Price discrimination can take three broad forms, which we call first-, second-, and third-degree price discrimination. We will examine them in turn.

1. First–Degree Price Discrimination

Ideally, a firm would like to charge a different price to each of its customers. If it could, it would charge each customer the maximum price that the customer is willing to pay for each unit bought. We call this maximum price the customer ’s reservation price. The practice of charging each customer his or her reservation price is called perfect first-degree price discrimination.1 Let’s see how it affects the firm’s profit.

First, we need to know the profit that the firm earns when it charges only the single price P* in Figure 11.2. To find out, we can add the profit on each incremen- tal unit produced and sold, up to the total quantity Q*. This incremental profit is the marginal revenue less the marginal cost for each unit. In Figure 11.2, this mar- ginal revenue is highest and marginal cost lowest for the first unit. For each addi- tional unit, marginal revenue falls and marginal cost rises. Thus the firm produces the total output Q*, at which point marginal revenue and marginal cost are equal.

If we add up the profits on each incremental unit produced, we obtain the firm’s variable profit; the firm’s profit, ignoring its fixed costs. In Figure 11.2, vari- able profit is given by the yellow-shaded area between the marginal revenue and marginal cost curves.2 Consumer surplus, which is the area between the average revenue curve and the price P* that customers pay, is outlined as a black triangle.

PERFECT PRICE DISCRIMINATION What happens if the firm can perfectly price discriminate? Because each consumer is charged exactly what he or she is will- ing to pay, the marginal revenue curve is no longer relevant to the firm’s output decision. Instead, the incremental revenue earned from each additional unit sold is simply the price paid for that unit; it is therefore given by the demand curve.

Since price discrimination does not affect the firm’s cost structure, the cost of each additional unit is again given by the firm’s marginal cost curve. Therefore, the additional profit from producing and selling an incremental unit is now the difference between demand and marginal cost. As long as demand exceeds marginal cost, the firm can increase its profit by expanding production. It will do so until it produces a total output Q**. At Q**, demand is equal to marginal cost, and producing any more reduces profit.

Variable profit is now given by the area between the demand and marginal cost curves.3 Observe from Figure 11.2 how the firm’s profit has increased. (The addi- tional profit resulting from price discrimination is shown by the purple-shaded area.) Note also that because every customer is being charged the maximum amount that he or she is willing to pay, all consumer surplus has been captured by the firm.

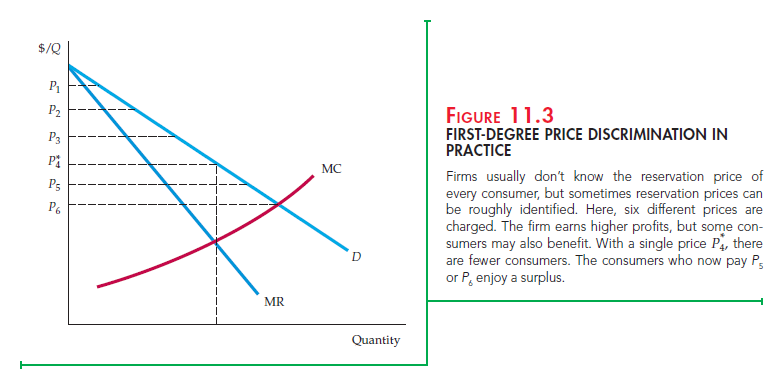

IMPERFECT PRICE DISCRIMINATION In practice, perfect first-degree price discrimination is almost never possible. First, it is usually impractical to charge each and every customer a different price (unless there are only a few custom- ers). Second, a firm usually does not know the reservation price of each cus- tomer. Even if it could ask how much each customer would be willing to pay, it probably would not receive honest answers. After all, it is in the customers’ interest to claim that they would pay very little.

Sometimes, however, firms can discriminate imperfectly by charging a few different prices based on estimates of customers’ reservation prices. This practice is often used by professionals, such as doctors, lawyers, accountants, or architects, who know their clients reasonably well. In such cases, the client’s willingness to pay can be assessed and fees set accordingly. For example, a doctor may offer a reduced fee to a low-income patient whose willingness to pay or insurance cov-erage is low, but charge higher fees to upper-income or better-insured patients. And an accountant, having just completed a client’s tax returns, is in an excellent position to estimate how much the client is willing to pay for the service.

Another example is a car salesperson, who typically works with a 15-percent profit margin. The salesperson can give part of this margin away to the customer by making a “deal,” or can insist that the customer pay the full sticker price. A good salesperson knows how to size up customers: A customer who is likely to look elsewhere for a car is given a large discount (from the salesperson’s point of view, a small profit is better than no sale and no profit), but the customer in a hurry is offered little or no discount. In other words, a successful car salesperson knows how to price discriminate!

Still another example is college and university tuition. Colleges don’t charge dif-ferent tuition rates to different students in the same degree programs. Instead, they offer financial aid, in the form of scholarships or subsidized loans, which reduces the net tuition that the student must pay. By requiring those who seek aid to dis-close information about family income and wealth, colleges can link the amount of aid to ability (and hence willingness) to pay. Thus students who are financially well off pay more for their education, while students who are less well off pay less.

