1. ‘Ownership’ and the Entrepreneur

Property rights theory as developed by Grossman, Hart and others in recent years is in the neoclassical tradition of analysis. It assumes rational utility-maximising behaviour in the presence of a known set of constraints. It is not Walrasian in the sense described in Chapter 1, with its assumption of a full set of markets for all goods and services. In property rights theory, some things are not contractible. Property rights theory is thus in the tradition of ‘contested exchange’.25 There are elements to the theory, however, which have implications for the issues which we began to develop in Chapter 3. There we argued that although conceptions of the role of the entrepreneur varied – whether the entrepreneur was an uncertainty bearer (after Knight), an alert intermediator (after Kirzner), a maker of judgemental decisions (after Casson), or a technological innovator (after Schumpeter) – the one feature in common was that entrepreneurial services were themselves not contractible. You cannot promise to supply entrepreneurial services because (in the language of property rights theory) such a contract would be unverifiable.

Entrepreneurs achieve pure profits through trading in property rights. These property rights do not have to be residual control rights. Any exchangeable right is capable of generating pure profit to the entrepreneur. From Kirzner’s point of view, for example, a person who buys a lease on some domestic property and then sells to a person who values it more highly gains an entrepreneurial rent. The fact that ‘ownership’ of the property has not changed hands does not matter; the entrepreneur might or might not be the ‘owner’ of the property. However, although ownership is not a necessary condition for the exercise of the entrepreneurial function, we might still wonder whether ownership is sometimes helpful to the entrepreneur.

The property rights theory reviewed in section 7.3 hinges on the idea that ‘ownership’ matters when contract fails. Consider now the position of an entrepreneur wishing to undertake a particular plan of action. If the entrepreneur owns the physical assets which are necessary to the successful completion of the plan, there is no need to ask anyone else’s permission to go ahead. The danger with having to negotiate with an owner is that the owner will then be able to demand a share in the entrepreneurial profit. Does this matter? Somewhat paradoxically, an Austrian theorist such as Kirzner would find it difficult to prove that it did matter. This is because Kirzner asserts that entrepreneurial insight is ‘costless’. Combine Kirzner’s costless alertness with Hart’s costless bargaining and the sharing of some of the profit with an asset owner will not reduce the amount of entrepreneurial alertness or the social gains achieved.26 Relaxing these assumptions of costless alertness and bargaining, however, makes the assignment of ownership rights important for entrepreneurial activity.

If bargaining is not a costless and efficient process, ownership of residual control rights by the entrepreneur will economise on bargaining costs and greatly facilitate entrepreneurial activity. This is an important Austrian’ theme which is taken up in Part 3 where the social importance of the assignment of control rights to ‘competence’ is discussed in more detail. Similarly, if entrepreneurial ideas require the commitment of time, energy and resources in ex ante non-contractible investments, the Grossman-Hart property rights approach can be applied directly to conclude that the necessary physical assets should be owned by the entrepreneur whose human capital is likely to be ‘essential’ to achieving the best results. This would be so, even if the cost of bargaining with the asset owner were zero ex post. The entrepreneur would predict that a portion of the value of his or her discoveries would be appropriated by the asset owner and would thus cut back on the level of ex ante investment.

A major reason for the lack of dynamism associated with socialist regimes during the twentieth century was the difficulty faced by most people in putting any entrepreneurial plan into action, because rights of control were not assigned privately. These control rights were also separated from profit rights. In fact, profit rights and control rights are highly complementary. If I possess profit rights but no control rights, I will expect to have to share some of my profit with the controller before I am permitted to go ahead with an entrepreneurial initiative. Conversely, if I have control rights but no profit rights, I will expect much of the value of my entrepreneurial activities to be harvested by the holder of profit rights. Holding one of these rights is not enough. I need to hold both together before the return to my non-contractible investments is protected. The close association between profit rights and control rights – the fact that these are usually seen as a ‘package’ constituting ‘ownership’ – thus follows naturally from property rights analysis.

2. The Property Rights Approach to the Finance of the Entrepreneur

In Chapter 3 we introduced Kirzner’s (1979, p. 94) idea that entrepreneurial profits are captured by those ‘who exercise pure entrepreneurship, for which ownership is never a condition’. By this statement, Kirzner is emphasising the point that entrepreneurial gains are a distinct category and nothing to do with the conventional return to capital. Precise textual analysis of Kirzner’s treatise does not concern us here, but it will be useful to interpret his use of the word ‘ownership’ at this point as meaning simply ‘wealth’. Kirzner is not making distinctions between ownership and other property rights but is simply making the challenging point that you do not have to be wealthy to be an entrepreneur. He notes that a capitalist might be induced to lend funds at interest and that this might permit pure profit to be earned without any net investment on the part of the entrepreneur.

