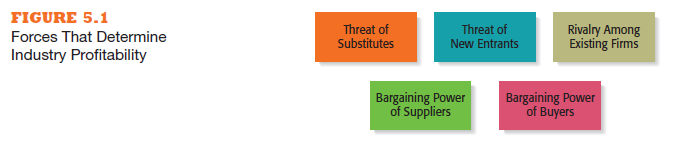

The five forces model is a framework entrepreneurs use to understand an industry’s structure. Professor Michael Porter developed this important tool. Shown in Figure 5.1, the framework is comprised of the forces that determine industry profitability.7 These forces—the threat of substitutes, the threat of new entrants (that is, new competitors), rivalry among existing firms, the bargaining power of suppliers, and the bargaining power of buyers—determine the average rate of return for the firms competing in a particular industry (e.g., the restau- rant industry) or a particular segment of an industry (e.g., the fast-casual seg- ment of the restaurant industry).

Each of Porter’s five forces affects the average rate of return for the firms in an industry by applying pressure on industry profitability. Well-managed companies try to position their firms in a way that avoids or diminishes these forces—in an attempt to beat the average rate of return for the industry. For example, the rivalry among existing firms in the wedding invitation industry is high. Greenvelope has diminished the impact of this threat to its profitability by selling customized wedding invitations online. Compared to traditional wed- ding invitation services, this approach lowers the cost to the consumer and provides a high profit margin per order for Greenvelope.

In his book Competitive Advantage, Porter points out that industry prof- itability is not a function of only a product’s features. Although the book was published in 1980 and the dynamics of the industries mentioned have changed, Porter’s essential points still offer important insights for entrepre- neurs such as the insight suggested by the following quote:

Industry profitability is not a function of what the product looks like or whether it embodies high or low technology but of industry structure. Some very mundane industries such as postage meters and grain trading are extremely profitable, while some more glamorous, high-technology industries such as personal computers and cable television are not profitable for many participants.8

The five competitive forces that determine industry profitability are described next. As mentioned in previous chapters, industry reports, produced by companies such as IBISWorld, Mintel, and Standard & Poor’s NetAdvantage, provide substantive information for analyzing the impact of the five forces on specific industries. All three of these resources are available free through many university library websites and are highlighted in the Internet Resources Table in Appendix 3.2.

1. Threat of Substitutes

In general, industries are more attractive when the threat of substitutes is low. This means that products or services from other industries can’t easily serve as substitutes for the products or services being made and sold in the focal firm’s industry. For example, there are few if any substitutes for prescription medicines, which is one of the reasons the pharmaceutical industry has his- torically been so profitable. When people are sick, they typically don’t quibble with the pharmacist about the price of a medicine. In contrast, when close substitutes for a product do exist, industry profitability is suppressed because consumers will opt not to buy when the price is too high. Consider the price of airplane tickets. If the price gets too high, businesspeople will increasingly switch to videoconferencing services such as Skype and GoToMeeting as a substitute for travel. This problem is particularly acute if the substitutes are free or nearly free. For example, if the price of express mail gets too high, peo- ple will increasingly attach documents to e-mail messages rather than sending them via UPS or FedEx.

The extent to which substitutes suppress the profitability of an industry depends on the propensity for buyers to substitute alternatives. This is why the firms in an industry often offer their customers amenities to reduce the likeli- hood they’ll switch to a substitute product, even in light of a price increase. Let’s look at the coffee restaurant industry as an example of this. The coffee sold at Starbucks is relatively expensive. A consumer could easily find a less expensive cup of coffee at a convenience store or brew coffee at home rather than pay more at Starbucks. To decrease the likelihood that customers will choose ei- ther of these alternatives, Starbucks offers high-quality fresh coffee, a pleasant atmosphere (often thought of as part of the “Starbucks experience”), and good service. Starbucks doesn’t do this just so its customers don’t go to a different coffee restaurant. It offers the service so its customers won’t switch to sub- stitute products as well. Although this strategy is still working for Starbucks, there have been times (such as during the recent economic slowdown) when its effectiveness was reduced. Because of this, Starbucks is now experimenting with offering less expensive coffees while maintaining its commitment to quality and providing customers with what the firm believes is the unique Starbucks experience.

