As we learned in Chapter 6, “Dow Theory,” Charles Dow was one of the first of the modern technicians to write about the fact that stock market prices trade in trends. Virtually all items that trade in free, liquid markets trade in trends. As noted by Dow, investors or traders must concentrate on the time horizon most favorable to their circumstances.

Trends are fractal in that their behavior is the same regardless of the period. Minute-to-minute trends behave exactly like day-to-day trends with only minor differences because of the understandable variation in liquidity over the shorter periods. Dow suggested there were three principal time horizons—the primary, the intermediate, and the minor—that he likened to tides, waves, and ripples. In fact, there are considerably more trend periods. Dow focused on the first two because he apparently believed no one could analyze the ripples. Today, some technicians recognize considerably more trends than Dow observed, but then he did not have the advantage of a computer that could track prices trade by trade.

Dow’s final, and perhaps most important, observation was that, by their very nature, trends tend to continue rather than reverse. If it were otherwise, first, there would not be a trend, and second, the trend could not be used for profit. This seems like a silly and perhaps too obvious statement, but it underlies almost everything the technician assumes when looking for the beginning or end of trends. It also vexes the academic theoretician who believes that price changes are random.

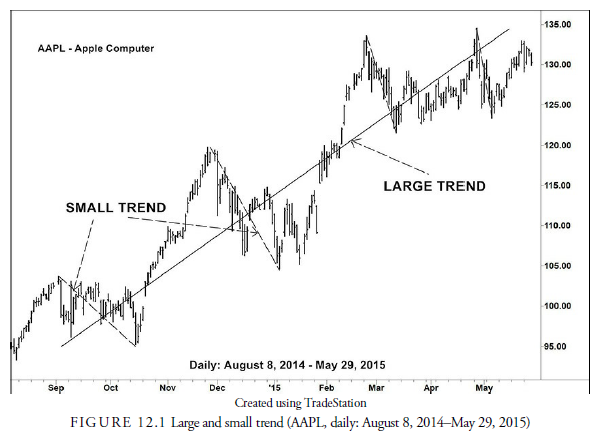

Any particular trend is influenced by its next larger and next smaller trend. For example, in Figure 12.1, we can see a well-defined uptrend in the stock of AAPL (Apple Computer). It is not a straight line upward, however. Within the rising trend are many smaller trends, both down and up, and if we look more closely, there are even smaller down- and uptrends within these. This is the fractal nature of trends. Notice also that the next set of trends below the long uptrend have larger rises and smaller declines. This is the effect the larger trend is having on the smaller trends. It is why the analyst, when studying any particular length trend, must be aware of the next longer and shorter trend directions. The longer trends will influence the strength of the trend of interest, and the shorter trends will often give early signs of turning in the longer. By definition, short-term trends reverse before medium-term, and medium-term trends reverse before long-term.

Source: Kirkpatrick II Charles D., Dahlquist Julie R. (2015), Technical Analysis: The Complete Resource for Financial Market Technicians, FT Press; 3rd edition.

This is really interesting, You’re a very skilled blogger. I’ve joined your feed and look forward to seeking more of your excellent post. Also, I’ve shared your site in my social networks!