2. Second-Degree Price Discrimination

In some markets, as each consumer purchases many units of a good over any given period, his reservation price declines with the number of units purchased. Examples include water, heating fuel, and electricity. Consumers may each pur- chase a few hundred kilowatt-hours of electricity a month, but their willingness to pay declines with increasing consumption. The first 100 kilowatt-hours may be worth a lot to the consumer—operating a refrigerator and providing for minimal lighting. Conservation becomes easier with the additional units and may be worth- while if the price is high. In this situation, a firm can discriminate according to the quantity consumed. This is called second-degree price discrimination, and it works by charging different prices for different quantities of the same good or service.

Quantity discounts are an example of second-degree price discrimination. A single light bulb might be priced at $5, while a box containing four of the same bulb might be priced at $14, making the average price per bulb $3.50. Similarly, the price per ounce for breakfast cereal is likely to be smaller for the 24-ounce box than for the 16-ounce box.

Another example of second-degree price discrimination is block pricing by electric power companies, natural gas utilities, and municipal water compa- nies. With block pricing, the consumer is charged different prices for different quantities or “blocks” of a good. If scale economies cause average and marginal costs to decline, the government agency that controls rates may encourage block pricing. Because it leads to expanded output and greater scale economies, this policy can increase consumer welfare while allowing for greater profit to the company: While prices are reduced overall, the savings from the lower unit cost still permits the company to increase its profit.

Figure 11.4 illustrates second-degree price discrimination for a firm with declining average and marginal costs. If a single price were charged, it would be P0, and the quantity produced would be Q0. Instead, three different prices are charged, based on the quantities purchased. The first block of sales is priced at P1, the second at P2, and the third at P3.

3. Third–Degree Price Discrimination

A well-known liquor company has what seems to be a strange pricing prac- tice. The company produces a vodka that it advertises as one of the smoothest and best-tasting available. This vodka is called “Three Star Golden Crown” and sells for about $16 a bottle.4 However, the company also takes some of this same vodka and bottles it under the name “Old Sloshbucket,” which is sold for about $8 a bottle. Why does it do this? Has the president of the company been spend- ing too much time near the vats?

Perhaps, but this company is also practicing third-degree price discrimina- tion, and it does so because the practice is profitable. This form of price dis- crimination divides consumers into two or more groups with separate demand curves for each group. It is the most prevalent form of price discrimination, and examples abound: regular versus “special” airline fares; premium versus nonpremium brands of liquor, canned food or frozen vegetables; discounts to students and senior citizens; and so on.

CREATING CONSUMER GROUPS In each case, some characteristic is used to divide consumers into distinct groups. For many goods, for example, students and senior citizens are usually willing to pay less on average than the rest of the population (because their incomes are lower), and identity can be readily established (via a college ID or driver ’s license). Likewise, to separate vacation- ers from business travelers (whose companies are usually willing to pay higher fares), airlines can put restrictions on special low-fare tickets, such as requiring advance purchase or a Saturday night stay. With the liquor company, or the pre- mium versus nonpremium (e.g., supermarket label) brand of food, the label itself divides consumers; many consumers are willing to pay more for a name brand even though the nonpremium brand is identical or nearly identical (and might be manufactured by the same company that produced the premium brand).

If third-degree price discrimination is feasible, how should the firm decide what price to charge each group of consumers? Let’s think about this in two steps.

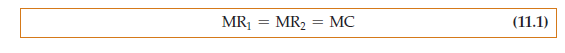

- We know that however much is produced, total output should be divided between the groups of customers so that marginal revenues for each group are equal. Otherwise, the firm would not be maximizing profit. For exam- ple, if there are two groups of customers and the marginal revenue for the first group, MR1, exceeds the marginal revenue for the second group, MR2, the firm could clearly do better by shifting output from the second group to the first. It would do this by lowering the price to the first group and raising the price to the second group. Thus, whatever the two prices, they must be such that the marginal revenues for the different groups are equal.

- We know that total output must be such that the marginal revenue for each group of consumers is equal to the marginal cost of production. Again, if this were not the case, the firm could increase its profit by raising or lowering total output (and lowering or raising its prices to both groups). For example, suppose that marginal revenues were the same for each group of consumers but that marginal revenue exceeded marginal cost. The firm could then make groups of consumers, so that marginal revenues for each group would fall (but would still be equal to each other) and would approach marginal cost.

Let’s look at this problem algebraically. Let P1 be the price charged to the first group of consumers, P2 the price charged to the second group, and C(QT) the total cost of producing output QT = Q1 + Q2. Total profit is then

![]()

The firm should increase its sales to each group of consumers, Q1 and Q2, until the incremental profit from the last unit sold is zero. First, we set incremental profit for sales to the first group of consumers equal to zero:

Here, A (P1Q1)/ A Q1 is the incremental revenue from an extra unit of sales to the first group of consumers (i.e., MR^. The next term, A C/A Q1, is the incremental cost of producing this extra unit—i.e., marginal cost, MC. We thus have

MR1 = MC

Similarly, for the second group of consumers, we must have

MR2 = MC

Putting these relations together, we see that prices and output must be set so that

Again, marginal revenue must be equal across groups of consumers and must equal marginal cost.

