As depicted in Figure 8.2, the analysis of a firm’s historical financial statement is followed by the preparation of forecasts. Forecasts are predictions of a firm’s future sales, expenses, income, and capital expenditures. A firm’s forecasts pro- vide the basis for its pro forma financial statements. A well-developed set of pro forma financial statements helps a firm create accurate budgets, build financial plans, and manage its finances in a proactive rather than a reactive manner.

As mentioned earlier, completely new firms typically base their forecasts on a good-faith estimate of sales and on industry averages (based on a percent- age of sales) or the experiences of similar start-ups for cost of goods sold and other expenses. As a result, a completely new firm’s forecast should be pre- ceded in its business plan by an explanation of the sources of the numbers for the forecast and the assumptions used to generate them. This explanation is called an assumptions sheet, as mentioned in Chapter 6. Investors typically study assumptions sheets like hawks to make sure the numbers contained in the forecasts and the resulting financial projections are realistic. For example, the assumptions sheet for a new venture may say that its forecasts are based on selling 500 units of its new product the first year, 1,000 units the second year, and 1,500 units the third year, and that its cost of goods sold will remain stable (meaning that it will stay fixed at a certain percentage of net sales) over the three-year period. It’s up to the reader of the plan to determine if these numbers are realistic.16 If the reader feels they are not, then the credibility of the entire plan is called into question.

1. Sales Forecast

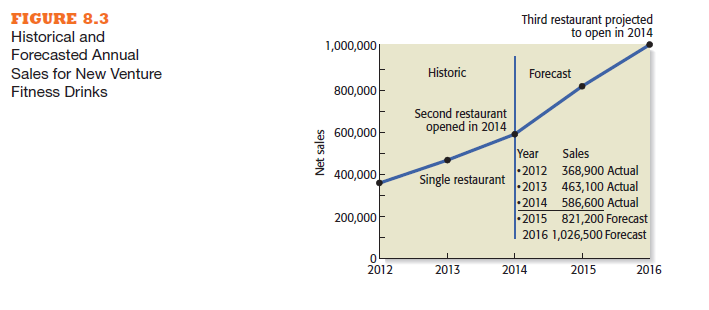

A sales forecast is a projection of a firm’s sales for a specified period (such as a year), though most firms forecast their sales for two to five years into the future.17 It is the first forecast developed and is the basis for most of the other forecasts.18 A sales forecast for an existing firm is based on (1) its record of past sales, (2) its current production capacity and product demand, and (3) any factor or factors that will affect its future production capacity and product de- mand. To demonstrate how a sales forecast works, Figure 8.3 is a graph of the past sales and the forecasted future sales for New Venture Fitness Drinks. The company’s sales increased at a rate of about 26 percent per year from 2012 to 2014 as the company became established and more people became aware of its brand. In forecasting its sales for 2015 and 2016, the company took into con- sideration the following factors:

■ The fitness craze in America continues to gain momentum and should con- tinue to attract new people to try its fitness drinks.

■ The interest in intramural sports, especially soccer, baseball, and softball, should continue to provide a high level of traffic for its restaurants, which are located near large intramural sports complexes.

■ The company expanded from a single location in 2011 to two locations in 2014 (the second restaurant was added in November 2014), and this should increase its capacity to serve fitness drinks by approximately 50 percent. The second restaurant is smaller than the first and is located in an area where the company is not as well known. The company will be actively promoting the new restaurant but knows it will take time to win market share.

■ The general economy in the city where the company is located is flat—it is neither growing nor shrinking. However, layoffs are rumored for a larger employer near the location of the new restaurant.

The combination of these factors results in a forecast of a 40 percent in- crease in sales from 2014 to 2015 and a 25 percent increase in sales from 2015 to 2016. It is extremely important for a company such as New Venture Drinks to forecast future sales as accurately as possible. If it overestimates the demand for its products, it might get stuck with excess inventory and spend too much on overhead. If it underestimates the demand for its product, it might have to turn away business, and some of its potential customers might get into the habit of buying other firms’ fitness drinks.

