Thus far, our attention has primarily been confined to describing property rights and presenting a simple taxonomy. Several questions now arise. Can we explain the development of different types of property rights? How will the nature of a person’s rights influence behaviour? Do property rights matter? One possible response to these questions is that of Demsetz (1967, 1979). Demsetz concentrates on the issue of economic efficiency. We have already seen how the process of exchange gives rise to efficiency gains. If, as a result of resource reallocation, everyone is made better off (as in the example of Chapter 1) the new allocation of resources is said to be ‘Pareto superior’ to the old allocation. It was from these ‘efficiency gains’ that the entrepreneur was seen to draw ‘pure entrepreneurial profit’ in Chapter 3. In Chapter 2, on the other hand, the obstacles to the realisation of gains from exchange, ‘transactions costs’, were considered. Demsetz makes the point that transactions costs are not independent of the types of property rights in which trade is taking place. As a result, some change in the structure of property rights in a resource may be required before potential efficiency gains can be appropriated.

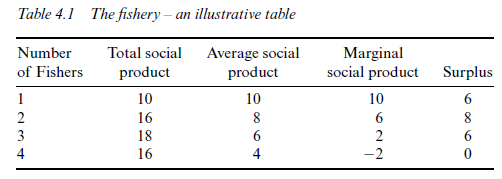

Consider once more the case of the four islanders A, B, C and D. Let us suppose that somewhere on the island is a freshwater lake containing fish. Each person is equally skilled at catching fish and equally conveniently located with respect to access to the lake. The fish are a delicate species living in a finely balanced harmony with predators and prey. One person fishing the lake can take ten fish per day, but two people fishing will find that only 16 fish per day are sustainable. A maximum yield per day of 18 fish can be achieved with three people, and any further fishing effort will actually reduce the sustainable yield of fish obtainable from the lake by depleting the stock of fish by more than can be compensated by the greater fishing effort. Table 4.1 records these illustrative figures for total social product of fish along with average and marginal social product schedules.

From the figures in Table 4.1, we see that each person fishing in the lake imposes on the others an ‘external diseconomy’. Suppose that A is fishing alone and taking home ten fish per day. Person B now comes along and starts fishing. Both A and B each take home eight fish per day. B’s fishing has reduced A’s catch by two fish per day. It would, however, be equally correct to say that A’s presence at the lake reduced B’s catch by two fish per day. The relationship is perfectly reciprocal. Each person imposes external diseconomies on the other. Real external diseconomies in production occur when one person’s actions affect the production possibilities faced by others, and the four individuals around the island lake are clearly interdependent in this way. The fishing resource is subject to congestion as reflected in the declining schedule of average social product (ASP) as the number of people fishing increases.

Assume now that all four islanders have a communal right to fish in the lake. No one is excluded from fishing, and hence the right to fish there has no market value. Each person will therefore fish as long as the product he or she takes home exceeds the value of the alternative uses of the time expended (the value of the fish exceeds its opportunity cost). Let this opportunity cost be the equivalent of four fish per day.7 Since the private return to each person is the average social product (ASP), extra people will fish if ASP is greater than four and this implies that all four people on the island will fish in the lake.

Of course, from the point of view of the group of islanders as a whole, this outcome is not ideal. They could all be better off by restricting access to the lake. This is more easily seen by considering the ‘surplus’ which the community as a whole has derived from the resource. The ‘surplus’ is simply the total social product of fish minus the opportunity costs of catching it. For the case of three fishermen, total product is 18 and total social cost is 12, thus resulting in a ‘surplus’ of six. With four people fishing, this surplus has declined to zero. The presence of the lake has conferred no net benefit on the four individuals. Between them, they have managed to sacrifice elsewhere things equivalent in value to the fish they have caught. If access to the lake were restricted to two people, the social product would be unchanged at 16, while the other two people would be free to take leisure or to produce additional goods elsewhere, goods or leisure which we have assumed are valued as equivalent to eight fish.

Restricting access to the lake implies changing the nature of the property rights which people hold. The lake can no longer be unrestricted common property. We can imagine many different ways in which this might come about.

