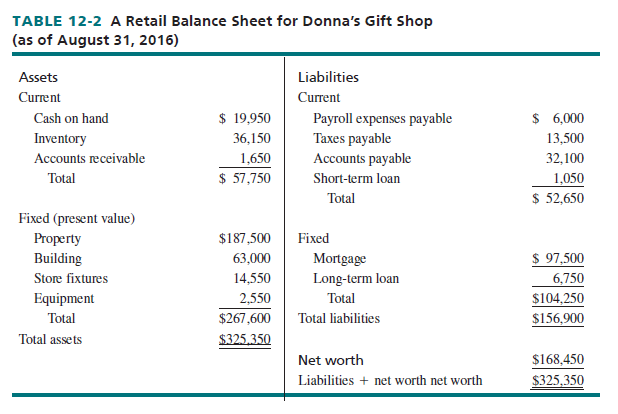

Each retailer has assets to manage and liabilities to control. This section covers the balance sheet, the strategic profit model, and other ratios. A balance sheet itemizes a retailer’s assets, liabilities, and net worth at a specific time—based on the principle that Assets = Liabilities + Net worth. Table 12-2 has a balance sheet for Donna’s Gift Shop.

Assets are any items a retailer owns with a monetary value. Current assets are cash on hand (or in the bank) and items readily converted to cash, such as inventory on hand and accounts receivable (amounts owed to the firm). Fixed assets are property, buildings (a store, warehouse, etc.), fixtures, and equipment such as cash registers and trucks; these are used for a long period. The major fixed asset for many retailers is real-estate. Unlike current assets, which are recorded at cost, fixed assets are recorded at cost less accumulated depreciation. Thus, records may not reflect the true value of these assets. Many retailing analysts use the term hidden assets to describe depreciated assets, such as buildings and warehouses, that are noted on a retail balance sheet at low values relative to their actual worth.

Liabilities are financial obligations a retailer incurs in operating a business. Current liabilities are payroll expenses payable, taxes payable, accounts payable (amounts owed to suppliers), and short-term loans; these must be paid in the coming year. Fixed liabilities comprise mortgages and long-term loans; these are generally repaid over several years.

A retailer’s net worth is computed as assets minus liabilities. It is also called owner’s equity and represents the value of a business after deducting all financial obligations.

In operations management, the retailer’s goal is to use its assets in the manner providing the best results possible. There are three basic ways to measure those results: net profit margin, asset turnover, and financial leverage. Each component is discussed next.

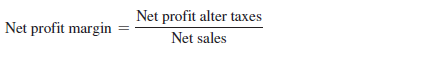

Net profit margin is a performance measure based on a retailer’s net profit and net sales:

At Donna’s Gift Shop, fiscal year 2016 net profit margin was 5.83 percent—a very good percentage for a gift shop. To enhance its net profit margin, a retailer must either raise gross profit as a percentage of sales or reduce expenses as a percentage of sales.1 It could lift gross profit by purchasing opportunistically, selling exclusive products, avoiding price competition through excellent service, and adding items with higher margins. It could reduce operating costs by stressing self-service, lowering labor costs, refinancing the mortgage, cutting energy costs, and so on. The firm must be careful not to lessen customer service to the extent that sales and profit would decline.

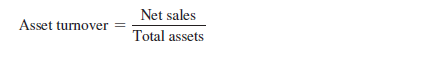

Asset turnover is a performance measure based on a retailer’s net sales and total assets:

Donna’s Gift Shop had a very low asset turnover, 1.0143—meaning it averaged $1.01 in sales per dollar of total assets. To improve the asset turnover ratio, a firm must generate increased sales from the same level of assets or keep the same sales with fewer assets. A firm might increase sales by having longer hours, accepting online orders, training employees to sell additional products, or stocking better-known brands. None of these tactics requires expanding the asset base. Or a firm might maintain its sales on a lower asset base by moving to a smaller store, simplifying fixtures (or having suppliers install fixtures), keeping a lower inventory, and negotiating for the property owner to pay part of the costs of a renovation.