2. Threat of new entrants

In general, industries are more attractive when the threat of entry is low. This means that competitors cannot easily enter the industry and successfully copy what the industry incumbents are doing to generate profits. There are a num- ber of ways that firms in an industry can keep the number of new entrants low. These techniques are referred to as barriers to entry. A barrier to entry is a condition that creates a disincentive for a new firm to enter an industry.9

Let’s look at the six major sources of barriers to entry:

■ Economies of scale: Industries that are characterized by large economies of scale are difficult for new firms to enter, unless they are willing to accept a cost disadvantage. Economies of scale occur when mass-producing a product results in lower average costs. For example, Intel has huge micro- processor factories that produce vast quantities of computer chips, thereby reducing the average cost of each chip produced. It would be difficult for a new entrant to match Intel’s advantage in this area. There are instances in which the competitive advantage generated by economies of scale can be overcome. For example, many microbreweries have successfully entered the beer industry by brewing their beer locally and relying on a local niche market clientele. By offering locally brewed, high-quality products, suc- cessful microbreweries counter the enormous economies of scale (and the lower price to consumers they permit) of major and often global brewers, such as Anheuser-Busch InBev, which manages a portfolio of over 200 beer brands.10

■ Product differentiation: Industries such as the soft-drink industry that are characterized by firms with strong brands are difficult to break into without spending heavily on advertising. For example, imagine how costly it would be to compete head-to-head against PepsiCo (owner of the Pepsi brands) or Coca-Cola Company. Product innovation is another way a firm can differentiate its good or service from competitors’ offerings. Apple is an example of a company that has differentiated itself in laptop computers by regularly improving the features on its line of MacBooks, such as the MacBook Air, as well as the unqiuness of the accessories customers can buy to enhance their experience as users. It does this to not only keep existing customers and win new ones, but also to deter competitors from making a big push to try to win market share from Apple in the laptop computer industry.

■ Capital requirements: The need to invest large amounts of money to gain entrance to an industry is another barrier to entry. The automobile industry is characterized by large capital requirements, although Tesla, which launched in 2003, was able to overcome this barrier and raise sub- stantial funds by winning the confidence of investors through its expertise and innovations in electric car technology. Current evidence suggests that this firm may have potential to achieve long-term success. In early 2014 for example, Tesla reported results for the fourth quarter of 2013 that exceeded analysts’ expectations and projected that sales of its Model S electric sedan would increase by 55 percent in 2014 compared to 2013.11

■ Cost advantages independent of size: Entrenched competitors may have cost advantages not related to size that are not available to new entrants. Commonly, these advantages are grounded in the firm’s history. For example, the existing competitors in an industry may have purchased land and equipment in the past when the cost was far less than new entrants would have to pay for the same assets at the time of their entry.

■ Access to distribution channels: Distribution channels are often hard to crack. This is particularly true in crowded markets, such as the convenience store market. For a new sports drink to be placed on a convenience store shelf, it typically has to displace a product that is already there. If Greenvelope decided to start producing traditional wed- ding invitations and greeting cards, it would find it difficult to gain shelf space in stationery stores where a large number of offerings from major producers are already available to consumers.

■ Government and legal barriers: In knowledge-intensive industries, such as biotechnology and software, patents, trademarks, and copyrights form major barriers to entry. Other industries, such as banking and broadcasting, require the granting of a license by a public authority.

