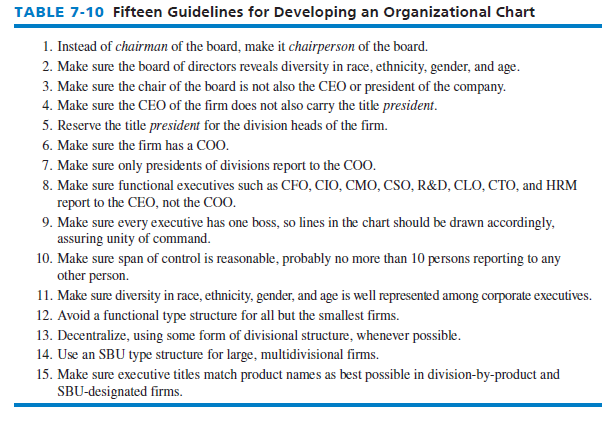

Students analyzing strategic-management cases (and actual corporate executives) oftentimes revise and improve a firm’s organizational structure. This section provides some basic guidelines for this endeavor. There are some basic dos and don’ts in regard to devising or constructing organizational charts, especially for midsize to large firms. First of all, reserve the title CEO for the top executive of the firm. Don’t use the title president for the top person; use it for the division top managers if there are divisions within the firm. Also, do not use the title president for functional business executives. They should have the title chief, or vice president, or manager, or officer, such as “Chief Information Officer,” or “VP of Human Resources.” Furthermore, do not recommend a dual title (such as CEO and president) for just one executive.

Do not let a single individual be both chairman of the board and CEO of a company, although Seifi Ghasemi was recently named as the new CEO, President, and Chairman of the large industrial-gas provider Air Products & Chemicals Inc. Also, Home Depot recently appointed their CEO Craig Menear to also be the company’s chairman of the board. Menear is the first person to hold both CEO and chairman titles of Home Depot since the company’s co-founder, Bernie Marcus. Actually, chairperson is much better than chairman for a top board person’s title. A significant movement among corporate America is to split the chairperson of the board and the CEO positions in publicly held companies.5 The movement includes asking the New York Stock Exchange and Nasdaq to adopt listing rules that would require separate positions. About 50 percent of companies in the S&P 500 stock index have separate positions, up from 22 percent in 2002, but this still leaves plenty of room for improvement. Among European and Asian companies, the split in these two positions is much more common. For example, 79 percent of British companies split the positions, and all virtually German and Dutch companies split the position.

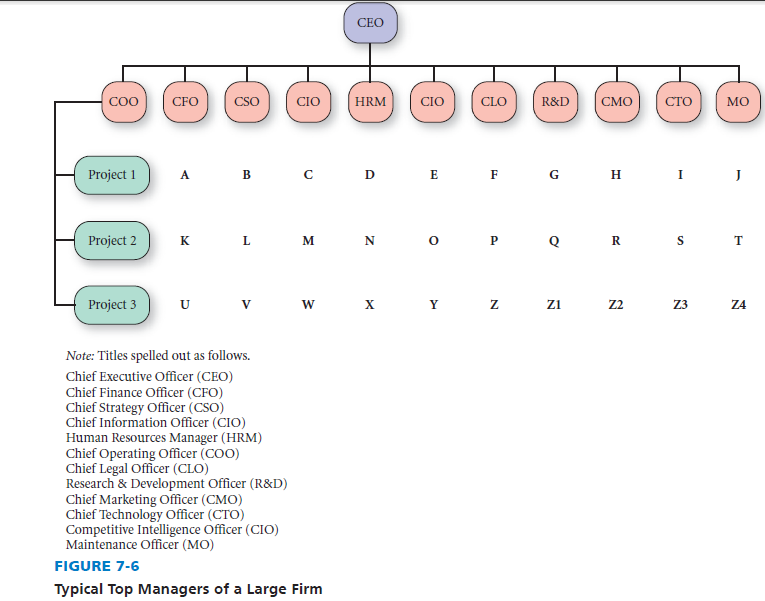

Directly below the CEO, it is best to have a COO (chief operating officer) with any division presidents reporting directly to the COO. On the same level as the COO and also reporting to the CEO, draw in your functional business executives, such as a CFO (chief financial officer), VP of human resources, a CSO (chief strategy officer), a CIO (chief information officer), a CMO (chief marketing officer), a VP of R&D, a VP of legal affairs, an investment relations officer, maintenance officer, and so on. Note in Figure 7-6 that these positions are labeled and placed appropriately in a matrix structure, which, as shown, generally include project managers rather than division presidents reporting to a Coo. However, note in Academic Research Capsule 7-1 the Coo position is losing favor in North America.

In developing an organizational chart, avoid having a particular person reporting to more than one person in the chain of command. This would violate the unity-of-command principle of management that “every employee should have just one boss.” AIso, do not have the CFO, CIO, CSO, human resource officer, or other functional positions report to the Coo. all these positions report directly to the CEO.