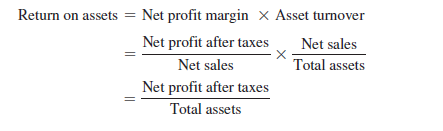

By looking at the relationship between net profit margin and asset turnover, return on assets (ROA) can be computed:

Donna’s Gift Shop had an ROA of 5.9 percent (0.0583 X 1.0143 = 0.059). This return is below average for gift stores; the good net profit margin does not adequately offset low asset turnover.

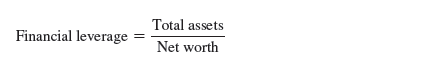

Financial leverage is a performance measure based on the relationship between a retailer’s total assets and net worth:

Donna’s Gift Shop’s financial leverage ratio was 1.9314. Assets were just under twice the net worth, and total liabilities and net worth were almost equal. This ratio was slightly lower than the average for gift stores (a conservative group). The store is in no danger.

A retailer with a high financial leverage ratio has substantial debt. A ratio of 1 means it has no debt—assets equal net worth. If the ratio is too high, there may be an excessive focus on costcutting and short-run sales so as to make interest payments, net profit margins may suffer, and a firm may be forced into bankruptcy if debts cannot be paid. When financial leverage is low, a retailer may be overly conservative—limiting its ability to renovate and expand existing stores and to enter new markets. Leverage is too low if the owner’s equity is relatively high; equity could be partly replaced by increasing short- and long-term loans and/or accounts payable. Some equity funds could be taken out of a business by the owner (stockholders, if a public firm).

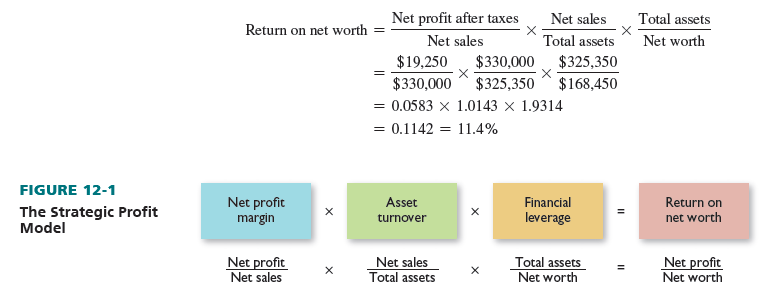

1. The Strategic Profit Model

The relationship among net profit margin, asset turnover, and financial leverage is expressed by the strategic profit model, which reflects a performance measure known as return on net worth (RONW). See Figure 12-1. The strategic profit model can be used to plan and/or control assets. Thus, a retailer could learn the major cause of its poor return on net worth is weak asset turnover or financial leverage that is too low. A firm can raise its return on net worth by lifting the net profit margin, asset turnover, or financial leverage. Because these measures are multiplied to determine return on net worth, doubling any of them would double the return on net worth.

This is how the strategic profit model can be applied to Donna’s Gift Shop:

Overall, Donna’s return on net worth was above average for gift stores.

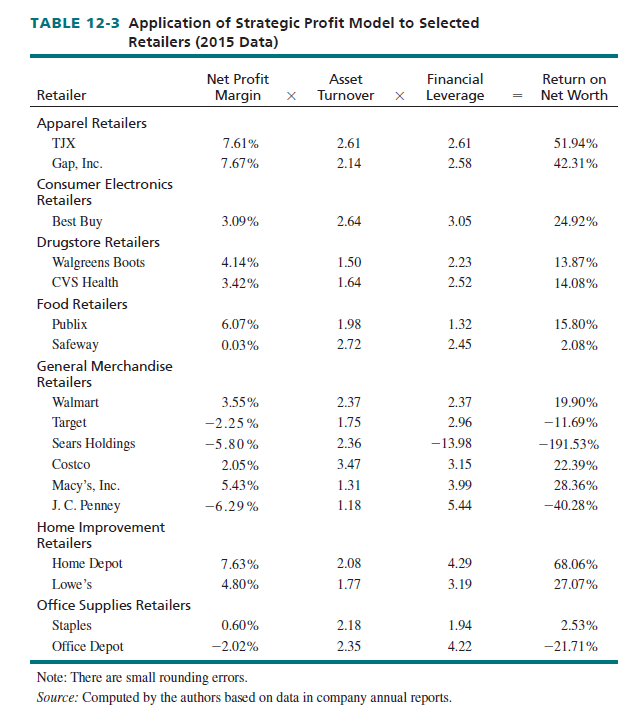

Table 12-3 applies the strategic profit model to various retailers. It is best to compare firms within given retail categories. For example, net profit margins of general merchandise retailers have historically been higher than those of food retailers. Because financial performance differs each year, caution is advised in studying these data. Furthermore, the individual components of the strategic profit model must be analyzed, not just the return on net worth. For example,

