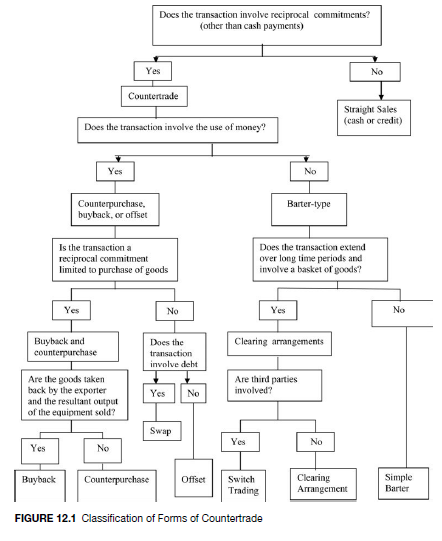

Countertrade takes a variety of forms (see Figure 12.1). Such transactions can be divided into two broad categories:

- Transactions in which products and/or services are traded in exchange for other products and /or services. These include barter, switch trading, and clearing arrangements.

- Transactions that feature two parallel money-for-goods transactions. These include buy-back, counterpurchase, and offset arrangements.

1. Exchange of Goods (Services) for Goods (Services)

1.1. Barter

A classic barter arrangement involves the direct exchange of goods or services between two trading parties (see International Perspective 12.1). An exporter from country A to country B is paid by a reciprocal export from country B to country A, and no money changes hands. The transaction is governed by a single contract. In view of its limited flexibility, barter accounts for about 4 percent of countertrade contracts (Fletcher, 2009). The major problems with barter relate to the determination of the relative value of the goods traded and the reluctance of banks to finance or guarantee such transactions.

Example: In 2009, India agreed to barter its machinery and equipment used for gemstone cutting and polishing for precious and semiprecious stones from the Philippines. Thailand agreed to barter its fruits for Chinese locomotives, passenger buses, and armored cars.

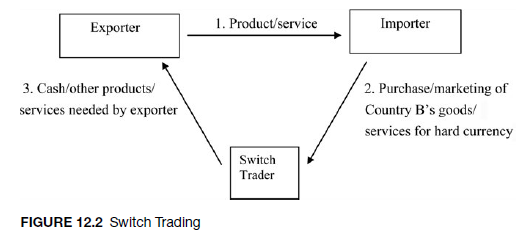

1.2. Switch Trading

This is an arrangement in which a switch trader will buy or market countertraded products for hard currency (Figure 12.2). The switch trader will often demand a sizable fee in the form of a discount on the goods delivered.

Example: A U.S. company exports fertilizer to Pakistan. However, the goods to be counterdelivered by Pakistan are of little interest to the U.S. seller. A Romanian company (switch trader) converts the Pakistani goods into cash, pays the U.S. exporter, and retains a commission.

1.3. Clearing Arrangements

Under clearing arrangements, two governments agree to purchase a certain volume of each other’s goods and/or services over a certain period of time, usually a year. Each country sets up an account in one currency, for example, clearing dollar, pound, or local currency. When a trade imbalance exists, settlement of accounts can be in the form of hard-currency payments for the shortfall, transfer of goods, issuance of a credit against the following year’s clearing arrangement, or switch trading. In switch trading, the creditor country can sell its credit to a switch trader for a discount and receive cash payment. The switch trader will subsequently sell the corresponding goods to third parties (see Figure 12.3).

Example: A Swedish company, Sukab, accumulated a large surplus in its clearing account with Pakistan. Sukab sold its credit to Marubeni, a Japanese company, at a discount, and Marubeni in turn liquidated this imbalance by purchasing Pakistani cotton and exporting it to a third country for hard currency (Anonymous, 1996).

