How much output should a firm produce over the short run, when its plant size is fixed? In this section we show how a firm can use information about revenue and cost to make a profit-maximizing output decision.

1. Short–Run Profit Maximization by a Competitive Firm

In the short run, a firm operates with a fixed amount of capital and must choose the levels of its variable inputs (labor and materials) to maximize profit. Figure 8.3 shows the firm’s short-run decision. The average and marginal revenue curves are drawn as a horizontal line at a price equal to $40. In this figure, we have drawn the average total cost curve ATC, the average variable cost curve AVC, and the marginal cost curve MC so that we can see the firm’s profit more easily.

Profit is maximized at point A, where output is q* = 8 and the price is $40, because marginal revenue is equal to marginal cost at this point. To see that q* = 8 is indeed the profit-maximizing output, note that at a lower output, say q1 = 7, marginal revenue is greater than marginal cost; profit could thus be increased by increasing output. The shaded area between q1 = 7 and q* shows the lost profit associated with producing at q1. At a higher output, say q2, mar- ginal cost is greater than marginal revenue; thus, reducing output saves a cost that exceeds the reduction in revenue. The shaded area between q* and q2 = 9 shows the lost profit associated with producing at q2. When output is q* = 8, profit is given by the area of rectangle ABCD.

The MR and MC curves cross at an output of q0 as well as q*. At q0, however, profit is clearly not maximized. An increase in output beyond q0 increases profit because marginal cost is well below marginal revenue. We can thus state the condition for profit maximization as follows: Marginal revenue equals marginal cost at a point at which the marginal cost curve is rising. This conclusion is very important because it applies to the output decisions of firms in mar- kets that may or may not be perfectly competitive. We can restate it as follows:

Output Rule: If a firm is producing any output, it should produce at the level at which marginal revenue equals marginal cost.

Figure 8.3 also shows the competitive firm’s short-run profit. The distance AB is the difference between price and average cost at the output level q*, which is the average profit per unit of output. Segment BC measures the total number of units produced. Rectangle ABCD, therefore, is the firm’s profit.

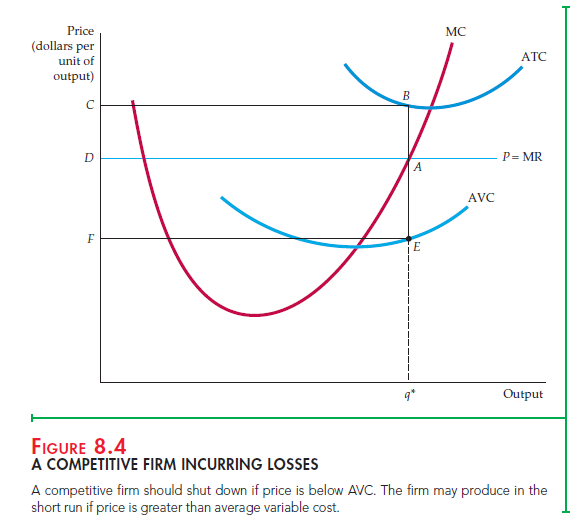

A firm need not always earn a profit in the short run, as Figure 8.4 shows. The major difference from Figure 8.3 is a higher fixed cost of production. This higher fixed cost raises average total cost but does not change the average variable cost and marginal cost curves. At the profit-maximizing output q*, the price P is less than average cost. Line segment AB, therefore, measures the average loss from production. Likewise, the rectangle ABCD now measures the firm’s total loss.

When Should the Firm Shut Down?

Suppose a firm is losing money. Should it shut down and leave the industry? The answer depends in part on the firm’s expectations about its future busi- ness conditions. If it believes that conditions will improve and the business will be profitable in the future, it might make sense to operate at a loss in the short run. But let’s assume for the moment that the firm expects the price of its product to remain the same for the foreseeable future. What, then, should it do?

Note that the firm is losing money when its price is less than average total cost at the profit-maximizing output q*. In that case, if there is little chance that conditions will improve, it should shut down and leave the industry. This deci- sion is appropriate even if price is greater than average variable cost, as shown in Figure 8.4. If the firm continues to produce, the firm minimizes its losses at output q*, but it will still have losses rather than profits because price is less than average total cost. Note also that in Figure 8.4, because of the presence of fixed costs, average total cost exceeds average variable cost, and average total cost also exceeds price, so that the firm is indeed losing money. Recall that fixed costs do not change with the level of output, but they can be eliminated if the firm shuts down. (Examples of fixed costs include the salaries of plant managers and security personnel, and the electricity to keep the lights and heat running.)

Will shutting down always be the sensible strategy? Not necessarily. The firm might operate at a loss in the short run because it expects to become profit- able again in the future, when the price of its product increases or the cost of production falls. Operating at a loss might be painful, but it will keep open the prospect of better times in the future. Moreover, by staying in business, the firm retains the flexibility to change the amount of capital that it uses and thereby reduce its average total cost. This alternative seems particularly appealing if the price of the product is greater than the average variable cost of production, since operating at q* will allow the firm to cover a portion of its fixed costs.

Our example of a pizzeria in Chapter 7 (Example 7.2) provides a useful illus- tration. Recall that pizzerias have high fixed costs (the rent that must be paid, the pizza ovens, and so on) and low variable costs (the ingredients and perhaps some employee wages). Suppose the price that the pizzeria is charging its cus- tomers is below the average total cost of production.Then the pizzeria is losing money by continuing to sell pizzas and it should shut down if it expects busi- ness conditions to remain unchanged in the future. But, should the owner sell the store and go out of business? Not necessarily; that decision depends on the owner ’s expectation as to how the pizza business will fare in the future. Perhaps adding jalapeno peppers, raising the price, and advertising the new spicy pizzas will do the trick.

Source: Pindyck Robert, Rubinfeld Daniel (2012), Microeconomics, Pearson, 8th edition.

I am so happy to read this. This is the kind of manual that needs to be given and not the accidental misinformation that’s at the other blogs. Appreciate your sharing this greatest doc.