- TJX had the highest return on net worth among all 17 retailers shown in Table 12-3. Its net profit margin was slightly lower than Gap, Inc., but its asset turnover was quite strong. TJX was also slightly more financially leveraged than Gap, Inc.

- Sears Holdings (including Sears and Kmart) had a very weak return on net worth. Its financial leverage and profit margin were especially weak.

- Staples outperformed Office Depot. It had a stronger profit margin and was not as leveraged.

2. Other Key Business Ratios

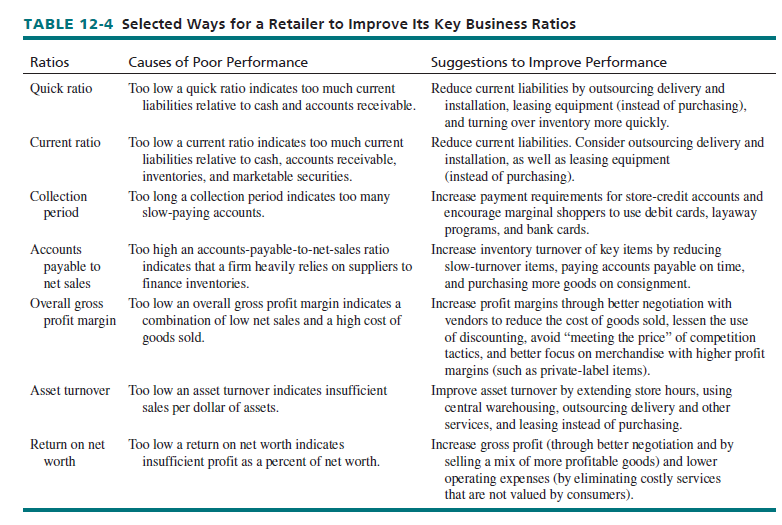

Additional ratios can also measure retailer success or failure in reaching performance goals. Here are several key business ratios—besides those covered in the preceding discussion:

- Quick ratio: Cash plus accounts receivable divided by total current liabilities, those due within one year. A ratio above 1-to-1 means the firm is liquid and can cover short-term debt.

- Current ratio: Total current assets (cash, accounts receivable, inventories, and marketable securities) divided by total current liabilities. A ratio of 2-to-1 or more is good.

- Collection period:Acounts receivable divided by net sales and then multiplied by 365. If most sales are on credit, a collection period one-third or more over normal terms (such as 40.0 for a store with 30-day credit terms) means slow-turning receivables.

- Accounts payable to net sales: Accounts payable divided by annual net sales. This compares how a retailer pays suppliers relative to volume transacted. A figure above the industry average indicates that a firm relies on suppliers to finance operations.

- Overall gross profit:Net sales minus the cost of goods sold and then divided by net sales. This companywide average includes markdowns, discounts, and shortages.2

For any retailer, large or small, the goal is to do as well as possible on these key business ratios. Areas of weakness must be identified and corrected for the firm to enhance its long-term results—and to avoid negative financial results. Table 12-4 describes ways to improve performance for each of the preceding ratios, as well as asset turnover and return on net worth.

3. Financial Trends in Retailing

Several trends relating to asset management merit discussion: the state of the economy; funding sources (including initial public offerings); mergers, consolidations, and spin-offs; bankruptcies and liquidations; and questionable accounting and financial reporting practices.

Many retailers are affected by the strength or weakness of the economy. During a strong economy, high consumer demand may mask retailer weaknesses. But when the economy is weak, sales stagnate, cash flow problems may occur, heavy markdowns may be needed (which cut profit margins), consumers are more reluctant to buy big-ticket items, and public firms may see their stock prices adversely affected.