A recent article (WSJ, 8-25-15, p. B5) reveals that since 2009 there has been a 40 percent rise in the number of chief accounting officers (CAo) among American companies. CAo’s now do much more than just manage the company’s books and prepare financial statements. Companies increasingly need a CAo that can stand up and debate strategic issues related to how best to balance the balance sheet, and know when and how to recognize revenue, and know how to report results using both USA and foreign standards (GAAP vs IFRS). CAo’s are more and more signing the company’s financial filings, making them personally liable for any mistakes or improprieties – along with the CFo and CEo. As more and more firms acquire foreign firms and even relocate their headquarters offshore (inversion), a CAo is needed who knows both USA and foreign insurance and accounting practices. Garu Kabureck, former CAo at Xerox Corp. says: “I think what happened over the last 15 years in the USA is that the accounting function started to separate from the controller function.” In a firm, a controller is typically more focused on budgeting and planning, whereas the CAo is responsible for the in’s and out’s of global bookkeeping. The CAo also interacts closely with the board’s audit committee, as well with outside firms auditing the company.

A relatively new, but increasingly popular, top management position, is the Chief Design officer (CDo). Johnson & Johnson (J&J), for example, just hired a chief design officer, Ernesto Quinteros, to be a liaison between the chief marketing officer (CMo) and R&D. the CDo position has equal status with the CMo position at J&J, pepsiCo, and phillips electronics NV— because “a product that is wonderfully designed sells itself, and has a huge benefit on the marketing side,” said J&J’s Sandi peterson, who created the CDo position at J&J.

If a firm is large with numerous divisions, an SBU type of structure would be more appropriate to reduce the span of control reporting to the Coo. one never knows for sure if a proposed or actual structure is indeed most effective for a particular firm. Declining financial performance signals a need for altering the structure. Some important guidelines to follow in devising organizational charts for companies are provided in table 7-10.

Why Is the COO Position Being Deleted in Many Organizations?

The COO position is increasingly being deleted in U.S. companies. Twitter recently divided the duties of its COO among all managers. McDonald’s, Tiffany & Co., and Yahoo recently deleted their COO position. In fact, the percentage of large companies in the United States with COOs has declined almost every year for a decade, to about 36 percent today. Health-care and industrial companies are least likely to have a COO today. A senior executive search firm, Crist Kolder Associates, reports that the percentage of Fortune 500 and S&P 500 companies with a COO has declined steadily from 48 percent in 2000 to 36 percent in 2014. An accounting firm, PricewaterhouseCoopers, suggests there are four reasons why companies are phasing out the COO position: (1) flatten their structure, (2) eliminate a layer of management, (3) reduce costs, and (4) expand the CEO’s authority and responsibility. Digital communications and even social media today enable a CEO oftentimes to perform COO duties. However, three situations that especially warrant having a COO include (1) whenever the CEO lacks operational experience, (2) whenever the firm desires to be transparent about their CEO succession plans, and (3) whenever the CEO needs to lead a restructuring or transformation of the firm. Although historically a stepping-stone position to the CEO position, many companies now delegate the traditional duties of a COO to the CEO or to other positions, such as the CFO or to the chief brand officer. Deleting the COO position does increase the span of control of the CEO, spreading him or her thinly, which is not a good idea for many companies.

Interestingly, as the COO position has declined, the chief f inancial officer (CFO) position has increased in responsibility and prevalence. An example is the CFO position at Twitter Inc., where Anthony Noto is being groomed perhaps to become that company’s CEO. Noto was recently also given head responsibility for marketing at Twitter. In the last year, it was Noto who initiated and coordinated the major business deals and acquisitions at Twitter.

Source: Based on Feintzeig, Rachel, “Coos Join Endangered Species List,” Wall Street Journal, June 13, 2014, B1. Also based on Crist Kolder Associates, “Trends in CEo recruiting and Succession,” Volatility Report 2014; http:// strategy-business.com/article/00328 published by pricewaterhouseCoopers; and Yoree Koh, “ascent of twitter CFo Creates a power Center,” Wall Street Journal, June 15, 2015, B1 and B4.

Source: David Fred, David Forest (2016), Strategic Management: A Competitive Advantage Approach, Concepts and Cases, Pearson (16th Edition).

It’s an remarkable post in support of all the web viewers; they will take advantage from it I am sure.

Fastidious replies in return of this difficulty with solid arguments

and describing everything concerning that.

Very nice post. I simply stumbled upon your weblog and wanted to mention that I’ve truly enjoyed browsing your weblog posts.

In any case I will be subscribing to your feed and I hope you write once more very soon!

If you are going for most excellent contents like myself, just pay a quick visit this website everyday because it offers quality contents, thanks