- All four islanders might come to some mutual agreement whereby they renounce their communal rights in exchange for a collective right to a share in the produce of the lake. This ‘fisheries consortium’ will then have an incentive to ensure that only two people actually fish in the lake.

- One of the islanders, perhaps the entrepreneur E of Chapter 3, might simply try to buy up the common rights of the others. Providing that the price of these rights is less than the surplus expected from the commercial exploitation of the lake, a profit will be achieved on the transactions. The bargaining and transactions costs involved in this strategy are likely to be considerable, however, because those who ‘hold out’ against the offers made by person E will in the end find themselves in a very strong bargaining position.8 It is this problem which is often used to justify an element of coercion by the state when bargaining costs threaten the achievement of potential efficiency gains. The power of compulsory purchase, for example, has been defended as a method of reducing transactions costs in situations which would otherwise be subject to the problem of ‘hold-out’.

- A third possibility is that one of the islanders announces to the others that from henceforth they cannot fish in the lake without his or her consent. Common rights are confiscated by force and replaced by private rights.

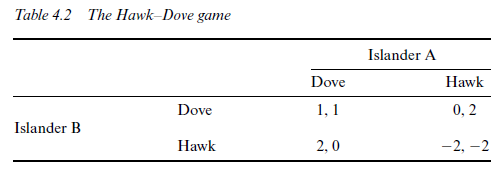

The establishment of property rights may be modelled as a Hawk-Dove game. Suppose, for example, that the social gains available from the more effective use of the lake are valued at two. Two ‘Doves’ would meet and split the benefit between them (as in the first of our three scenarios). A ‘Hawk’ meeting a ‘Dove’ would take all the gains by the threat of force. Two ‘Hawks’ meeting, however, might do each other great damage. Let us suppose the payoff to each in this situation is -2. The payoffs are recorded in Table 4.2.

If all of the islanders are equally equipped to fight and equally likely to win in the event of a fight, the expected payoff to the two possible strategies will depend upon the probability of meeting a ‘Hawk’ or a ‘Dove’. A high probability of meeting a ‘Hawk’ makes a ‘Dove’ strategy more attractive, and vice versa. With the payoffs as recorded, a probability of meeting a ‘Dove’ of 2/3 will result in the same expected payoff to each strategy. Biologists use this type of argument to model the evolution of a stable proportion of aggressive to non-aggressive animals in a certain species.

The outcome would be different, however, if the islanders could be distinguished in some way and if this distinction began to be associated with the probability of their playing a ‘Hawk’ or ‘Dove’ strategy.9 Islander B might, for example, live closer to the lake, or have fished in the lake for longer. If proximity to or use of a resource is recognised by the players as conditioning the likelihood of playing a given strategy in the Hawk-Dove game, conventions of property can evolve. A convention might become established such as ‘play the Hawk strategy if you live closer to the resource than your opponent’ or ‘play the Dove strategy if your opponent has used the resource for longer than you have’ and so forth. Just as in the repeated exchange game of Chapter 1, these property conventions could become self-enforcing. As an islander it would be in my self-interest to recognise the sorts of characteristics likely to determine whether an opponent would fight or not. In other words it pays me to recognise emergent rules of property.

Whatever the mechanism by which changes in property rights are effected, one result is the same. By restricting access to the resource, efficiency gains are achievable. The distribution of these gains will depend on the property assignment between the islanders. They may all accrue to the strongest person, to the person who lives closest to the lake, to the only person with a gun, to the entrepreneur E, or they may be shared between members of the fisheries consortium. Whatever the rights assignment turns out to be, a licence to fish in the lake set at a price equivalent to four fish would reduce the number of people fishing to two, and procure an income of eight fish for the resource owner or owners.

