During the financial scandals of the early 2000s, stockholders, creditors, and other investors lost billions of dollars.1 As a result, the U.S. Congress passed the Sarbanes-Oxley Act of 2002. This act, often referred to as Sarbanes-Oxley, is one of the most important laws affecting U.S. companies in recent history. The purpose of Sarbanes-Oxley is to maintain public confidence and trust in the financial reporting of companies.

Sarbanes-Oxley applies only to companies whose stock is traded on public exchanges, referred to as publicly held companies. However, Sarbanes-Oxley highlighted the importance of assessing the financial controls and reporting of all companies. As a result, companies of all sizes have been influenced by Sarbanes-Oxley.

Sarbanes-Oxley emphasizes the importance of effective internal control.2 Internal control is defined as the procedures and processes used by a company to:

- Safeguard its assets.

- Process information accurately.

- Ensure compliance with laws and regulations.

Sarbanes-Oxley requires companies to maintain effective internal controls over the recording of transactions and the preparing of financial statements. Such controls are important because they deter fraud and prevent misleading financial statements as shown on the next page.

- Exhibit 2 in Chapter 1 briefly summarizes these scandals.

- Sarbanes-Oxley also has important implications for corporate governance and the regulation of the public accounting profession. This chapter, however, focuses on the internal control implications of Sarbanes-Oxley.

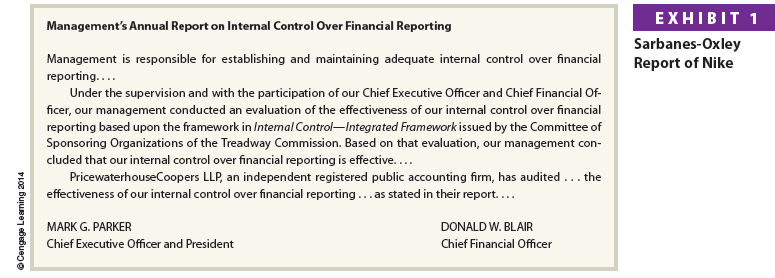

Sarbanes-Oxley also requires companies and their independent accountants to report on the effectiveness of the company’s internal controls.[1] These reports are required to be filed with the company’s annual 10-K report with the Securities and Exchange Commission. Companies are also encouraged to include these reports in their annual reports to stockholders. An example of such a report by the management of Nike is shown in Exhibit 1.

Exhibit 1 indicates that Nike based its evaluation of internal controls on Internal Control—Integrated Framework, which was issued by the Committee of Sponsoring Organizations (COSO) of the Treadway Commission. This framework is the standard by which companies design, analyze, and evaluate internal controls. For this reason, this framework is used as the basis for discussing internal controls.

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

Hello there, I found your blog via Google while searching for a related topic, your web site came up, it looks great. I have bookmarked it in my google bookmarks.