2. Parallel Transactions

2.1. Buyback (Compensation Agreement)

In a buyback or compensation transaction, a private firm sells or licenses technology or builds a plant (with payment in hard currency) and agrees to purchase, over a given number of years, a certain proportion of the output of the technology or plant. The output is to be purchased in hard currency. However, since the products are closely related, a codependency exists between the trading parties (see Figure 12.4). The duration of a compensation arrangement could range from a few years to thirty years or longer in cases in which the technology supplier (seller) is dependent upon the buyer’s output for itself and its subsidiaries. The arrangement involves two contracts, each paid in hard currency, that is, one for the delivery of technology and equipment and another for the buyback of the resulting output. The two contracts are linked by a protocol that, inter alia, stipulates that the output to be purchased by the technology supplier is to be produced with the technology delivered. Since the agreement entails transfer of proprietary technology, it is quite important to pay special attention to the protection of patents, trademarks, and know-how, as well as to the rights of the technology recipient (importer/buyer) with respect to these industrial property rights. Buybacks are estimated to account for 21 percent of countertrade transactions (International Perspective 12.2).

Example: A Japanese company exports computer chip processing and design technology to South Korea, Singapore, and Taiwan, with a promise to purchase a certain percentage of the output over a given period of time. Levi Strauss transfers its know-how and trademark to a Hungarian firm for the production and sale of its products, with an agreement to purchase and market the output in Western Europe.

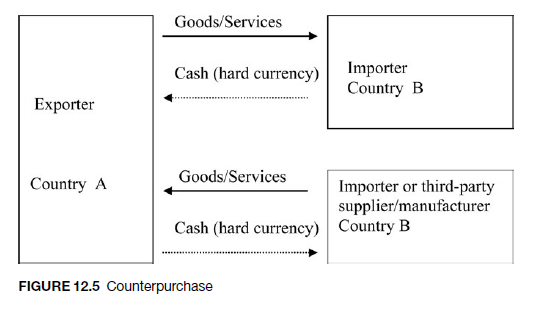

2.2. Counterpurchase

As in a compensation arrangement, counterpurchase consists of two parallel hard currency- for-goods transactions (see Figure 12.5). However, in a counterpurchase, a firm sells goods and/ or services to an importer, promising to purchase from the latter or other entities in the importing nation goods that are unrelated to the items sold. The duration of such transactions is often short (three to five years), and the commitment usually requires a reciprocal purchase of less than the full value of the original sale. In cases in which the reciprocal purchase involves goods that are of low quality or in excess supply, the firm usually resells them to trading companies at a discount. Since the arrangement is often governed by two separate contracts, financing can be organized in a way that is similar to any other export transaction. In addition to flexibility in financing, the contractual separation also provides for separate provisions with regard to guarantee coverage, maturity of payments, and deliveries. As in compensation agreements, the two contracts are linked by a third contract that ties the purchase and sales contracts together and includes terms such as the ratio between purchases and sales, starting time of both contracts, import-export verification system, and so forth (Welt, 1990). Counterpurchase accounts for 54 percent of countertrade transactions (Fletcher, 2009). (See International Perspective 12.3).

Examples: Rockwell and the government of Zimbabwe signed a contract in which Rockwell offered to purchase Zimbabwe’s ferro chrome and nickel in exchange for its sale of a printing press to Zimbabwe.

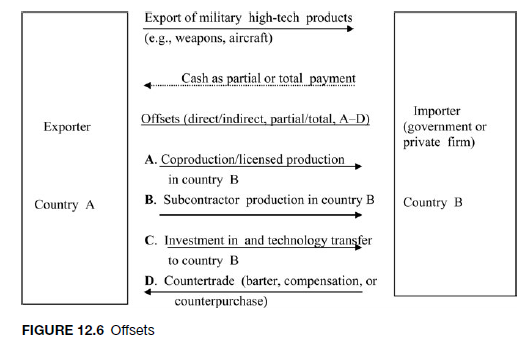

2.3. Offsets

An offset is a transaction in which an exporter allows the purchaser, generally a foreign government, to “offset’’ the cost of purchasing its (the exporter’s) product (Cole, 1987) (see Figure 12.6). Such arrangements are mainly used for defense-related sales, sales of commercial aircraft, or sales of other high-technology products. Offsets are used by many countries as a way to compensate for the huge hard-currency payments resulting from the purchase as well as to create investment opportunities and employment. Such arrangements became widespread after 1973 when OPEC sharply increased the price of oil and countries were left with limited hard currency to pay for major expenditures (Egan and Shipley, 1996; Schaffer, 1989).