Note that sophisticated tools are available to help firms project their fu- ture sales. One approach is to use regression analysis, which is a statistical technique used to find relationships between variables for the purpose of pre- dicting future values.19 For example, if New Venture Fitness Drinks felt that its future sales were a function of its advertising expenditures, the number of people who participate in intramural sports at the sports complexes near its restaurants, and the price of its drinks, it could predict future sales using re- gression analysis as long as it had historical data for each of these variables. If the company used simpler logic and felt that its future sales would increase a certain percentage over its current sales, regression analysis could be used to generate a more precise estimate of future sales than was predicted from the information contained in Figure 8.3. For a new firm that has limited years of “annual data,” monthly data could be used to project sales.

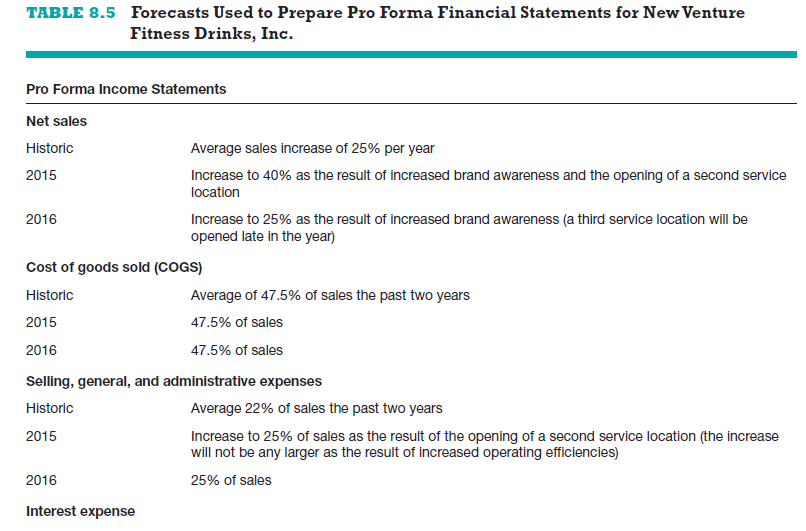

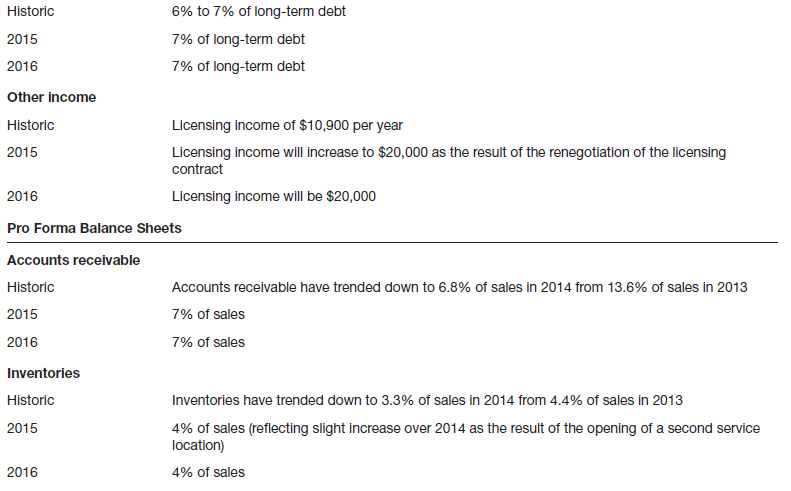

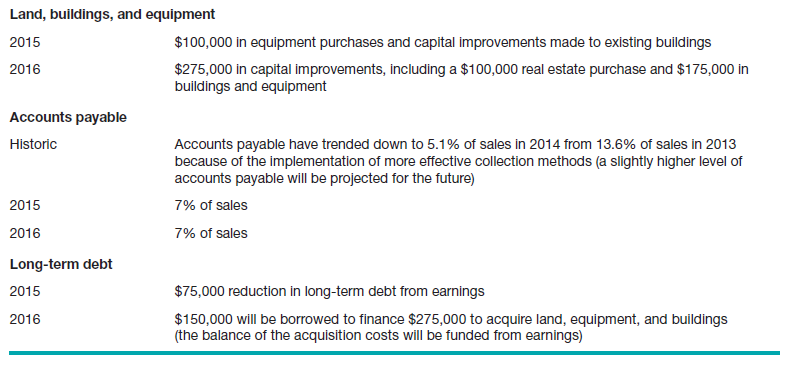

2. Forecast of costs of sales and other items

After completing its sales forecast, a firm must forecast its cost of sales (or cost of goods sold) and the other items on its income statement. The most common way to do this is to use the percent-of-sales method, which is a method for ex- pressing each expense item as a percentage of sales.20 For example, in the case of New Venture Fitness Drinks, its cost of sales has averaged 47.5 percent over the past two years. In 2014, its sales were $586,600 and its cost of sales was $268,900. The company’s sales are forecast to be $821,200 in 2015. Therefore, based on the percent-of-sales method, its cost of sales in 2015 will be $390,000, or 47.5 percent of projected sales. The same procedure could be used to fore- cast the cost of each expense item on the company’s income statement.

Once a firm completes its forecast using the percent-of-sales method, it usually goes through its income statement on an item-by-item basis to see if there are opportunities to make more precise forecasts. For example, a firm can closely estimate its depreciation expenses, so it wouldn’t be appropriate to use the percent-of-sales method to make a forecast for this item. In addition, some expense items are not tied to sales. For those items, the firm makes rea- sonable estimates.

Obviously, a firm must apply common sense in using the percent-of-sales method. If a company is implementing cost-cutting measures, for example, it might be able to justify projecting a smaller percentage increase in expenses as opposed to sales. Similarly, if a firm hires an upper-level manager, such as a chief financial officer, toward the end of the year and plans to pay the person $100,000 the next year, that $100,000 may not have an immediate impact on sales. In this case, the firm’s forecast for administrative expenses may have to be adjusted upward beyond what the percent-of-sales method would suggest.