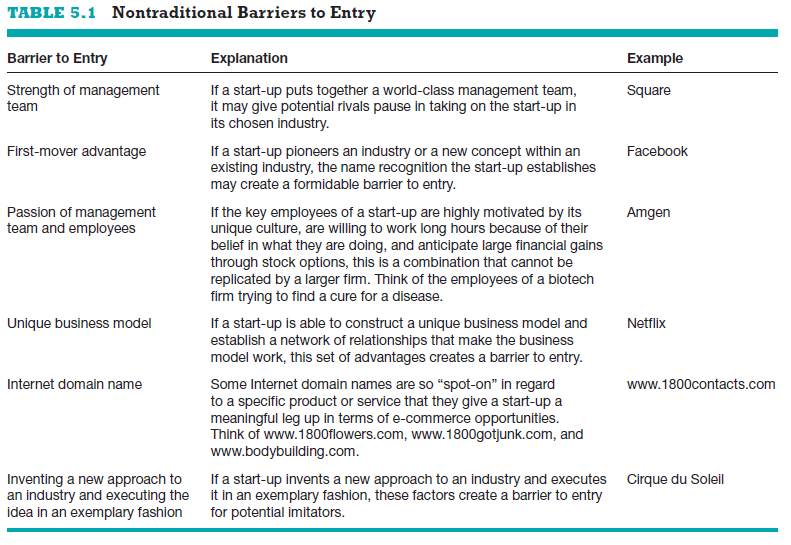

When start-ups create their own industries or create new niche markets within existing industries, they must create barriers to entry of their own to reduce the threat of new entrants. It is difficult for start-ups to create barriers to entry that are expensive, such as economies of scale, because money is usu- ally tight. The biggest threat to a new firm’s viability, particularly if it is creating a new market, is that larger, better-funded firms will step in and copy what it is doing. The ideal barrier to entry is a patent, trademark, or copyright, which prevents another firm from duplicating what the start-up is doing. Companies like Greenvelope typically have trade secrets associated with the functionality of their websites; in turn, trade secrets create a barrier to entry for a firm think- ing about emulating the service provided by firms holding those secrets. The strength of Greenvelope’s brand and the network of freelance designers and artists that it has assembled to create its invitations are also aspects of its busi- ness model that would be difficult to copy. Apart from these types of options, however, start-ups have to rely on nontraditional barriers to entry to discourage new entrants, such as assembling a world-class management team that would be difficult for another company to replicate. In Table 5.1, we provide a list of nontraditional barriers to entry that are particularly suited to start-up firms.

3. Rivalry among existing Firms

In most industries, the major determinant of industry profitability is the level of competition among the firms already competing in the industry. Some indus- tries are fiercely competitive to the point where prices are pushed below the level of costs. When this happens, industry-wide losses occur. In other industries, competition is much less intense and price competition is subdued. For exam- ple, the airline industry is fiercly competitive and profit margins hinge largely on fuel prices and consumer demand. In contrast, the market for specialized medi- cal equipment is less competitive, and profit margins are higher.

There are four primary factors that determine the nature and intensity of the rivalry among existing firms in an industry:

■ Number and balance of competitors: With a larger number of competi- tors, it is more likely that one or more will try to gain customers by cutting prices. Price-cutting causes problems throughout the industry and occurs more often when all the competitors in an industry are about the same size and when there is no clear market leader.

■ Degree of difference between products: The degree to which products differ from one producer to another affects industry rivalry. For example, commodity industries such as paper products producers tend to compete on price because there is no meaningful difference between one manufac- turer’s products and another’s.

■ Growth rate of an industry: The competition among firms in a slow- growth industry is stronger than among those in fast-growth industries. Slow-growth industry firms, such as insurance, must fight for market share, which may tempt them to lower prices or increase quality to obtain customers. In fast-growth industries, such as e-book publishing, there

are enough customers to satisfy most firms’ production capacity, making price-cutting less likely.

■ Level of fixed costs: Firms that have high fixed costs must sell a higher volume of their product to reach the break-even point than firms with low fixed costs. Once the break-even point is met, each additional unit sold contributes directly to a firm’s bottom line. Firms with high fixed costs are anxious to fill their capacity, and this anxiety may lead to price-cutting.

