Some liabilities may arise from past transactions only if certain events occur in the future. These potential liabilities are called contingent liabilities.

The accounting for contingent liabilities depends on the following two factors:

- Likelihood of occurring: Probable, reasonably possible, or remote

- Measurement: Estimable or not estimable

The likelihood that the event creating the liability occurring is classified as probable, reasonably possible, or remote. The ability to estimate the potential liability is classified as estimable or not estimable.

1. Probable and Estimable

If a contingent liability is probable and the amount of the liability can be reasonably estimated, it is recorded and disclosed. The liability is recorded by debiting an expense and crediting a liability.

To illustrate, assume that during June a company sold a product for $60,000 that includes a 36-month warranty for repairs. The average cost of repairs over the warranty period is 5% of the sales price. The entry to record the estimated product warranty expense for June is as shown below.

The preceding entry records warranty expense in the same period in which the sale is recorded. In this way, warranty expense is matched with the related revenue (sales).

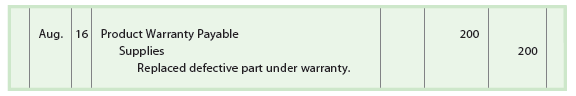

If the product is repaired under warranty, the repair costs are recorded by debiting Product Warranty Payable and crediting Cash, Supplies, Wages Payable, or other appropriate accounts. Thus, if a $200 part is replaced under warranty on August 16, the entry is as follows:

2. Probable and Not Estimable

A contingent liability may be probable, but cannot be estimated. In this case, the contingent liability is disclosed in the notes to the financial statements. For example, a company may have accidentally polluted a local river by dumping waste products. At the end of the period, the cost of the cleanup and any fines may not be able to be estimated.

3. Reasonably Possible

A contingent liability may be only possible. For example, a company may have lost a lawsuit for infringing on another company’s patent rights. However, the verdict is under appeal and the company’s lawyers feel that the verdict will be reversed or significantly reduced. In this case, the contingent liability is disclosed in the notes to the financial statements.

4. Remote

A contingent liability may be remote. For example, a ski resort may be sued for injuries incurred by skiers. In most cases, the courts have found that a skier accepts the risk of injury when participating in the activity. Thus, unless the ski resort is grossly negligent, the resort will not incur a liability for ski injuries. In such cases, no disclosure needs to be made in the notes to the financial statements. The accounting treatment of contingent liabilities is summarized in Exhibit 8.

Common examples of contingent liabilities disclosed in notes to the financial statements are litigation, environmental matters, guarantees, and contingencies from the sale of receivables.

An example of a contingent liability disclosure from a recent annual report of Google Inc. is shown below.

We have also had copyright claims filed against us alleging that features of certain of our products and services, including Google Web Search, Google News, Google Video, Google Image Search, Google Book Search and YouTube, infringe their rights. Adverse results in these lawsuits may include awards of substantial monetary damages, costly royalty or licensing agreements or orders preventing us from offering certain functionalities, and may also result in a change in our business practices, which could result in a loss of revenue for us or otherwise harm our business. . . .

Although the results of litigation and claims cannot be predicted with certainty, we believe that the final outcome of the matters discussed above will not have a material adverse effect on our business. . . .

Professional judgment is necessary in distinguishing between classes of contingent liabilities. This is especially the case when distinguishing between probable and reasonably possible contingent liabilities.

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

Pretty section of content. I just stumbled upon your blog and in accession capital to assert that I get actually enjoyed account your blog posts.

Any way I’ll be subscribing to your feeds and even I achievement you access consistently

rapidly.