If the business plan successfully elicits the interest of a potential investor, the next step is to meet with the investor and present the plan in person. The in- vestor will typically want to meet with the firm’s founders. Because investors ultimately fund only a few ventures, the founders of a new firm should make as positive an impression on the investor as possible.

The first meeting with an investor is generally very short, about one hour.26

The investor will typically ask the firm to make a 15- to 20-minute presenta- tion using PowerPoint slides and use the rest of the time to ask questions. If the investor is impressed and wants to learn more about the venture, the pre- senters will be asked back for a second meeting to meet with the investor and his or her partners. This meeting will typically last longer and will require a more thorough presentation.

1. The oral Presentation of a Business Plan

When asked to meet with an investor, the founders of a new venture should prepare a set of PowerPoint slides that will fill the time slot allowed for the presentation portion of the meeting. The same format applies to most business plan competitions. The first rule in making an oral presentation is to follow instructions. If an investor tells an entrepreneur that he or she has one hour and that the hour will consist of a 20-minute presentation and a 40-minute question-and-answer period, the presentation shouldn’t last more than 20 minutes. The presentation should be smooth and well-rehearsed. The slides should be sharp and not cluttered with material.

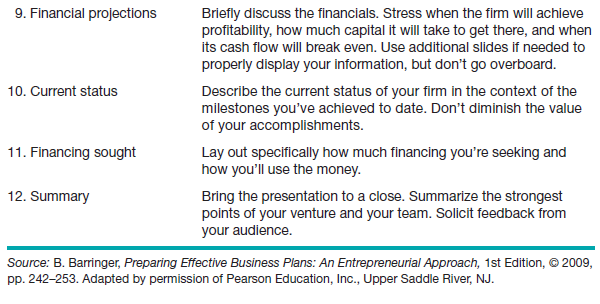

The entrepreneur should arrive at the appointment on time and be well prepared. If any audiovisual equipment is needed, the entrepreneur should be prepared to supply the equipment if the investor doesn’t have it. These arrangements should be made prior to the meeting. The presenta- tion should consist of plain talk and should avoid technical jargon. Start-up entrepreneurs may mistakenly spend too much time talking about the tech- nology that will go into a new product or service and not enough time talking about the business itself. The most important issues to cover in the presen- tation and how to present them are shown in Table 6.5. This presentation format calls for the use of 12 slides. A common mistake entrepreneurs make is to prepare too many slides and then try to rush through them during a 20-minute presentation.

2. Questions and Feedback to expect from investors

Whether in the initial meeting or on subsequent occasions, an entrepreneur will be asked a host of questions by potential investors. The smart entre- preneur has a solid idea of what to expect and is prepared for these queries. Because investors often come across as being very critical,27 it is easy for an entrepreneur to become discouraged, particularly if the investor seems to be poking holes in every aspect of the business plan. The same dynamic typifies the question-and-answer sessions that follow presentations in business plan competitions. In fact, an investor who is able to identify weaknesses in a busi- ness plan or presentation does a favor for the entrepreneur. This is because the entrepreneur can take the investor’s feedback to heart and use it to im- prove the business plan and/or the presentation.

In the first meeting, investors typically focus on whether a real opportunity exists and whether the management team has the experience and skills to pull off the venture. The investor will also try to sense whether the managers are highly confident in their own venture. The question-and-answer period is extremely important. Here investors are typically looking for how well entrepre- neurs think on their feet and how knowledgeable they are about the business venture. Michael Rovner, a partner of Rob Adam’s at AV Labs, put it this way: “We ask a lot of peripheral questions. We might not want answers—we just want to evaluate the entrepreneur’s thought process.”28

Source: Barringer Bruce R, Ireland R Duane (2015), Entrepreneurship: successfully launching new ventures, Pearson; 5th edition.

Greetings! I know this is kinda off topic however , I’d figured I’d ask. Would you be interested in trading links or maybe guest writing a blog post or vice-versa? My site covers a lot of the same subjects as yours and I feel we could greatly benefit from each other. If you might be interested feel free to send me an e-mail. I look forward to hearing from you! Great blog by the way!