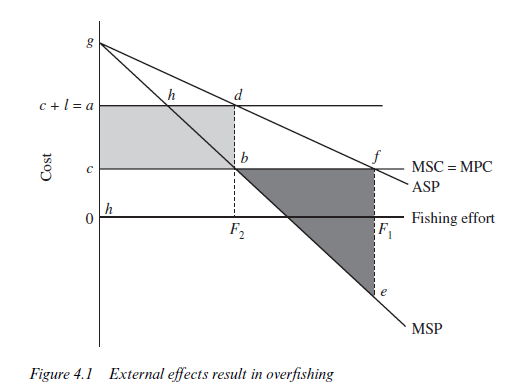

Figure 4.1 illustrates the entire argument geometrically. The average social product of fishing effort is depicted by curve ASP. Since, by assumption, all people are equally skilled at fishing, the private return to extra fishing effort will equal the average social return. This implies that people will continue to supply more fishing effort as long as average social product exceeds marginal private cost. Marginal private costs (equal to social costs) are assumed constant at c. Thus, with unrestricted entry into fishing we find a quantity of fishing effort F1 provided. This is inefficient, since the marginal social product of fishing effort (MSP) is well below marginal social cost (MSC) at this level of effort. Efficiency requires a level of fishing effort F2, where MSP = MSC. The vertical distance between ASP and MSP represents the external cost imposed on others by extra fishing effort. Similarly the vertical distance between ASP and MPC represents the private benefit accruing to extra fishing effort. Clearly, if external costs exceed private benefit it will be possible for people to get together to bribe some of their number not to fish, since the bribers will gain from reduced congestion more than they have to pay in compensation to the people being bribed (see especially Coase, 1960).

The gain to restricting fishing effort in this way is given by area bfe. Once private rights to fishing have been established, a licence fee per unit of fishing effort (l) can be introduced, the private marginal costs of fishing will increase to l + c = a and fishing effort will fall to F2. Total revenue from the sale of licences will be area acbd and in these circumstances will precisely equal the efficiency gains achieved (area bfe).10

For Demsetz, therefore, property rights will change when people find that there are substantial efficiency gains (mutual benefits) to be derived from such a change. These benefits must be sufficient to compensate for the transactions costs involved in establishing and in policing the new structure of rights. If people cannot, except at prohibitively high cost, be prevented from fishing in the lake, no changes in the structure of rights will emerge. On the other hand ‘prohibitive’ here means ‘relative to potential benefits’, and the more congested the lake becomes the larger become the efficiency gains from mitigating the problem, and the more likely therefore that the policing costs are worth incurring.

Demsetz cites as an example of this process changes in the rights to use land among the Indians of Labrador. It appears that in the seventeenth century there was no restriction on hunting rights. The development of the fur trade, however, gave rise, according to this theory, to the division of territory among hunting bands. Clearly, without such rights each hunting

party could impose severe external disbenefits on the others. When animals were hunted merely for food and clothing for the Indian population, the problem of external costs was insignificant, but with commercial development this was no longer the case and more restrictive property rights emerged. Demsetz then poses the question: why did a similar process not occur among the plains Indians of the south west? One answer is that the cost of defining and policing property rights on the plains would have been much higher than in the forests. Animals grazing on the plains wander over vast areas; those in the forests are more restricted in their movements. Thus, simple delineation of a given policeable area is not sufficient to appropriate a right to tend and harvest a particular herd on the plains, and property rights remained common and open. The consequence of this structure of property rights for the buffalo herds is, of course, well known.

Although property rights may develop in ways conducive to the more efficient use of economic resources, it should not be assumed that this tendency is inevitable. The point about conventions is that there are many possible ones that might evolve and that, once evolved, they are self-enforcing. Whether the conventions most likely to evolve turn out to be the ones that, once established, are the most efficient, is not certain. As we have seen, some writers have tended to assume that a benign process of social development can be expected over time. Others are less sure. Further discussion of this issue must await Chapter 12.

Source: Ricketts Martin (2002), The Economics of Business Enterprise: An Introduction to Economic Organisation and the Theory of the Firm, Edward Elgar Pub; 3rd edition.

Glad to be one of several visitants on this awing web site : D.

Your style is so unique compared to many other people. Thank you for publishing when you have the opportunity,Guess I will just make this bookmarked.2