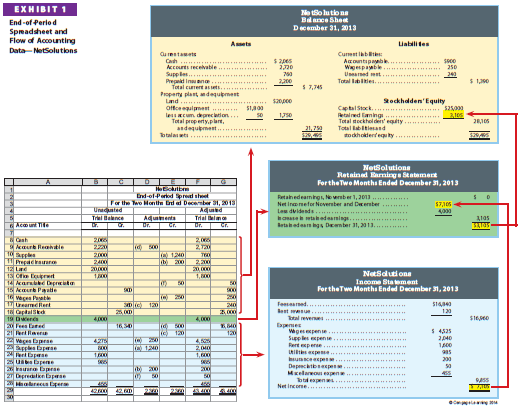

The process of adjusting the accounts and preparing financial statements is one of the most important in accounting. Using the NetSolutions illustration from Chapters 1-3 and an end-of-period spreadsheet, the flow of accounting data in adjusting accounts and preparing financial statements are summarized in Exhibit 1.

The end-of-period spreadsheet in Exhibit 1 begins with the unadjusted trial balance. The unadjusted trial balance verifies that the total of the debit balances equals the total of the credit balances. If the trial balance totals are unequal, an error has occurred. Any errors must be found and corrected before the end-of-period process can continue.

The adjustments for NetSolutions from Chapter 3 are shown in the Adjustments columns of the spreadsheet. Cross-referencing (by letters) the debit and credit of each adjustment is useful in reviewing the effect of the adjustments on the unadjusted account balances. The adjustments are normally entered in the order in which the data are assembled. If the titles of the accounts to be adjusted do not appear in the unadjusted trial balance, the accounts are inserted in their proper order in the Account Title column. The total of the Adjustments columns verifies that the total debits equal the total credits for the adjusting entries. The total of the Debit column must equal the total of the Credit column.

The adjustments in the spreadsheet are added to or subtracted from the amounts in the Unadjusted Trial Balance columns to arrive at the amounts inserted in the Adjusted Trial Balance columns. In this way, the Adjusted Trial Balance columns of the spreadsheet illustrate the effect of the adjusting entries on the unadjusted accounts. The totals of the Adjusted Trial Balance columns verify that the totals of the debit and credit balances are equal after adjustment.

Exhibit 1 illustrates the flow of accounts from the adjusted trial balance into the financial statements as follows:

- The revenue and expense accounts (spreadsheet lines 20-28) flow into the income statement.

- The dividends account (spreadsheet line 19) flows into the retained earnings statement. The net income of $7,105 also flows into the retained earnings statement from the income statement.

- The asset, liability, and capital stock accounts (spreadsheet lines 8-18) flow into the balance sheet. The end-of-the-period retained earnings of $3,105 also flows into the balance sheet from the retained earnings statement.

To summarize, Exhibit 1 illustrates the process by which accounts are adjusted. In addition, Exhibit 1 illustrates how the adjusted accounts flow into the financial statements. The financial statements for NetSolutions can be prepared directly from Exhibit 1.

The spreadsheet in Exhibit 1 is not required. However, many accountants prepare such a spreadsheet, sometimes called a work sheet, as part of the normal end-of- period process. The primary advantage in doing so is that it allows managers and accountants to see the effect of adjustments on the financial statements. This is especially useful for adjustments that depend upon estimates. Such estimates and their effect on the financial statements are discussed in later chapters.1

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

Howdy very nice website!! Guy .. Beautiful .. Wonderful .. I will bookmark your site and take the feeds also…I’m satisfied to seek out so many helpful information here in the publish, we want develop extra techniques on this regard, thank you for sharing. . . . . .

You have remarked very interesting points! ps decent internet site.