Property rights theory provides a tool for investigating this claim in more detail. Obviously there is a level at which the possibility of successful entrepreneurship with zero wealth is a matter of pure tautology rather than positive economics. Maybe there really are capitalists somewhere who might be induced to lend to entrepreneurs with zero wealth. Possibly the entrepreneur has discovered an opportunity that can be pursued by means that are not inherently non-contractible. Nevertheless, the commonsense observation that it is less difficult to act entrepreneurially if you have some wealth than if you do not can be analysed more systematically and is capable of yielding insights concerning the use of debt in financial contracting.27

Consider, for example, an entrepreneur who has no wealth (for the sake of convenience we shall take this entrepreneur to be a woman). She discovers an opportunity that will result in a flow of revenue in the future. The revenue flow will be R1 at the end of period 1 and R2 at the end of period 2. There is no uncertainty in this model which gives it a rather Kirznerian flavour. In order to achieve this revenue flow, the entrepreneur must invest in an asset costing K0 at the beginning of period 1. The asset depreciates over the two periods. At the end of period 2 it is worthless. Assume that the rate of interest is zero so that this project is worth undertaking if

Ko< R + R2 (4.1)

If there are no contractual difficulties confronting capitalist and entrepreneur, we can imagine the entrepreneur borrowing K0 from the capitalist. The entrepreneur could make repayments from the revenue stream spread over the life of the project. The pure profit might be split between capitalist and entrepreneur.

In fact, of course, the entrepreneur and the capitalist face a very hazardous contractual environment. These hazards can be introduced by assuming that R1 and R2 are unverifiable. It is always possible for the entrepreneur to claim that she had not, after all, received any revenues and that the project had failed. She could regretfully announce this news even as she is making secret deposits in a foreign bank account. This is an extreme situation. It is not denied that social mechanisms exist to help enforce debt repayments and overcome hazards. If the project is a local one, and if the lenders of funds are neighbours, the power of peer pressure and other monitoring devices might be used. These matters will be considered in Chapters 10 and 11. The assumption of the non-verifiability of revenue flows, however, helps to focus attention on the root of the contractual problem and is a useful basis for modelling potential responses.

The first thing to note is that, with non-contractible flows of revenue, the project is unlikely to get financed if the entrepreneur has no wealth. There is, however, one possible escape route. If the asset does not depreciate at all during period 1, the entrepreneur could make the following offer to the capitalist. ‘If you will lend me a sum K0, I will undertake to repay this sum at the end of period 1. If I fail to make this repayment, you may take over the ownership rights in the assets which will have a liquidation value at that time of K0.’ This has the features of a classic debt contract. Ownership of the asset resides with the entrepreneur for so long as an agreed schedule of repayments is adhered to. Failure to meet this schedule of payments will lead to ownership rights passing to the capitalist. Clearly, if K0 is used to acquire assets these will normally depreciate so that the entrepreneur’s offer mentioned above will not generally be possible. Perhaps the nearest approach in practice would be the finance of a farmer by a mortgage on the land. Nevertheless, the main point is that the entrepreneur can gain access to debt finance providing she has wealth enough to cover the depreciation on the asset during period 1. If the asset has a liquidation value of K1 at the end of period 1, the entrepreneur will be able to borrow K1 during that period of time. She will therefore require wealth of K0 — K1 to start her project. We will assume initially that the entrepreneur uses all her available wealth ( W) to get her project off the ground (W =K0 — Kl).

Starting the project is all very well, but will she be able to finish it? It is not obvious that it will be worth borrowing K1 and investing her personal wealth K0 — K1, in the certain knowledge that liquidation will occur at the end of period 1. How will she make the payment Kj at that point? One answer might be that the revenue Rj is more than enough to pay off the debt; that is, Rj > Kj. The project would certainly have to be extremely profitable for this to be the case but it is a logical possibility. Notice that, if the entrepreneur is not to liquidate the project herself, the revenue at the end of period 2 must also exceed Kj. Thus we assume R2 >K1 to ensure that liquidation of the project at the end of period 1 is not the efficient thing to do in any case. We conclude that there might exist some projects with such attractive cash flows that the entrepreneur will be able to use them to finance her borrowing. The capitalist will have security for his loan and the entrepreneur the means and the incentive to repay at the end of period 1. Note also that, for a given level of investment K0, the smaller is the depreciation of the assets during period 1 the more the entrepreneur can borrow, but the greater the cash flows have to be at the end of periods 1 and 2 to enable and to warrant the repayment of debt. Entrepreneurs with very modest wealth will therefore only be able to finance projects using assets which depreciate slowly at first, which are not highly project-specific and which have cash flows which imply a very high level of profitability.

