All well-designed control systems involve the use of feedback to determine whether performance meets established standards. In this section, we will examine the key steps in the feedback control model and then look at how the model applies to organizational budgeting.

1. STEPS OF FEEDBACK CONTROL

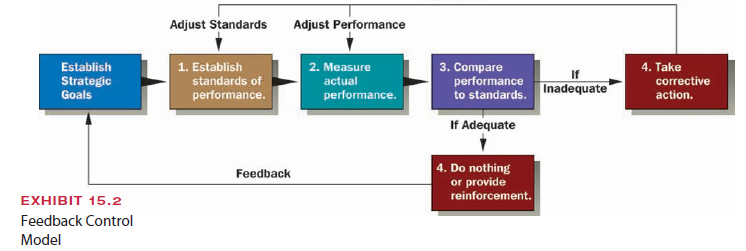

Managers set up control systems that consist of the four key steps illustrated in Exhibit 15.2: establish standards, measure performance, compare performance to standards, and make corrections as necessary.

Establish Standards of Performance. Within the organization’s overall strategic plan, managers define goals for organizational departments in specific, operational terms that include a standard of performance against which to compare organizational activities. A standard of performance could include “reducing the reject rate from 15 to 3 percent,” “increasing the corporation’s return on investment to 7 percent,” or “reducing the number of accidents to one per each 100,000 hours of labor.” Managers should carefully assess what they will measure and how they will define it. For example, at pharmaceutical companies such as Wyeth, getting more productivity from research and development has become a top priority, so Wyeth’s R&D chief Robert Ruffolo set firm targets for how many compounds must move forward at each stage of the drug development process. The clear standards have helped Wyeth boost the number of potentially hot products in its drug pipeline.10

Tracking such matters as customer service, employee involvement, and turnover is an important supplement to traditional financial and operational performance measure- ment, but many companies have a hard time identifying and defining nonfinancial measurements.11 To effectively evaluate and reward employees for the achievement of stan- dards, managers need clear standards that reflect activities that contribute to the organiza- tion’s overall strategy in a significant way. Standards should be defined clearly and precisely so employees know what they need to do and can determine whether their activities are on target.12 George Clooney’s standard of making socially relevant films was not enough to keep his production company afloat, as described in Chapter 11’s Business Blooper.

Measure Actual Performance. Most organizations prepare formal reports of quantitative performance measurements that managers review daily, weekly, or monthly. These measurements should be related to the standards set in the first step of the control process. For example, if sales growth is a target, the organization should have a means of gathering and reporting sales data. If the organization has identified appropriate measure- ments, regular review of these reports helps managers stay aware of whether the organization is doing what it should.

In most companies, managers do not rely exclusively on quantitative measures. They get out into the organiza- tion to see how things are going, especially for such goals as increasing employee participation or improving cus- tomer satisfaction. Managers have to observe for them- selves whether employees are participating in decision making and have opportunities to add to and share their knowledge. Interaction with customers is necessary for managers to really understand whether activities are meeting customer needs.

Compare Performance to Standards. The third step in the control process is comparing actual activities to performance standards. When managers read computer reports or walk through the plant, they identify whether actual performance meets, exceeds, or falls short of standards. Typically, performance reports simplify such comparisons by placing the performance standards for the reporting period alongside the actual performance for the same period and by computing the variance—that is, the difference between each actual amount and the associ- ated standard. To correct the problems that most require attention, managers focus on variances.

When performance deviates from a standard, managers must interpret the deviation. They are expected to dig beneath the surface and find the cause of the problem. If the sales goal is to increase the number of sales calls by 10 percent, and a salesperson achieved an increase of 8 percent, where did the salesperson fail to achieve the goal? Perhaps several businesses on the route closed, additional salespeople were assigned to the area by competitors, or the salesperson needs training in making cold sales calls more effectively. Managers should take an inquiring approach to deviations to gain a broad understanding of factors that influence performance. Effective management con- trol involves subjective judgment and employee discussions, as well as objective analysis of performance data.

Take Corrective Action. Managers also determine what changes, if any, are needed. In a traditional top-down approach to control, managers exercise their formal authority to make necessary changes. Managers may encourage employees to work harder, redesign the production process, or fire employees. In contrast, managers using a partici- pative control approach collaborate with employees to determine the corrective action necessary.

In some cases, managers may take corrective action to change performance standards. They may realize that standards are too high or too low if departments continually fail to meet or routinely exceed standards. If contingency factors that influence organizational performance change, performance standards may need to be altered to make them realistic and to provide continued motivation for employees.

Managers may want to provide positive reinforcement when performance meets or exceeds targets. For example, they may reward a department that has exceeded its planned goals or congratulate employees for a job well done. Managers should not ignore high- performing departments at the expense of taking corrective actions elsewhere. The online auction company eBay provides a good illustration of the feedback control model.

2. APPLICATION TO BUDGETING

Budgetary control, one of the most commonly used methods of managerial control, is the process of setting targets for an organization’s expenditures, monitoring results and com- paring them to the budget, and making changes as needed. As a control device, budgets are reports that list planned and actual expenditures for cash, assets, raw materials, salaries, and other resources. In addition, budget reports usually list the variance between the budgeted and actual amounts for each item.

A budget is created for every division or department within an organization, no matter how small, as long as it performs a distinct project, program, or function. The fundamental unit of analysis for a budget control system is called a responsibility center. A responsibility center is defined as any organizational department or unit under the supervision of a single person who is responsible for its activity.14 A three-person appliance sales office in Watertown, New York, is a responsibility center, as is a quality control department, a marketing department, and an entire refrigerator manufacturing plant. The manager of each unit has budget responsibility. Top managers use budgets for the company as a whole, and middle managers traditionally focus on the budget performance of their department or division. Budgets that managers typically use include expense budgets, revenue budgets, cash budgets, and capital budgets.

Budgeting is an important part of organizational planning and control. Many tradi- tional companies use top-down budgeting, which means that the budgeted amounts for the coming year are literally imposed on middle- and lower-level managers.15 These man- agers set departmental budget targets in accordance with overall company revenues and expenditures specified by top executives. Although the top-down process provides some advantages, the movement toward employee empowerment, participation, and learning means that many organizations are adopting bottom-up budgeting, a process in which lower-level managers anticipate their departments’ resource needs and pass them up to top management for approval.16 Companies of all kinds are increasingly involving line manag- ers in the budgeting process. At the San Diego Zoo, scientists, animal keepers, and other line managers use software and templates to plan their department’s budget needs because, as CFO Paula Brock says, “Nobody knows that side of the business better than they do.”17

Each of the 145 zoo departments also does a monthly budget close and reforecast so that resources can be redirected as needed to achieve goals within budget constraints. Thanks to the bottom-up process, for example, the Zoo was able to quickly redirect resources to pro- tect its valuable exotic bird collection from an outbreak of a highly infectious bird disease, without significantly damaging the rest of the organization’s budget.18

Source: Daft Richard L., Marcic Dorothy (2009), Understanding Management, South-Western College Pub; 8th edition.

great post, i love it

Good info. Lucky me I reach on your website by accident, I bookmarked it.