The housing recession in 2008 and the shallow economic recovery that followed saw deep discounting by retailers to lure customers to stores and malls in order to increase revenues, which hurt profitability. It also conditioned shoppers to expect discounts every time they purchased or they would not shop at all. Many people have remained frugal despite the recovery and continue to trade down to lower-priced retailers, online retailing, and off-price and discount stores.3 The disruptive effect of online retailing has further eroded retailer profitability. To stay competitive, many retailers are making investments in upgraded supply chains, digital marketing, information technology (both in-store and systemwide), and logistics to implement omnichannel strategies.4 Margins remain under pressure from discounting, free shipping, price matching, greater expenses for ads, the high level of online returns, and expanded store hours.

Three sources offunding are important to retailers. First, because interest rates have remained low, many firms have sought to refinance their mortgages and leases—which can dramatically decrease their monthly payments. Even though funding has sometimes been tight, due to the tougher restrictions imposed by the financial markets, retailers retained some leverage. The weak economy led to many retail store vacancies and the rental marketplace has still not fully bounced back. Further, prior to the recession, retail developers overbuilt, which created even more vacancies. Although commercial property prices have been steadily increasing since 2008, they have now started to plateau despite tight supply.5

Second, shopping center developers often use a retail real-estate investment trust (REIT) to fund construction. With this strategy, investors buy shares in a REIT as they would a stock. Until the 2008 recession, investors favored REITs because property had historically been a good investment. Then, during the worst of the economic decline, many REITs struggled and their value fell. Nonetheless, the long-term forecast for REITs is good. Most REITS own strip malls and suburban shopping centers that fare better during recessions than tied to apartments or office space, and they typically have higher returns when domestic consumer spending rise. The limited supply of shopping center space in choice areas, the ability to raise rents, and the safe and relatively high yields of 2 to 4 percent that a typical REIT investor gets make them a desired investment vehicle.6

Third, a funding source that has gained retailing acceptance over the past 30 years is the initial public offering (IPO), whereby a privately-owned firm raises money by becoming public and selling stock. An IPO is typically used to fund expansion. What do investors look for in an IPO? Retailers with sustained high growth rates or profitability or preferably both, with unique goods or services, in markets with high barriers to entry are more likely to succeed. Retailers preparing to go public need to weigh the risks of public scrutiny of strategies, actions, and security regulations versus the rewards of such a move. In considering an IPO, retailers need to look beyond the current business landscape and evaluate the long-term profitability of being publicly traded. Despite a lackluster IPO market in 2015, retail IPOs performed better than the market average with such firms as Duluth Holdings, Etsy, Ollie’s Bargain Outlet Holdings, Shopify, and Xcel going public.7

Mergers and consolidations represent a way for retailers to add to their asset base without building new facilities or waiting for new business units to turn a profit. They also present a way for weak retailers to receive financial transfusions. For example, in the last several years, Dick’s Sporting Goods acquired Gaylan’s, TD Bank acquired Commerce Bancorp, Dollar Tree acquired Family Dollar, and Foot Locker acquired Foot Action. These deals were driven by the relative weakness of the acquired firms. Typically, mergers and consolidations lead to some stores being shut, particularly those with trading-area overlap, and cutbacks among management personnel.

The leveraged buyout (LBO) is a type of acquisition in which a retail ownership change is mostly financed by loans from banks, investors, and others. The LBO phenomenon has had a big effect on retail budgeting and cash flow. At times, because debts incurred with LBOs can be high, some well-known retailers have had to focus more on paying interest on their debts than on investing in their businesses, run sales to generate enough cash to cover operating costs and buy new goods, and sell store units to pay off debt. Two major retailers involved with LBOs were weakened: Toys “R” Us and Barneys New York.

