costs associated with organizational activities from purchasing raw materials to manufacturing product(s) to marketing those products. Value chain analysis aims to identify where low-cost advantages or disadvantages exist anywhere along the value chain from raw material to customer service activities. The VCA process can enable a firm to better identify its own strengths and weaknesses, especially as compared to competitors’ value chain analyses and their own data examined over time.

Substantial judgment may be required in performing a VCA because different items along the value chain may impact other items positively or negatively, at times creating complex interrelationships. For example, exceptional customer service may be especially expensive yet may reduce the costs of returns and increase revenues. Cost and price differences among rival firms can have their origins in activities performed by suppliers, distributors, creditors, or even shareholders. The initial step in implementing VCA is to divide a firm’s operations into specific activities or business processes. Then the analyst attempts to attach a cost to each discrete activity; the costs could be in terms of both time and money. Finally, the analyst converts the cost data into information by looking for competitive cost strengths and weaknesses that may yield competitive advantage or disadvantage. Conducting a value chain analysis is supportive of the research-based view’s examination of a firm’s assets and capabilities as sources of distinctive competence.

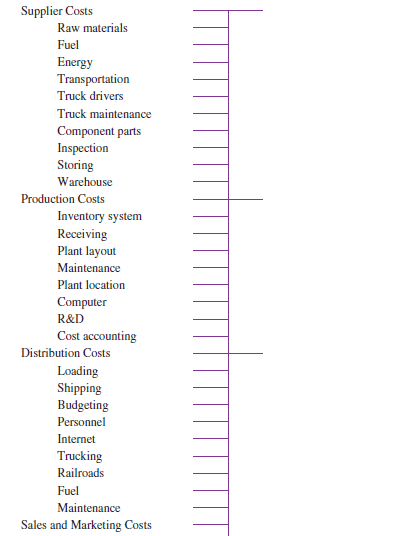

When a major competitor or new market entrant offers products or services at low prices, this may be because that firm has substantially lower value chain costs or perhaps the rival firm is just waging a desperate attempt to gain sales or market share. Thus, VCA can be critically important for a firm in monitoring whether its prices and costs are competitive. An example value chain is illustrated in Figure 4-7. There can be more than a hundred particular value-creating activities associated with the business of producing and marketing a product or service, and each one of the activities can represent a competitive advantage or disadvantage for the firm. The combined costs of all the various activities in a company’s value chain define the firm’s cost of doing business. Firms should determine where cost advantages and disadvantages in their value chain occur relative to the value chain of rival firms.

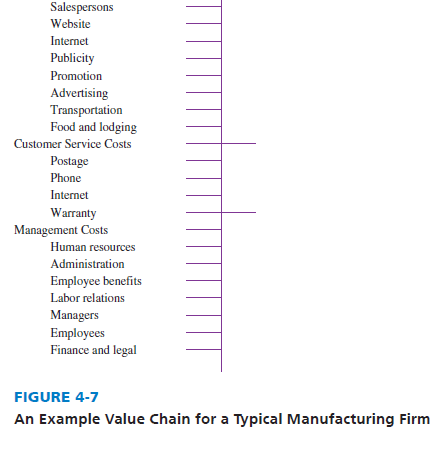

Value chains differ immensely across industries and firms. Whereas a paper products company, such as Stone Container, would include on its value chain timber farming, logging, pulp mills, and papermaking, a company such as Hewlett-Packard would include programming, peripherals, software, hardware, and laptops. A motel would include food, housekeeping, check-in and check-out operations, website, reservations system, and so on. However, all firms should use value chain analysis to develop and nurture a core competence and convert this competence into a distinctive competence. A core competence is a VCA that a firm performs especially well. When a core competence evolves into a major competitive advantage, then it is called a distinctive competence. Figure 4-8 illustrates this process.

More and more companies are using VCA to gain and sustain competitive advantage by being especially efficient and effective along various parts of the value chain. For example, Walmart has built powerful value advantages by focusing on exceptionally tight inventory control and volume purchasing of products. In contrast, computer companies compete aggressively along the distribution end of the value chain. Price competitiveness is a key component of competitiveness for both mass retailers and computer firms.

1. Benchmarking

Benchmarking is an analytical tool used to determine whether a firm’s value chain analysis is competitive compared to those of rivals and thus conducive to winning in the marketplace. Benchmarking entails measuring costs of value chain activities across an industry to determine “best practices” among competing firms for the purpose of duplicating or improving on those best practices. Benchmarking enables a firm to take action to improve its competitiveness by identifying (and improving on) value chain activities where rival firms have comparative advantages in cost, service, reputation, or operation.

A comprehensive survey on benchmarking was recently commissioned by the Global Benchmarking Network, a network of benchmarking centers representing 22 countries. More than 450 organizations responded from over 40 countries. Here are two important results:

- Mission and vision statements along with customer (client) surveys are the most used (77 percent of organizations) of 20 improvement tools, followed by SWOT (strengths, weaknesses, opportunities, threats) analysis (72 percent), and informal benchmarking (68 percent). Performance benchmarking was used by 49 percent and best practice benchmarking was used by 39 percent of respondents.

- The tools that are likely to increase the most in popularity over the next 3 years are performance benchmarking, informal benchmarking, SWOT, and best practice benchmarking. More than 60 percent of organizations not currently using these tools indicated they are likely to use them in the next 3 years.32

The hardest part of benchmarking can be gaining access to other firms’ value chain analyses with associated costs. typical sources of benchmarking information, however, include published reports, trade publications, suppliers, distributors, customers, partners, creditors, shareholders, lobbyists, and willing rival firms. Some rival firms share benchmarking data. However, the International Benchmarking Clearinghouse provides guidelines to help ensure that restraint of trade, price fixing, bid rigging, bribery, and other improper business conduct do not arise between participating firms.

Source: David Fred, David Forest (2016), Strategic Management: A Competitive Advantage Approach, Concepts and Cases, Pearson (16th Edition).

Hi , I do believe this is an excellent blog. I stumbled upon it on Yahoo , i will come back once again. Money and freedom is the best way to change, may you be rich and help other people.