We often want to compare the price of a good today with what it was in the past or is likely to be in the future. To make such a comparison meaningful, we need to measure prices relative to an overall price level. In absolute terms, the price of a dozen eggs is many times higher today than it was 50 years ago. Relative to prices overall, however, it is actually lower. Therefore, we must be careful to correct for inflation when comparing prices across time. This means measuring prices in real rather than nominal terms.

The nominal price of a good (sometimes called its “current-dollar” price) is its absolute price. For example, the nominal price of a pound of butter was about

$0.87 in 1970, $1.88 in 1980, about $1.99 in 1990, and about $3.42 in 2010. These are the prices you would have seen in supermarkets in those years. The real price of a good (sometimes called its “constant-dollar” price) is the price relative to an aggregate measure of prices. In other words, it is the price adjusted for inflation.

For consumer goods, the aggregate measure of prices most often used is the Consumer Price Index (CPI). The CPI is calculated by the U.S. Bureau of Labor Statistics by surveying retail prices, and is published monthly. It records how the cost of a large market basket of goods purchased by a “typical” consumer changes over time. Percentage changes in the CPI measure the rate of inflation in the economy.

Sometimes we are interested in the prices of raw materials and other interme- diate products bought by firms, as well as in finished products sold at wholesale to retail stores. In this case, the aggregate measure of prices often used is the Producer Price Index (PPI). The PPI is also calculated by the U.S. Bureau of Labor Statistics and published monthly, and records how, on average, prices at the wholesale level change over time. Percentage changes in the PPI measure cost inflation and predict future changes in the CPI.

So which price index should you use to convert nominal prices to real prices? It depends on the type of product you are examining. If it is a product or service normally purchased by consumers, use the CPI. If instead it is a product nor- mally purchased by businesses, use the PPI.

Because we are examining the price of butter in supermarkets, the relevant price index is the CPI. After correcting for inflation, do we find that the price of butter was more expensive in 2010 than in 1970? To find out, let’s calculate the

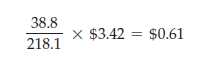

2010 price of butter in terms of 1970 dollars. The CPI was 38.8 in 1970 and rose to about 218.1 in 2010. (There was considerable inflation in the United States during the 1970s and early 1980s.) In 1970 dollars, the price of butter was

In real terms, therefore, the price of butter was lower in 2010 than it was in 1970.5. Put another way, the nominal price of butter went up by about 293 percent, while the CPI went up 462 percent. Relative to the aggregate price level, butter prices fell.

In this book, we will usually be concerned with real rather than nominal prices because consumer choices involve analyses of price comparisons. These relative prices can most easily be evaluated if there is a common basis of comparison. Stating all prices in real terms achieves this objective. Thus, even though we will often measure prices in dollars, we will be thinking in terms of the real purchas-ing power of those dollars.

Source: Pindyck Robert, Rubinfeld Daniel (2012), Microeconomics, Pearson, 8th edition.

Hey there! This is kind of off topic but I need some help from an established blog. Is it difficult to set up your own blog? I’m not very techincal but I can figure things out pretty fast. I’m thinking about setting up my own but I’m not sure where to start. Do you have any ideas or suggestions? Cheers

Your house is valueble for me. Thanks!…

Hello.This article was really motivating, particularly because I was browsing for thoughts on this matter last Wednesday.