If a firm determines that it can use the percent-of-sales method and it fol- lows the procedure described previously, then the net result is that each ex- pense item on its income statement (with the exception of those items that may be individually forecast, such as depreciation) will grow at the same rate as sales. This approach is called the constant ratio method of forecasting. This approach will be used in preparing the pro forma financial statements for New Venture Fitness Drinks in the next section.

A summary of the forecasts used to prepare the pro forma financial state- ments for New Venture Fitness Drinks is provided in Table 8.5.

In addition to computing sales forecasts, when a company like New Venture Fitness Drinks considers opening a new restaurant or producing a new prod- uct, it often calculates a break-even analysis to determine if the proposed initiative is feasible. The break-even point for a new restaurant or product is the point where total revenue received equals total costs associated with the output of the restaurant or the sale of the product.21 In the case of opening a new restaurant, New Venture Fitness Drinks could use break-even analysis as one way of determining whether the proposed initiative is feasible. The formula for break-even analysis is as follows: Total fixed costs/(price – average variable costs). In most instances, average variable cost is the same number as average cost of goods sold. As a result, if the total fixed cost associated with opening a new restaurant is $101,000 per year, the average price for a fitness drink is $2.75, and the variable cost (or cost of goods sold) for each drink is $1.10, then the break-even point for the new restaurant is as follows:

![]()

This number means that the new restaurant will have to sell 61,212 “units,” or fitness drinks, per year to “break even” at the current price of the drinks. That number breaks down to the sale of 170 fitness drinks per day, on average, based on a 360-day year. To determine whether opening the new restaurant is feasible, the managers of New Venture Fitness Drinks would compare this number against the historic sales figures for their other restau- rants, making adjustments as appropriate (e.g., the new restaurant may have a better or worse location than the existing restaurants). If selling 170 fitness drinks per day seems unrealistic, then the managers of New Fitness Drinks might opt to not open the new restaurant, or find ways to lower fixed or vari- able costs or increase revenues. An obvious way to increase revenues is to raise the price of the fitness drinks, if that option is realistic given the competi- tive nature of the marketplace.

Source: Barringer Bruce R, Ireland R Duane (2015), Entrepreneurship: successfully launching new ventures, Pearson; 5th edition.

An fascinating dialogue is worth comment. I feel that it’s best to write more on this matter, it may not be a taboo subject but generally people are not enough to talk on such topics. To the next. Cheers

I am often to blogging and i really appreciate your content. The article has really peaks my interest. I am going to bookmark your site and keep checking for new information.