In every organization, managers need to watch how well the organization is performing finan- cially. Not only do financial controls tell whether the organization is on sound financial foot- ing, but they can be useful indicators of other kinds of performance problems. For example, a sales decline may signal problems with products, customer service, or sales force effectiveness.

FINANCIAL STATEMENTS

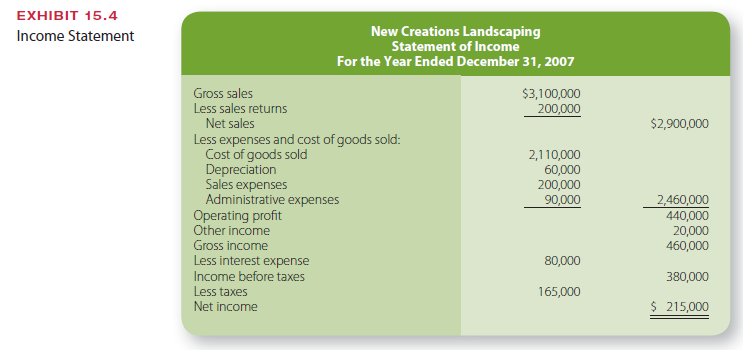

Financial statements provide the basic information used for financial control of an organi- zation. Two major financial statements—the balance sheet and the income statement—are the starting points for financial control.

The balance sheet shows the firm’s financial position with respect to assets and liabili-ties at a specific point in time. An example of a balance sheet is presented in Exhibit 15.3. The balance sheet provides three types of information: assets, liabilities, and owners’ equity. Assets are what the company owns, and they include current assets (those that can be converted into cash in a short time period) and fixed assets (such as buildings and equipment that are long term in nature). Liabilities are the firm’s debts, including both current debt (obligations that will be paid by the company in the near future) and long-term debt (obliga- tions payable over a long period). Owners’ equity is the difference between assets and liabili- ties and is the company’s net worth in stock and retained earnings.

The income statement, sometimes called a profit-and-loss statement or P&L for short, summarizes the firm’s financial performance for a given time interval, usually one year. A sample income statement is shown in Exhibit 15.4. Some organizations calculate the income statement at three-month intervals during the year to see whether they are on target for sales and profits. The income statement shows revenues coming into the organization from all sources and subtracts all expenses, including cost of goods sold, inter- est, taxes, and depreciation. The bottom line indicates the net income—profit or loss—for the given time period.

The owner of Aahs!, a specialty retailing chain in California, used the income statement to detect that sales and profits were dropping significantly during the summer months.19

He immediately evaluated company activities and closed two money-losing stores. He also began a training program to teach employees how to increase sales and cut costs to improve net income. This use of the income statement follows the control model described in the previous section, beginning with setting targets, measuring actual performance, and then taking corrective action to improve performance to meet targets.

Source: Daft Richard L., Marcic Dorothy (2009), Understanding Management, South-Western College Pub; 8th edition.

recommended article, i like it

I dugg some of you post as I thought they were extremely helpful handy

Hello! I just would like to give a huge thumbs up for the great info you have here on this post. I will be coming back to your blog for more soon.