Many countries use import quotas and tariffs to keep the domestic price of a product above world levels and thereby enable the domestic industry to enjoy higher profits than it would under free trade. As we will see, the cost to taxpay- ers from this protection can be high, with the loss to consumers exceeding the gain to domestic producers.

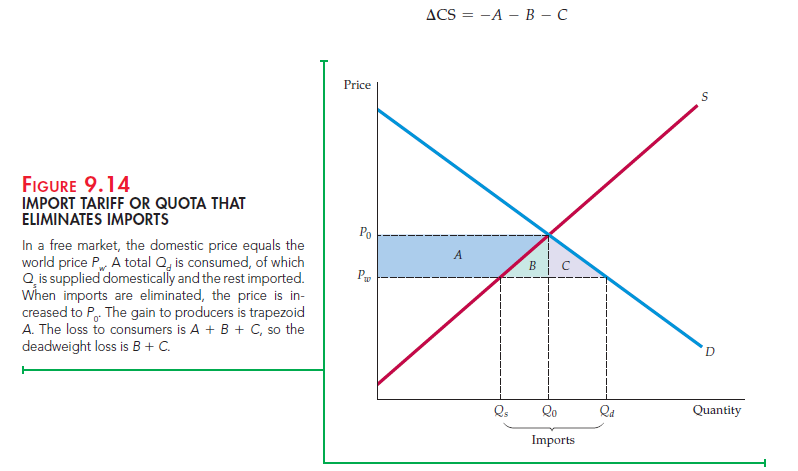

Without a quota or tariff, a country will import a good when its world price is below the price that would prevail domestically were there no imports. Figure 9.14 illustrates this principle. S and D are the domestic supply and demand curves. If there were no imports, the domestic price and quantity would be P0 and Q0, which equate supply and demand. But because the world price Pw is below P0, domestic consumers have an incentive to purchase from abroad and will do so if imports are not restricted. How much will be imported? The domestic price will fall to the world price Pw; at this lower price, domestic production will fall to Qs, and domes- tic consumption will rise to Qd. Imports are then the difference between domestic consumption and domestic production, Qd − Qs.

Now suppose the government, bowing to pressure from the domestic indus-try, eliminates imports by imposing a quota of zero—that is, forbidding any importation of the good. What are the gains and losses from such a policy?

With no imports allowed, the domestic price will rise to P0. Consumers who still purchase the good (in quantity Q0) will pay more and will lose an amount of surplus given by trapezoid A and triangle B. In addition, given this higher price, some consumers will no longer buy the good, so there is an additional loss of consumer surplus, given by triangle C. The total change in consumer surplus is therefore

What about producers? Output is now higher (Q0 instead of Qs) and is sold at a higher price (P0 instead of Pw). Producer surplus therefore increases by the amount of trapezoid A:

![]()

The change in total surplus, ACS + APS, is therefore -B – C. Again, there is a deadweight loss—consumers lose more than producers gain.

Imports could also be reduced to zero by imposing a sufficiently large tariff. The tariff would have to be equal to or greater than the difference between P0 and Pw. With a tariff of this size, there will be no imports and, therefore, no government revenue from tariff collections, so the effect on consumers and producers would be the same as with a quota.

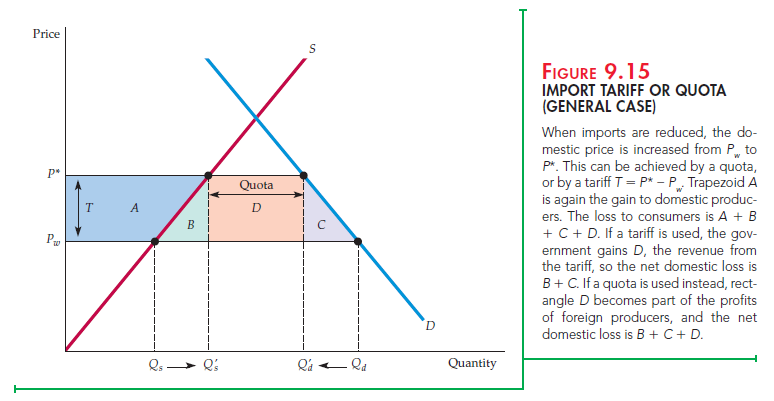

More often, government policy is designed to reduce but not eliminate imports. Again, this can be done with either a tariff or a quota, as Figure 9.15 shows. Under free trade, the domestic price will equal the world price Pw, and imports will be Qd – Qs. Now suppose that a tariff of T dollars per unit is imposed on imports. Then the domestic price will rise to P* (the world price plus the tariff); domestic production will rise and domestic consumption will fall.

In Figure 9.15, this tariff leads to a change of consumer surplus given by

Finally, the government will collect revenue in the amount of the tariff times the quantity of imports, which is rectangle D. The total change in welfare, ACS plus A PS plus the revenue to the government, is therefore -A – B – C – D + A + D = -B – C. Triangles B and C again represent the deadweight loss from restricting Suppose the government uses a quota instead of a tariff to restrict imports: Foreign producers can only ship a specific quantity (Q’d − Q’s in Figure 9.15) to the United States and can then charge the higher price P* for their U.S. sales. The changes in U.S. consumer and producer surplus will be the same as with the tariff, but instead of the U.S. government collecting the revenue given by rectangle D, this money will go to the foreign producers in the form of higher profits. The United States as a whole will be even worse off than it was under the tariff, losing D as well as the deadweight loss B and C.12

This situation is exactly what transpired with automobile imports from Japan in the 1980s. Under pressure from domestic automobile producers, the Reagan administration negotiated “voluntary” import restraints, under which the Japanese agreed to restrict shipments of cars to the United States. The Japanese could therefore sell those cars that were shipped at a price higher than the world level and capture a higher profit margin on each one. The United States would have been better off by simply imposing a tariff on these imports.

Source: Pindyck Robert, Rubinfeld Daniel (2012), Microeconomics, Pearson, 8th edition.

This is a very good tips especially to those new to blogosphere, brief and accurate information… Thanks for sharing this one. A must read article.