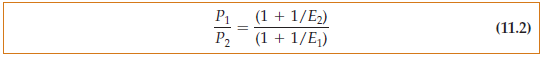

DETERMINING RELATIVE PRICES Managers may find it easier to think in terms of the relative prices that should be charged to each group of consumers and to relate these prices to the elasticities of demand. Recall from Section 10.1 that we can write marginal revenue in terms of the elasticity of demand:

MR = P(1 + 1/Ed)

Thus MR1 = P1(1 + 1/E1) and MR2 = P2(1 + 1/E2), where E1 and E2 are the elasticities of demand for the firm’s sales in the first and second markets, respectively. Now equating MR1 and MR2 as in equation (11.1) gives the following relationship that must hold for the prices:

As you would expect, the higher price will be charged to consumers with the lower demand elasticity. For example, if the elasticity of demand for consumers in group 1 is —2 and the elasticity for consumers in group 2 is —4, we will have P1/P2 = (1 _ 1/4)/(1 – 1/2) = (3/4)/(1/2) = 1.5. In other words, the price charged to the first group of consumers should be 1.5 times as high as the price charged to the second group.

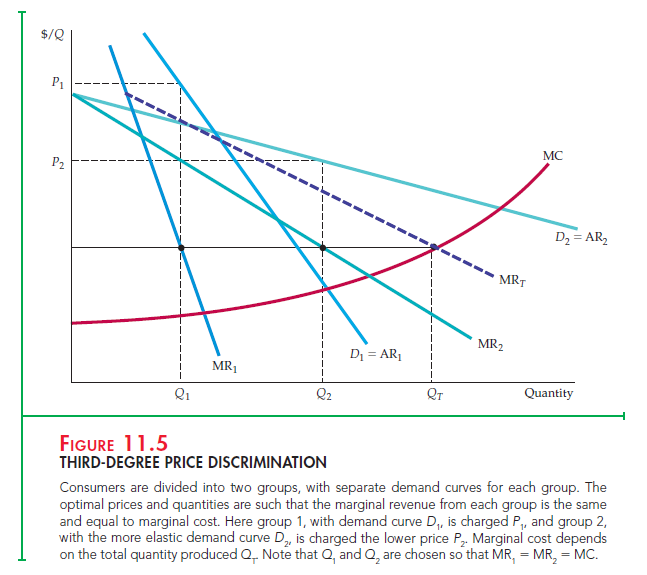

Figure 11.5 illustrates third-degree price discrimination. Note that the demand curve D1 for the first group of consumers is less elastic than the curve for the second group; thus the price charged to the first group is higher. The total quantity produced, Qt = Q1 + Q2, is found by summing the marginal revenue curves MR1 and MR, horizontally, which yields the dashed curve MR, and finding its intersection with the marginal cost curve. Because MC must equal MR1 and MR, we can draw a horizontal line leftward from this intersection to find the quantities Q1 and Q2.

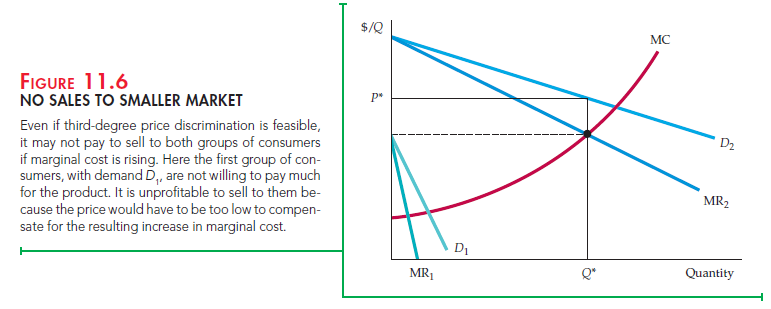

It may not always be worthwhile for the firm to try to sell to more than one group of consumers. In particular, if demand is small for the second group and marginal cost is rising steeply, the increased cost of producing and selling to this group may outweigh the increase in revenue. In Figure 11.6, the firm is better off charging a single price P* and selling only to the larger group of consumers: The additional cost of serving the smaller market would outweigh the additional revenue that might come from selling to it.

Source: Pindyck Robert, Rubinfeld Daniel (2012), Microeconomics, Pearson, 8th edition.

Fastidious answer back in return of this matter with solid arguments and telling everything regarding that.

I think this is among the most vital information for me.

And i’m glad reading your article. But wanna remark on few general things, The site style is wonderful, the articles is really great : D.

Good job, cheers

Hi there, just became alert to your blog through Google, and found

that it is truly informative. I’m going to watch out for brussels.

I’ll appreciate if you continue this in future. A lot of

people will be benefited from your writing.

Cheers!

Great article thanks for sharing… really fascinating,

great work and also thanks for sharing such a good blog.

Inspiring quest there. What occurred after? Good luck!