Corporations finance their operations using the following sources:

- Short-term debt, such as purchasing goods or services on account.

- Long-term debt, such as issuing bonds or notes payable.

- Equity, such as issuing common or preferred stock.

Short-term debt, including the purchase of goods and services on account and the issuance of short-term notes payable, was discussed in Chapter 10. Issuing equity in the form of common or preferred stock was discussed in Chapter 11. This chapter focuses on the use of long-term debt such as bonds and notes payable to finance a company’s operations.

A bond is a form of an interest-bearing note. Like a note, a bond requires periodic interest payments, with the face amount to be repaid at the maturity date. As creditors of the corporation, bondholder claims on the corporation’s assets rank ahead of stockholders.

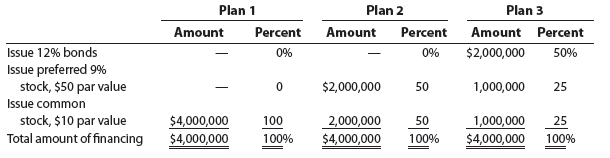

To illustrate the effects of long-term financing, assume Huckadee Corporation is considering the following plans to issue debt and equity:

Each of the preceding plans finances some of the corporation’s operations by issuing common stock. However, the percentage financed by common stock varies from 100% (Plan 1) to 25% (Plan 3). In deciding among financing plans, the effect on earnings per share is often considered.

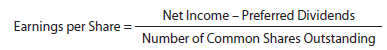

Earnings per share (EPS) measures the income earned by each share of common stock. It is computed as follows:1

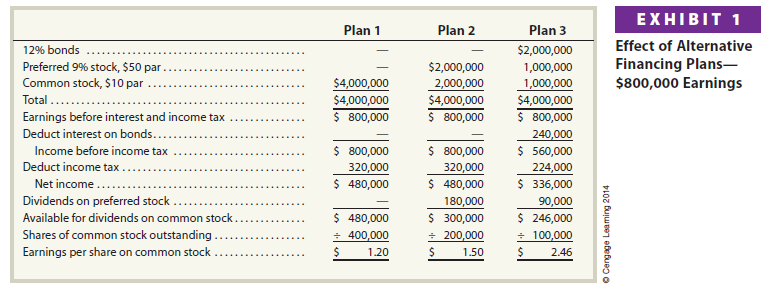

To illustrate, assume the following data for Huckadee Corporation:

- Earnings before interest and income taxes are $800,000.

- The tax rate is 40%.

- All bonds or stocks are issued at their par or face amount.

The effect of the preceding financing plans on Huckadee’s net income and earnings per share is shown in Exhibit 1.

Exhibit 1 indicates that Plan 3 yields the highest earnings per share on common stock and, thus, is the most attractive for common stockholders. If the estimated earnings are more than $800,000, the difference between the earnings per share to common stockholders under Plans 1 and 3 is even greater.2

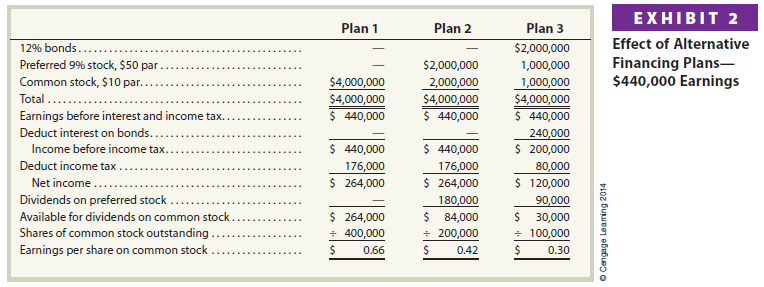

If smaller earnings occur, however, Plans 1 and 2 become more attractive to common stockholders. To illustrate, Exhibit 2 shows the effect on earnings per share if estimated earnings are $440,000 rather than $800,000 as estimated in Exhibit 1.

In addition to earnings per share, the corporation should consider other factors in deciding among the financing plans. For example, if bonds are issued, the interest and the face value of the bonds at maturity must be paid. If these payments are not made, the bondholders could seek court action and force the company into bankruptcy. In contrast, a corporation is not legally obligated to pay dividends on preferred or common stock.

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

I’m usually to running a blog and i actually appreciate your content. The article has actually peaks my interest. I am going to bookmark your web site and preserve checking for new information.