Debt securities include notes and bonds, issued by corporations and governmental organizations. Most companies invest excess cash in bonds as investments to earn interest revenue.

The accounting for bond investments1 includes recording the following:

- Purchase of bonds

- Interest revenue

- Sale of bonds

1. Purchase of Bonds

The purchase of bonds is recorded by debiting an investments account for the purchase price of the bonds, including any brokerage commissions. If the bonds are purchased between interest dates, the purchase price includes accrued interest since the last interest payment. This is because the seller has earned the accrued interest, but the buyer will receive the accrued interest when it is paid.

To illustrate, assume that Homer Company purchases $18,000 of U.S. Treasury bonds at their face amount on March 17, 2014, plus accrued interest for 45 days. The bonds have an interest rate of 6%, payable on July 31 and January 31.

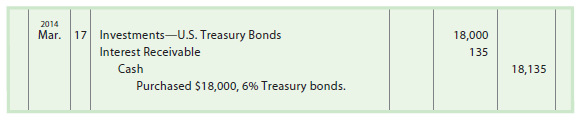

The entry to record the purchase of the Treasury bonds is as follows:

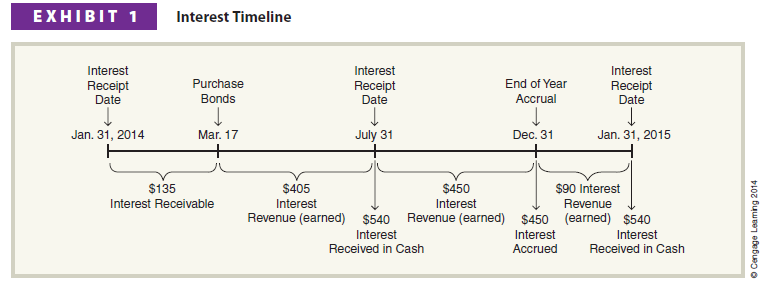

Since Homer Company purchased the bonds on March 17, it is also purchasing the accrued interest for 45 days (January 31 to March 17), as shown in Exhibit 1. The accrued interest of $135 is computed as follows:[1]

Accrued Interest = $18,000 x 6% x (45/360) = $135

The accrued interest is recorded by debiting Interest Receivable for $135. Investments is debited for the purchase price of the bonds of $18,000.

2. Interest Revenue

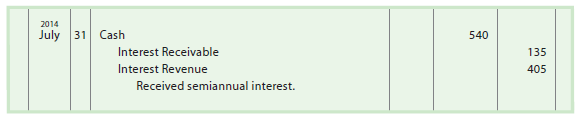

On July 31, Homer Company receives a semiannual interest payment of $540 ($18,000 x 6% X %). The $540 interest includes the $135 accrued interest that Homer Company purchased with the bonds on March 17. Thus, Homer Company has earned $405 ($540 – $135) of interest revenue since purchasing the bonds, as shown in Exhibit 1. The receipt of the interest on July 31 is recorded as follows:

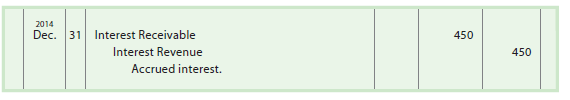

Homer Company’s accounting period ends on December 31. Thus, an adjusting entry must be made to accrue interest for five months (August 1 to December 31) of $450 ($18,000 X 6% X /l2), as shown in Exhibit 1. The adjusting entry to record the accrued interest is as follows:

For the year ended December 31, 2014, Homer Company would report Interest revenue of $855 ($405 + $450) as part of Other income on its income statement.

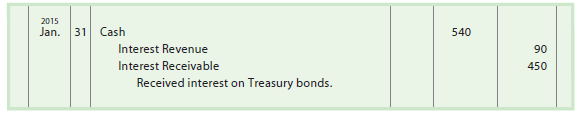

The receipt of the semiannual interest of $540 on January 31, 2015, is recorded as follows:

3. Sale of Bonds

The sale of a bond investment normally results in a gain or loss. If the proceeds from the sale exceed the book value (cost) of the bonds, then a gain is recorded. If the proceeds are less than the book value (cost) of the bonds, a loss is recorded.

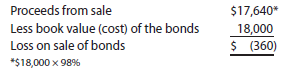

To illustrate, on January 31, 2015, Homer Company sells the Treasury bonds at 98, which is a price equal to 98% of their face amount. The sale results in a loss of $360, as shown below.

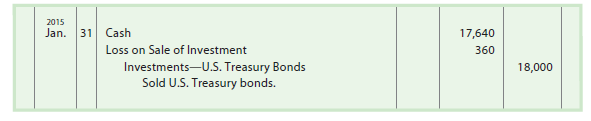

The entry to record the sale is as follows:

There is no accrued interest upon the sale, since the interest payment date is also January 31. If the sale were between interest dates, interest accrued since the last interest payment date would be added to the sale proceeds and credited to Interest Revenue. The loss on the sale of bond investments is reported as part of Other income (loss) on Homer Company’s income statement.

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

Some genuinely quality posts on this website , saved to fav.

Hello. splendid job. I did not imagine this. This is a remarkable story. Thanks!