Direct Offsets

Direct offsets are contractual arrangements, often involving goods or services related to the products exported. Direct offsets include coproduction, subcontractor production, investments, and technology transfer.

Coproduction. Coproduction is an overseas production arrangement, usually based on a government-to-government agreement that permits a foreign government or producer to acquire the technical information to manufacture all or part of an equipment or component originating in the exporting country. It may include a government-to-government production under license. The essential difference between coproduction and licensed production is that the former is normally a joint venture, while the latter does not entail ownership and/or management of the overseas production by the technology supplier. In coproduction, there is usually a government-to-government negotiation, whereas licensed production is based on direct commercial arrangements between the foreign manufacturer and host government or producer. In most cases, coproduction and licensed production are direct offsets because the resulting output directly fulfills part of the sales obligation.

Example: France purchased AWACS (airborne warning and control system) aircraft from Boeing, based on a coproduction arrangement between the U.S. and the French governments. According to the agreement, 80 percent of the contract value was to be offset by the purchase of engines produced through a joint venture between General Electric and a French firm.

Subcontractor production. Subcontractor production is usually a direct commercial arrangement between a manufacturer and an overseas producer (in the host country) for the production of a part or component of the manufacturer’s export article. Such an arrangement does not often involve licensing of technological information.

Example: Lockheed Martin and the government of Poland reached a $3.8 billion deal for the latter’s purchase of F-16s that included subcontracts with Polish firms to produce “the Pratt & Whitney engine for the F-16” as well as “commercial jet parts for business aircraft,” which would then be exported by Poland back to the United States (Peterson, 2011).

Overseas investments. Overseas investments arising from the offset agreement usually take the form of capital investment to establish or expand a company in the purchasing country.

Example: Company A, a U.S. firm, makes an investment in Company B, a foreign firm located in country C, so that Company B can create a new production line to produce a component of a defense article that is subject to an offset agreement between Company A and country C. The transaction would be categorized as investment and would be direct offset because the investment involves an item covered by the offset agreement.

Technology transfer. Even though technology transfer provisions could be included in coproduction or licensed production arrangements, they are often distinct from both categories. A technology transfer arrangement usually involves the provision of technical assistance and R&D capabilities to the joint-venture partner or other firms as part of the offset agreement.

Example: Spain purchases F-18 aircraft from the United States under an offset arrangement that requires the transfer of aerospace and other related technology to Spain.

Indirect Offsets

Indirect offsets are contractual arrangements in which goods and services unrelated to the exports are acquired from or produced in the host (purchasing) country. These include but are not limited to certain forms of foreign investment, technology transfer, and countertrade.

Example 1: As part of the cooperative defense agreement, the Netherlands purchased Patriot fire units from Raytheon Corporation of the United States for $305 million. Raytheon agreed to provide $115 million in direct offsets and $120 million in indirect offsets. The latter obligation was to be discharged through the purchase of goods and services in the Netherlands.

Arms sales account for a substantial part of offset transactions, which, in turn, make up the largest percentage of countertrade deals.

Example 2: Company A, a U.S. firm, makes arrangements for a line of credit at a financial institution for Company B, a foreign firm located in country C, so that Company B can produce an item that is not subject to the offset agreement between Company A and country C. The transaction would be categorized as credit assistance and would be indirect because the credit assistance is unrelated to an item covered by the offset agreement.

Example 3: Company A, a U.S. firm, purchases various off-the-shelf items from Company B, a foreign firm located in country C, but none of these items will be used by Company A to produce the defense article subject to the offset agreement between Company A and country C. The transaction would be categorized as purchases and would, like all purchase transactions, be indirect.

Source: Seyoum Belay (2014), Export-import theory, practices, and procedures, Routledge; 3rd edition.

I really appreciate this post. I’ve been looking everywhere for this! Thank goodness I found it on Bing. You’ve made my day! Thx again!