4. Bargaining power of Suppliers

In general, industries are more attractive when the bargaining power of sup- pliers is low. In some cases, suppliers can suppress the profitability of the industries to which they sell by raising prices or reducing the quality of the components they provide. If a supplier reduces the quality of the components it supplies, the quality of the finished product will suffer, and the manufacturer will eventually have to lower its price. If the suppliers are powerful relative to the firms in the industry to which they sell, industry profitability can suffer.12

For example, Intel, with its Pentium chip, is a powerful supplier to the PC industry. Because most PCs feature Pentium chips, Intel can command a premium price from the PC manufacturers, thus directly affecting the overall profitability of the PC industry. Several factors have an impact on the ability of suppliers to exert pressure on buyers and suppress the profitability of the in- dustries they serve. These include the following:

■ Supplier concentration: When there are only a few suppliers to provide a critical product to a large number of buyers, the supplier has an advan- tage. This is the case in the pharmaceutical industry, where relatively few drug manufacturers are selling to thousands of doctors and their patients.

■ Switching costs: Switching costs are the fixed costs that buyers encounter when switching or changing from one supplier to another.

If switching costs are high, a buyer will be less likely to switch suppliers. For example, suppliers often provide their largest buyers with special- ized software that makes it easy to buy their products. After the buyer spends time and effort learning the supplier’s ordering and inventory management systems, it will be less likely to want to spend time and effort learning another supplier’s system.

■ Attractiveness of substitutes: Supplier power is enhanced if there are no attractive substitutes for the products or services the supplier offers. For example, there is little the computer industry can do when Microsoft and Intel raise their prices, as there are relatively few substitutes for these firms’ products (although this is less true today than has been the case historically).

■ Threat of forward integration: The power of a supplier is enhanced if there is a credible possibility that the supplier might enter the buyer’s industry. For example, Microsoft’s power as a supplier of computer operat- ing systems is enhanced by the threat that it might enter the PC industry if PC makers balk too much at the cost of its software or threaten to use an operating system from a different software provider.

5. Bargaining power of Buyers

In general, industries are more attractive when the bargaining power of buy- ers (a start-up’s customers) is low. Buyers can suppress the profitability of the industries from which they purchase by demanding price concessions or increases in quality. For example, even in light of the problems it has en- countered over the past several years, the automobile industry remains dom- inated by a handful of large automakers that buy products from thousands of suppliers in different industries. This enables the automakers to suppress the profitability of the industries from which they buy by demanding price reductions. Similarly, if the automakers insisted that their suppliers pro- vide better -quality parts for the same price, the profitability of the suppliers would suffer. Several factors affect buyers’ ability to exert pressure on sup- pliers and suppress the profitability of the industries from which they buy. These include the following:

■ Buyer group concentration: If the buyers are concentrated, meaning that there are only a few large buyers, and they buy from a large number of suppliers, they can pressure the suppliers to lower costs and thus affect the profitability of the industries from which they buy.

■ Buyer’s costs: The greater the importance of an item is to a buyer, the more sensitive the buyer will be to the price it pays. For example, if the component sold by the supplier represents 50 percent of the cost of the buyer’s product, the buyer will bargain hard to get the best price for that component.

■ Degree of standardization of supplier’s products: The degree to which a supplier’s product differs from its competitors’ offering affects the buy- er’s bargaining power. For example, a buyer who is purchasing a standard or undifferentiated product from a supplier, such as the corn syrup that goes into a soft drink, can play one supplier against another until it gets the best combination of features such as price and service.

■ Threat of backward integration: The power of a buyer is enhanced if there is a credible threat that the buyer might enter the supplier’s indus- try. For example, the PC industry can keep the price of computer monitors down by threatening to make its own monitors if the price gets too high.

Source: Barringer Bruce R, Ireland R Duane (2015), Entrepreneurship: successfully launching new ventures, Pearson; 5th edition.

But wanna comment that you have a very nice web site, I like the design and style it really stands out.