So far, we have discussed how firms and consumers can decide whether to invest in physical capital—buildings and equipment, in the case of firms, and durable goods such as cars and major appliances, in the case of consumers. We have seen how to apply the net present value rule to these decisions: Invest when the present value of the gains from the investment exceeds the present value of the costs.

Some very important investment decisions involve human capital rather than physical capital. Given that you are now reading this book, you are probably making an investment in your own human capital at this very moment.16 By studying microeconomics, perhaps as part of an undergraduate or graduate degree program, you are obtaining valuable knowledge and skills that will make you more productive in the future.

Human capital is the knowledge, skills, and experience that make an individual more productive and thereby able to earn a higher income over a lifetime. If you go to college or graduate school, take postgraduate courses, or enroll in a special- ized job training program, you are investing in human capital. Most likely, the money, time, and effort that you invest to build up your human capital will pay off in the form of more rewarding or high-paying job opportunities.

How should an individual decide whether to invest in human capital? To answer this question, we can use the same net present value rule that we have applied to investments in physical capital.

Suppose, for example, that upon completing high school you are deciding whether to go to college for four years or skip college and go to work instead. To keep things as simple as possible, let’s analyze this decision on a purely financial basis and ignore any pleasure (in the form of parties and football games) or pain (in the form of exams and papers) that college might entail. We will calculate the NPV of the costs and benefits of getting a college degree.

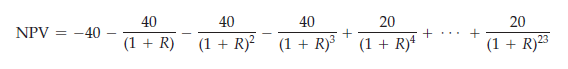

THE NPV OF A COLLEGE EDUCATION There are two major costs associated with college. First, because you will be studying rather than working, you will incur the opportunity cost of the lost wages that you could have earned had you taken a job. For a typical high school graduate in the United States, those lost wages might be about $20,000 per year. The second major cost is for tuition, room and board, and related expenses (such as the cost of this book). Tuition and room and board can vary widely, depending on whether one is attending a public or private college, whether one is living at home or on campus, and whether one is receiving a scholarship. Let’s use $20,000 per year as a rough average number. (Most public universities are less expensive, but many private colleges and universities cost more.) Thus we will take the total economic cost of attending college to be $40,000 per year for each of four years.An important benefit of college is the ability to earn a higher salary throughout your working life. In the United States, a college graduate will on average earn about $20,000 per year more than a high school graduate. In practice, the salary differential is largest during the first 5 to 10 years following college graduation, and then becomes smaller. For simplicity, however, we will assume that this $20,000 salary differential persists for 20 years. In that case, the NPV (in $1000’s) of investing in a college education is

What discount rate, R, should one use to calculate this NPV? Because we have kept the costs and benefits fixed over time, we are implicitly ignoring inflation. Thus we should use a real discount rate. In this case, a reasonable real discount rate would be about 5 percent. This rate would reflect the opportunity cost of money for many households—the return that could be made by investing in assets other than human capital. You can check that the NPV is then about $66,000. With a 5-percent discount rate, investing in a college education is a good idea, at least as a purely financial matter.

Although the NPV of a college education is a positive number, it is not very large. Why isn’t the financial return from going to college higher? Because in the United States, entry into college has become attainable for the majority of graduating high school seniors.In other words, a college education is an investment with close to free entry. As we saw in Chapter 8, in markets with free entry, we should expect to see zero economic profits, which implies that investments will earn a competitive return. Of course, a low economic return doesn’t mean that you shouldn’t complete your college degree—there are many benefits to a college education that go beyond increases in future earnings.

Source: Pindyck Robert, Rubinfeld Daniel (2012), Microeconomics, Pearson, 8th edition.

I got good info from your blog

I like this website very much so much good info .