Retailers sometimes consolidate their businesses to streamline operations and improve profits. Winn-Dixie, Eddie Bauer, Kmart, Macy’s, Pier 1, Michaels, Sears, and many others have shut underperforming stores. Other times, retailers use spin-offs to generate more money or to sell a division that no longer meets expectations. Many retailers (Macy’s, Life Time Fitness, etc.) and restaurant chains (Darden, Bob Evans, etc.) spin off their real-estate to REITs or external investors and then lease them back.8 Retailers may spin off a division for strategic reasons. For example, eBay spun off PayPal, its online payments division, because technology advances, growth opportunities, and challenges for the two business had diverged. As two standalone firms, each is now able to compete more effectively in its respective market.9 Unlike a retail-estate spin-off, a business unit spin-off or split does not generate additional funds.10 Hot Topic, a popular national

retailer that sells music and pop culture-inspired clothes and accessories for young women spun off Torrid, which sells plus-size goth, rave, and punk clothing.11 Supervalu, the grocery retailer is spinning off its discount retail chain Save-A-Lot.12

To safeguard against mounting debts, as well as to continue in business, faltering retailers may seek bankruptcy protection under Chapter 11 of the Federal Bankruptcy Code (which was toughened in 2005). In November 2006, when the economy was quite strong, only 3.8 percent of the large retailers tracked by a turnaround consulting firm were facing a high possibility of bankruptcy or financial distress. By November 2008, the figure had risen to 25.8 percent.13 Today, the figure is much lower (closer to pre-recession percentages), but rising in the retail sector.14

With bankruptcy protection, retailers can renegotiate bills, get out of leases, and work with creditors to plan for the future. Declaring bankruptcy has major ramifications: disruptions in supply (cash payment for stock purchased 20 days prior to bankruptcy); loss of key executives and demoralization of those who stay; short time frame to reorganize or sell stores; emergency liquidation of stock in stores that are trimmed; and the legal and financial advisory fees of bankruptcy protection. Chapter 11 bankruptcy fends off creditors and lets firms pay off debt and survive what may be a temporary upheaval. More than half of large store-based retailers who filed for bankruptcy since 2006 have been liquidated.15 See Figure 12-2.

Since 2008, several large retailers have declared bankruptcy, with some ultimately going out of business. These include American Apparel (2015), Circuit City (2008), Linens ‘n Things (2008), A&P (2015), Radio Shack (2015), Blockbuster (2010), Borders (2011), Sbarro (2011 and 2014), Friedman’s (2008), Brookstone (2014), and Quiksilver (2015).16

American Apparel entered into a bankruptcy in which its secured lenders would receive shares in the reformed company in exchange for the bonds they held. Extra financing was also obtained from participating bondholders to enable American Apparel to keep its manufacturing operations functioning and its 130 U.S. stores open. The reorganization would wipe out the holdings of existing American Apparel stockholders.

Some retailers that focus on teenage consumers have recently struggled. In 2014, for example, Wet Seal, Bed Shops, Delia’s, and Body Central declared bankruptcy. Many teenagers have switched to shopping with H&M, Zara, and other “fast-fashion” retailers that can quickly stock fast-selling fashion items from Asian suppliers.17

When a retailer goes out of business, it is painful for all parties: the owner/stockholders, employees, creditors, landlords (who then have vacant store sites), and customers. See Figure 12-3.

As with other sectors of business, over the last few years, some retailers have been heavily criticized for questionable accounting and financial practices. Sometimes, the practices have been illegal. For example, Sterling—which owns the Kay, Zales, Jared, and Signet jewelry chains—has been under scrutiny because it receives more revenue for sales made with extended-credit servicing plans provided by its own in-house facility. This may overstate revenues and profits and misleads investors.18

To avoid questionable or illegal practices, many larger retailers have enacted formal policies. At Home Depot, for example, there is a detailed “Code of Ethics for Senior Financial Officers,” as shown here. The code applies to Home Depot’s chief executive, chief financial officer, and other high-ranking personnel. Each of these executives must adhere to such practices as the following:

Act in all financial and accounting matters in a way that shows honesty, integrity, and fairness.

- Do not let personal interests override company interests; and avoid conflicts of interest.

- Report data that have been recorded inaccurately.

- Be sure that all activities are lawful, accurate, complete, and not intended to mislead.

- Be proactive in promoting ethical behavior.

- Responsibly use company resources.19

Source: Barry Berman, Joel R Evans, Patrali Chatterjee (2017), Retail Management: A Strategic Approach, Pearson; 13th edition.

28 May 2021

28 May 2021

28 May 2021

28 May 2021

28 May 2021

28 May 2021