Customer lifetime value (CLV), lifetime customer value (LCV) or lifetime value (LTV) and the new concept of “customer lifecycle management” is the present value of the future cash flows attributed to the customer relationship. The use of customer lifetime value as a marketing metric tends to place greater emphasis on customer service and long-term customer satisfaction, rather than on maximizing short-term sales. CLV is defined as the present value of future cash flows minus costs through long-term customer relationships. The equation is as follows:

Customer Lifetime Value = Customer Value – Cost (Acquisition, Retention and Service)

The measures that determine customer value include:

- Frequency measures how often the customer has interacted with the company for products or service offerings. The more frequently a customer has made purchases from the company, the more likely that the customer will purchase again in the future.

- Recency measures how recently the customer purchased a product or service offering. The more recently a customer purchased a product, the more likely that the customer will purchase again.

- Average transaction size is a key indicator of future expected transaction value. Future expected transaction value is what a customer is willing to invest in products or services in exchange for the value the customer assumes the product or service will deliver. Average transaction size also indicates the volume of business that the customer is willing to transact at any time, which indicates the current and potential need.

- Buying habits and needs evolve as customers mature. Their requirements can grow in terms of volume of product purchased, product attribute requirements and service level requirements. As customers evolve, their value to the business can grow significantly if it is measured and managed appropriately.

- Customer network value gives an insight into sales to all those who were influenced— either directly or indirectly—by existing customers.

The measures that determine costs include new customer acquisition; account servicing, incentives and promotions campaigns, retention efforts and new product strategies. These expenses can vary by customer segment, by product and by channel.

Effective customer lifetime value analysis gives companies an opportunity to increase profit and return on investment by:

- Attracting prospects with the highest potential lifetime value.

- Forging stronger, more profitable relationships with the existing customers.

- Allocating the right resources to those customers who are most likely to drive revenue and profit growth.

1. Dimensions of CLV

- The duration of the “customer lifetime.”

- The firm’s share of the wallet of its customers, i.e. what portions of the customer’s purchases in the firm’s offering categories are captured by the firm as opposed to its competitors.

- The firm’s success in terms of frequency of up and cross-selling to its customers so as to increase the levels and monetary value of their purchases over time.

- The firm’s costs of acquiring, serving and retaining its customers.

2. Customer Portfolios

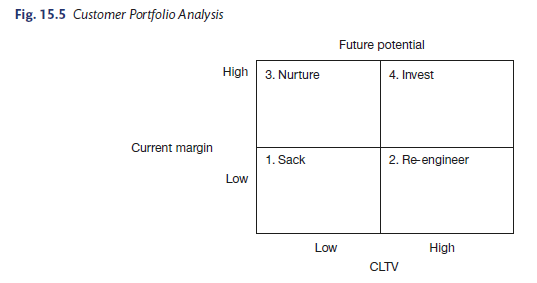

As shown in Figure 15.5, customers can be classified on the basis of the net margin presently earned in the relationship and their future LTV potential. Most businesses seem to have little idea of how their customer base is distributed among these four types. Some typical breakdowns are given below:

- Cell 4: Invest 5–30 per cent

- Cell 3: Nurture 25–50 per cent

- Cell 2: Re-engineer 30–60 per cent

- Cell 1: Sack 40–80 per cent

The four cells in the matrix indicate four strategies.

- There will almost certainly be some customers who contribute no value now and have no future potential as shown in Cell 1.

- It may be possible to re-engineer the relationship, finding ways of stripping out cost or adding value so that the relationship becomes more profitable as shown in Cell 2.

- There are customers who are presently profitable but offer apparently little future potential (Cell 3). It may be possible to nurture these relationships in ways that improve LTV potential.

- There are customers with whom present and future relationships should be profitable. Companies need to invest in these customers and reward them for the value they contribute to the business. Many companies are taking actions such as prioritizing production, customizing products/services, offering flexible invoicing dates and preferential payment terms offering loyalty awards, operating a dedicated customer service line and assigning the best staff.

3. How to Make a CLTV Method Successful?

The following points should be focused on ensuring the success of a CLTV method:

- Connect with the overall strategy of the business.

- It should link with the loyalty that the company seeks to bring in.

- Referrals must be part of the component of the CLTV.

- Constant rate of retention and discount not feasible.