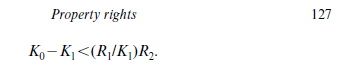

There is, however, another possibility. In the above paragraph, the implicit assumption was made that the full project either achieved completion at the end of period 2 or was liquidated at the end of period 1. Perhaps, however, the entrepreneur could herself partially liquidate the project at the end of period 1 using the proceeds of asset sales to repay her loan to the capitalist – thus retaining control rights in the assets that remain. Even with R1 < K1, therefore, the entrepreneur need not give up her plans for period 2, pocket R1, go into liquidation and hand over all control rights to the capitalist. She could borrow K1 and repay partly from period 1 revenues but partly from asset sales. This would only be possible, of course, if the project were flexible enough to be scaled back. In order to meet her obligations to the capitalist she would have to sell a proportion (K1 — R1)/K1 of the assets at the end of period 1. This would leave her in possession of R1/K1 of the assets from which we assume she could derive a revenue of (R1/K1)R2 at the end of period 2. The entrepreneur therefore invests K0— K1 (still assumed to be equal to her personal wealth) at the beginning of period 1 and receives the return (R1/K1)R2 at the end of period 2. This will be profitable providing that

Since K1 =R1 + (1 — R1IK1)K1, this condition for the entrepreneur to invest can also be written

![]()

The last two terms on the right hand side of 4.1′ constitute a weighted average of K1 and R2. Since K1 < R2 we deduce that

![]()

In other words, the entrepreneur will not undertake all projects for which the revenues exceed K0. She will undertake only those projects for which the cash flows (allowing for partial liquidation at the end of period 1) exceed K0. Clearly if R1 = K1, the entrepreneur will be able to undertake the project with no inefficient early liquidation, just as discussed in an earlier paragraph.

Up to this point, the entrepreneur’s personal wealth has served entirely to finance the depreciation of the asset during period 1. If she does not have access to this level of wealth, she cannot get the project through the first period. This is because, by assumption, she cannot commit to pay the capitalist more than the liquidation value of the asset at the end of period 1.28 If, however, her wealth is more than sufficient to cover asset depreciation during the first period she might use the remaining portion, in conjunction with revenue accruing at the end of period 1, to repay the capitalist and avoid some of the inefficient liquidation which might otherwise be necessary. This partial liquidation of assets occurs because she cannot commit to pay the capitalist any of the non-verifiable revenue accruing at the end of period 2.

An entrepreneur will be able to finance a project without partial liquidation of assets along the way providing her wealth ( W) exceeds asset depreciation in the first period (K0 — K1) plus any shortfall in period 1’s revenue below the liquidation value of the assets (K1 — Rl). Thus:

![]()

ensures that the entrepreneur’s plan can be financed without liquidating assets. If wealth exceeds K0—K1 but is less than K0 — Rl the proportion of the project liquidated at the end of period 1 will be (K0 — Rl — W)IK1.

Private wealth is thus important to entrepreneurial initiative in a property rights analysis. The contract of debt whereby control rights pass to the capitalist in the event of default is indeed a method whereby entrepreneurs can pursue their ideas without having to finance it all themselves. But some private wealth assists entrepreneurship. The greater the depreciation of assets in period 1 (perhaps the more project specific the capital) the more private wealth is required to finance the project. Similarly, the more end- weighted the project returns (the smaller the revenues accruing at the end of period 1) the more private wealth will be required to avoid partial liquidation of assets.

The role of private wealth in economic development is of considerable theoretical and practical interest. In a recent book, for example, de Soto (2000) asks why it is that capitalism seems to be successful in some countries but apparently fails in others. His answer is that even people living in conditions of great poverty have accumulated in aggregate vast resources which eclipse flows of aid and even far exceed the capitalisation of companies quoted on the local stock exchanges. His main point is that these assets held by the poor constitute ‘dead capital’ because legal title to the assets is absent or hugely expensive to assert. He estimates untitled real estate holdings in Haiti to be worth $5.2 billion, in Peru $74 billion, in the Philippines $133 billion, in Egypt $240 billion and, in the third world as a whole, $9.3 trillion.29 Without legal title, the potential energy contained within these assets cannot be realised. ‘What creates capital in the West, in other words, is an implicit process buried in the intricacies of its formal property systems’ (p.39).

In the context of this chapter, we might interpret de Soto’s argument along the following lines. The existence of legal title and the ability to trade ownership rights cheaply and freely is a determinant of the level of personal wealth that people can bring to bear on their entrepreneurial projects. People in many countries live in poverty unable to exercise entrepreneurial talent because the assets which they have developed, which are part of their everyday existence and whose value is collectively enormous, cannot be used in the type of bargains that we have been discussing in section 8. Untitled assets might be valued by ‘think-tanks’ at $9.3 trillion throughout the world, but, for the mass of people, W is effectively zero.

Source: Ricketts Martin (2002), The Economics of Business Enterprise: An Introduction to Economic Organisation and the Theory of the Firm, Edward Elgar Pub; 3rd edition.

This website is mostly a walk-through for all the data you needed about this and didn’t know who to ask. Glimpse right here, and you’ll positively discover it.