We have seen how government regulation can deal with the inefficiencies that arise from externalities. Emissions fees and transferable emissions permits work because they change a firm’s incentives, forcing it to take into account the exter- nal costs that it imposes. But government regulation is not the only way to deal with externalities. In this section we show that in some circumstances, inefficien- cies can be eliminated through private bargaining among the affected parties or by a legal system in which parties can sue to recover the damages they suffer.

1. Property Rights

Property rights are the legal rules that describe what people or firms may do with their property. If you have property rights to land, for example, you may build on it or sell it and are protected from interference by others.

To see why property rights are important, let’s return to our example of the firm that dumps effluent into the river. We assumed both that it had a property right to use the river to dispose of its waste and that the fishermen did not have a property right to “effluent-free” water. As a result, the firm had no incentive to include the cost of effluent in its production calculations. In other words, the firm externalized the costs generated by the effluent. But suppose that the fishermen had a property right to clean water. In that case, they could demand that the firm pay them for the right to dump effluent. The firm would either cease production or pay the costs associated with the effluent. These costs would be internalized and an efficient allocation of resources achieved.

2. Bargaining and Economic Efficiency

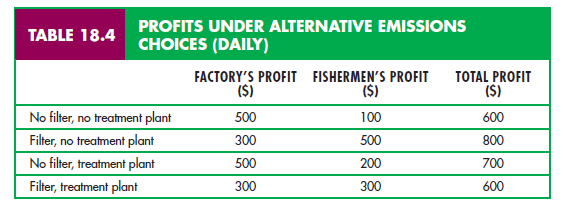

Economic efficiency can be achieved without government intervention when the externality affects relatively few parties and when property rights are well specified. To see how, let’s consider a numerical version of our effluent example. Suppose the steel factory’s effluent reduces the fishermen’s profit. As Table 18.4 shows, the factory can install a filter system to reduce its effluent, or the fisher- men can pay for the installation of a water treatment plant.19

The efficient solution maximizes the joint profit of the factory and the fisher- men. Maximization occurs when the factory installs a filter and the fishermen do not build a treatment plant. Let’s see how alternative property rights lead these two parties to negotiate different solutions.

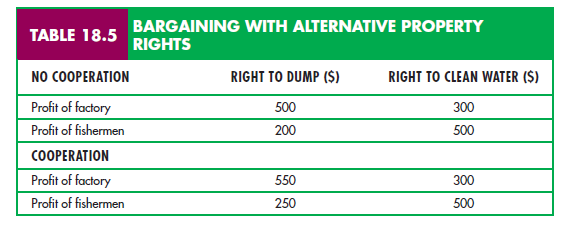

Suppose the factory has the property right to dump effluent into the river. Initially, the fishermen’s profit is $100 and the factory’s $500. By installing a treat- ment plant, the fishermen can increase their profit to $200, whereby the joint profit, without cooperation, is $700 ($500 + $200). Moreover, the fishermen are willing to pay the factory up to $300 to install a filter—the difference between the $500 profit with a filter and the $200 profit without cooperation. Because the factory loses only $200 in profit by installing a filter, it will be willing to do so because it is more than compensated for its loss. In this case, the gain to both parties by coop- erating is equal to $100: the $300 gain to the fishermen less the $200 cost of a filter.

Suppose the factory and the fishermen agree to split this gain equally by having the fishermen pay the factory $250 to install the filter. As Table 18.5 shows, this bargaining solution achieves the efficient outcome. Under the column “Right to Dump,” we see that without cooperation, the fishermen earn a profit of $200 and the factory $500. With cooperation, the profit of both increases by $50.

Now suppose the fishermen are given the property right to clean water, which requires the factory to install the filter. The factory earns a profit of $300 and the fishermen $500. Because neither party can be made better off by bargaining, having the factory install the filter is efficient.

This analysis applies to all situations in which property rights are well specified. When parties can bargain without cost and to their mutual advantage, the resulting outcome will be efficient, regardless of how the property rights are specified. The italicized proposi- tion is called the Coase theorem, after Ronald Coase who did much to develop it.20

3. Costly Bargaining—The Role of Strategic Behavior

Bargaining can be time-consuming and costly, especially when property rights are not clearly specified. In that case, neither party is sure how hard to bargain before the other party will agree to a settlement. In our example, both parties knew that the bargaining process had to settle on a payment between $200 and $300. If the parties are unsure of the property rights, however, the fishermen might be will- ing to pay only $100, and the bargaining process would break down.

Bargaining can break down even when communication and monitoring are costless if both parties believe they can obtain larger gains. For example, one party might demand a large share and refuse to bargain, assuming incorrectly that the other party will eventually concede. Another problem arises when many parties are involved. Suppose, for example, that the emissions from a factory are adversely affecting hundreds or thousands of households who live downstream. In that case, the costs of bargaining will make it very difficult for the parties to reach a settlement.

4. A Legal Solution—Suing for Damages

In many situations involving externalities, a party who is harmed (the victim) by another has the legal right to sue. If successful, the victim can recover monetary damages equal to the harm that it has suffered. A suit for damages is differ- ent from an emissions or effluent fee because the victim, not the government, is paid.

To see how the potential for a lawsuit can lead to an efficient outcome, let’s reexamine our fishermen–factory example. Suppose first that the fishermen are given the right to clean water. The factory, in other words, is responsible for harm to the fishermen if it does not install a filter. The harm to the fishermen in this case is $400: the difference between the profit that the fishermen make when there is no effluent ($500) and their profit when there is effluent ($100). The fac- tory has the following options:

- Do not install filter, pay damages: Profit = $100 ($500 – $400)

- Install filter, avoid damages: Profit = $300 ($500 – $200)

The factory will find it advantageous to install a filter, which is substantially cheaper than paying damages, and the efficient outcome will be achieved.

An efficient outcome (with a different division of profits) will also be achieved if the factory is given the property right to emit effluent. Under the law, the fish- ermen would have the legal right to require the factory to install the filter, but they would have to pay the factory for its $200 lost profit (not for the cost of the filter). This leaves the fishermen with three options:

- Put in a treatment plant: Profit = $200

- Have factory put in a filter but pay damages: Profit = $300 ($500 – $200)

- Do not put in treatment plant or require a filter: Profit = $100

The fishermen earn the highest profit if they take the second option. They will thus require the factory to put in a filter but compensate it $200 for its lost profit. Just as in the situation in which the fishermen had the right to clean water, this outcome is efficient because the filter has been installed. Note, however, that the $300 profit is substantially less than the $500 profit that the fishermen get when they have a right to clean water.

This example shows that a suit for damages eliminates the need for bargain- ing because it specifies the consequences of the parties’ choices. Giving the party that is harmed the right to recover damages from the injuring party ensures an efficient outcome. (When information is imperfect, however, suing for damages may lead to inefficient outcomes.)

Source: Pindyck Robert, Rubinfeld Daniel (2012), Microeconomics, Pearson, 8th edition.

I used to be suggested this website through my cousin. I am no longer certain whether this post is written by way of him as nobody else know such exact about my difficulty. You are incredible! Thanks!