- Risk rate should also be associated.

- Dynamics of the different sectors must be incorporated.

- Truly customized CLTV for highly volatile sectors such as financial services and online companies.

- It should link with loyalty programmes.

4. Customer Value Management

Customer value management (CVM) offers a roadmap to acquiring, developing and retaining the most valuable customers. CVM improves customer profitability by understanding the value of each individual customer and implementing marketing strategies, retention campaigns and loyalty programmes that maximize that value.

CVM focuses on managing each customer relationship with the goal of achieving maximum lifetime profit from the entire customer base. CVM enables companies to take full advantage of the economics of loyalty by increasing retention, reducing risk and amortizing acquisition costs over a longer and more profitable period of engagement.

CVM shifts the focus of the enterprise from managing products or marketing campaigns to managing the profitability of each individual customer over the entire life of the relationship. CVM will help firms to accurately determine what drives value for customers, measure the performance relative to the competition, align efforts, focus scarce resources and create sustainable competitive advantage in the market place.

The concept of CVM is all about:

- Asking customers in your target market what they’re looking for when they do business with vendors.

- Determining how customers in your target market rate the value you provide relative to the value provided by your competitors.

- Deciding what changes on your part will have the greatest positive impact on customers’ perception of the relative value of your offering.

- Aligning people and processes in a common focus to deliver value.

- Providing a consistent flow of data and information to keep them aligned.

- Winning with customers, with employees and with shareholders.

Every company in the present business environment is stressing on customer focus. However, what’s lacking in most companies are useful and practical ways to capture customer needs, measure how well you’re satisfying those needs and building actionable plans to improve the company’s bottom line.

5. Three R’s of the CVM Cycle

The customer value management cycle can be broken down into three stages:

- Right customers (acquisition)

- Right relationship (development)

- Right retention (keeping valuable customers)

Right customers: The customer value management cycle starts with identifying and acquiring thecustomers who will be most valuable to the company’s business. All customers are not equal. Companies can no longer afford to indiscriminately recruit customers without examining their long-term value. Customer vintage analysis—examining the loyalty and profitability of customers who joined at different times through different channels adds insight into customer base. Finer segmentation and analysis of customer base reveals hidden characteristics and trends that affect value.

Right relationship: Managers must concentrate on developing relationships with loyal customers. Customers do repeat business with vendors that understand and respond to their individual needs, and respond when those needs change. Unless marketers can distinguish high potential customers from ones who will always be low-value, companies will waste resources trying to develop customers who will never grow.

For any business, the right relationship is one that maximizes that customer’s lifetime value. The customer LTV is measured by using the following formula:

LTV = Purchase Size x Frequency x Duration

The business goal of CRM is to increase the size and frequency of purchases and extend how long the customer continues to buy. Marketers usually use loyalty measures to estimate the duration. Companies that develop the capability to track changes in the value of individual customers can guard against competitive attacks and respond quickly to changing customer behaviour to maintain and grow customer value.

Right retention: Retaining right customers and not every customer is the effective retention strategy. Marketers need to focus their retention actions on customers with the highest lifetime value. Right retention is; therefore, rooted in knowing which individuals are most valuable and why. Box 15.2 discusses how Infosys Technologies focuses on designing innovative products to ensure customer retention.

Box 15.2 Infosys Focuses on Customer Delight

Infosys Technologies, a giant in Indian IT, launched Finacle Direct Banking Solution on 15 June 2009. Finacle Direct Banking Solution supports the full-fledged branchless delivery of a range of assets and liabilities, through the Internet, mobile and call centre channels. The company also offers complete operational partnership including consulting, implementation and BPO. Two leading global banks have already chosen Finacle Direct Banking Solution.

The Finacle Direct Banking Solution enables banks to expand their networks as well as offers a cost-effective strategy to expand into new geographies. Banks can convert prospects to new customers without the support of a branch using Finacle.

The main features of FDBS are new customer acquisition, online service fulfillment and business process outsourcing services. The benefits are rapid business roll-out, aggressive customer acquisition, improved cross-selling framework, robust security and customer delight.

Source: Poornima M. Charantimath (2017), Total Quality Management, Pearson; 3rd edition.

1 Jun 2021

17 Jul 2021

16 Jul 2021

17 Jul 2021

1 Jun 2021

17 Jul 2021