1. MONITORING AND MORAL HAZARD

Monitoring is a response to the problem of ‘moral hazard’. Because people, by assumption, cannot be relied upon to keep a promise to exert effort e, ‘direct incentives’ via piece-rates are required to ensure compliance. The risk-sharing losses involved are the result of moral hazard, but they may be reduced by monitoring. As Stiglitz (1975) puts it ‘workers voluntarily undertake to be supervised . . . They submit to being compelled to work harder than direct incentives provide for because the consequence is a higher expected utility’ (p. 571). Against these potential benefits it is necessary to set the costs of monitoring, as we saw in Chapter 5. It may also be that individuals will resent the presence of a monitor, and extra costs (utility losses) will result from working in a less pleasant ‘atmosphere’.

In Chapter 5 we analysed ‘monitoring gambles’ which involved the imperfect observations of an agent’s effort. In practice, of course, many jobs are very complex and the relatively simple ‘principal and agent’ approach which assumes observable and ‘verifiable’ outcomes does not fully encapsulate the contractual difficulties. Many aspects of complex management jobs are difficult to contract over. As was emphasised in Chapter 4, subsection 7.3, some outcomes are non-contractible because, while ‘observable’, they are nonverifiable. If, as a principal, we were to draw up contracts simply using a verifiable subset of the outcomes that we wish our agent to achieve, we would run the risk of encouraging severely dysfunctional behaviour. Teachers paid by the examination results of their pupils, for example, might ignore less able children or divert attention from non-contractible outcomes such as inculcating enthusiasm for a wide range of cultural activities. Surgeons penalised for deaths might become highly risk averse and not take actions which are actually in the interests of certain categories of patient. ‘Lower-powered’ incentives might be more appropriate if these dangers are serious.

One response to this problem of complex non-verifiable objectives is to monitor using ‘subjective’ measures of performance. An obvious immediate objection is that the agent might not trust the monitor to be honest in his or her ‘subjective’ evaluation. The system would seem to constitute an open invitation to the principal-monitor to ‘move the goalposts’ by claiming to have observed deficiency in some non-verifiable realm of activity. Clearly, repeat dealing and the game-theoretic mechanisms for the evolution of ‘trust’ and ‘reputation’ discussed in Chapter 1, section 8, are significant elements in a solution to this problem. Further comments on this subject appear below in the context of ‘bond posting’ and the ‘tournament’. A further problem with subjective criteria occurs when the monitor is not the same person as the principal. If monitors are themselves agents of the principal and their decisions are not verifiable, they will be subject to pressure from the people they are monitoring. This pressure might take the form, for example, of personal unwillingness to ‘judge’ unfavourably the performance of a close colleague.9 Attempts to influence the decisions of a monitor through ‘influence activities’ could range, however, all the way from flattery to blackmail or outright bribery.10

2. CONTRACTS AND ADVERSE SELECTION: THE SCREENING MECHANISM

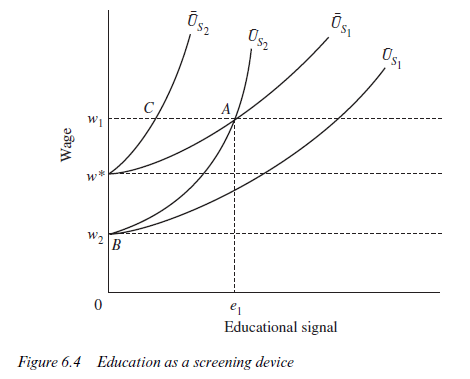

Contractual responses to the adverse-selection problem are possible, although they will not always be effective. The firm may employ screening devices or skill indicators, as was briefly mentioned in Chapter 2, subsection 2.1.3. In Figure 6.4 we illustrate the case of an educational-screening mechanism. Let there be two types of potential employee with productivity (skill) levels s1 and s2 respectively. The average productivity of potential employees is w* and a firm can break even by paying skilled and unskilled alike a wage of w*. Now suppose that educational qualifications are more costly to achieve for the unskilled than the skilled. In both cases it will be necessary to pay a higher wage to persuade potential employees to acquire qualifications.12 However, the lower costs faced by the skilled will mean that they will require a smaller upward adjustment to the wage for any given level of educational attainment than will the unskilled. Thus, in Figure 6.4 the indifference curves with the subscript s1 apply to the relatively skilled individuals, while the indifference curves with the subscript s2 apply to the less skilled. The curves of the skilled are less steep, at any given level of education, than are those of the unskilled.

Instead of offering a contract at w* for all its employees, the firm could instead try to separate the skilled from the unskilled. In Figure 6.4 this can be accomplished by offering a choice of two contracts, one at A and one at B. The contract at A offers a wage of w1 contingent upon the applicant achieving educational level e1. The contract at B offers a wage of w2 with no stipulation about educational attainment. Points A and B are both on an indifference curve applying to skill-level 2. Thus, a relatively unskilled person will be indifferent between the two contracts. A skilled person, in contrast, is better off at A than at B. In this case, therefore, a ‘separating equilibrium’ exists. A contract at A (or fractionally to the right of A) will be accepted by the skilled and rejected by the unskilled in favour of B.

It is worth noticing that, as the figure is drawn, the screening mechanism has harmed the less skilled while leaving the more skilled at the same utility level as they would have enjoyed if a single contract at w* had been offered. From a social point of view, therefore, screening or signalling may not always result in benefits. Further, the social opportunity cost of the resources used in providing the signal does not appear in the figure. However, the model has been presented in a particularly extreme form. If the process of acquiring the education itself increases productivity, or if the internal training procedures of the firm are more effective because of the information provided by the signal, signalling or screening can have productive and not merely redistributional consequences.

It should also be noted that a simple separating equilibrium is not always assured. If, for example, the contract at point A were less preferred than one at w* by the skilled individuals, it would be open to a firm to avoid screening, offer a contract at w* to skilled and unskilled alike and still break even. The situation would be unstable, however, because another firm could counter by offering a contract just below or to the right of point C, thereby attracting all the skilled individuals but forcing adjustments on the ‘pooling’ firms.13 Contractual responses to adverse selection can be expected to be only partially effective, therefore, and should be regarded as complementary with rather than complete substitutes for internal monitoring.

Source: Ricketts Martin (2002), The Economics of Business Enterprise: An Introduction to Economic Organisation and the Theory of the Firm, Edward Elgar Pub; 3rd edition.

Great work! This is the type of information that should be shared around the web. Shame on the search engines for not positioning this post higher! Come on over and visit my site . Thanks =)