1. STATIONARY AND NONSTATIONARY VARIABLES

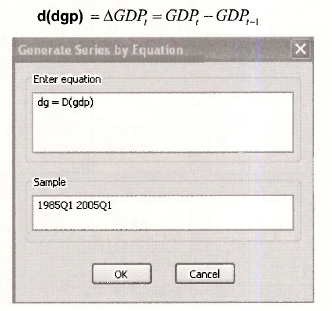

Time-series data display a variety of behavior. The data shown in Figure 12.1 is stored in the EViews workfile usa.wfl. They are real gross domestic product (GDP), inflation rate (INF), Federal funds rate (F) and the 3-year Bond rate (B). The changes for real gross domestic product (DG), inflation (DI), Federal funds rate (DF) and the 3-year Bond rate (DB) are computed using Genr and EViews first-difference operator d. For example,

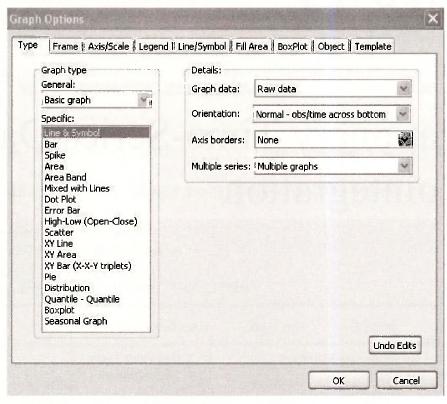

To plot the graphs, select the 8 variables, open the Group, then select View/ Graph/ Line & Symbol/ Multiple graphs as shown below.

Clicking on OK produces the EViews ouput below. This set of graphs illustrate the variety of behavior observed with time series data, such as ‘trending’ (see GDP), ‘wandering around a trend’ (see F, and B), ‘wandering around a constant’ (see INF), ‘fluctuating around a trend’ (see DG) and fluctuating around a constant (see DI, DF, and DB). In general, nonstationary variables display wandering behavior (around constant and/or trend) while stationary data display fluctuating behavior (around constant and/or trend).

2. SPURIOUS REGRESSIONS

The main reason why it is important to know whether a time series is stationary or nonstationary before one embarks on a regression analysis is that there is a danger of obtaining apparently significant regression results from unrelated data when nonstationary series are used in regression analysis. Such regressions are said to be spurious.

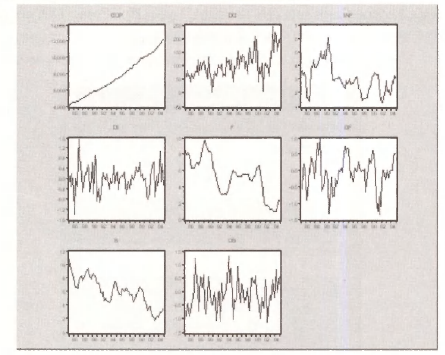

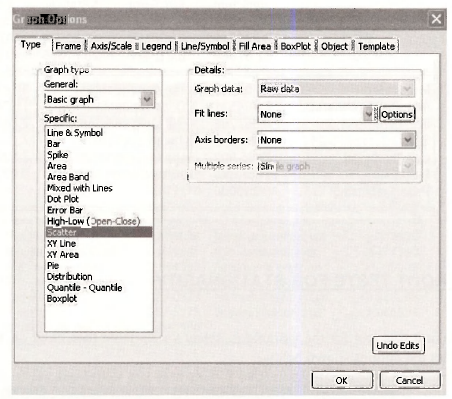

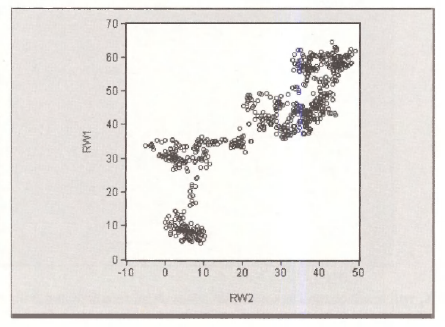

The EViews workfile spurious.wfl contains the 2 random variables (RW1 and RW2) shown in Figure 12.3(a). To plot the scatter graph, select the 2 variables, open Group, View / Graph/ and select Scatter as shown below.

Clicking OK will produce the EViews output below.

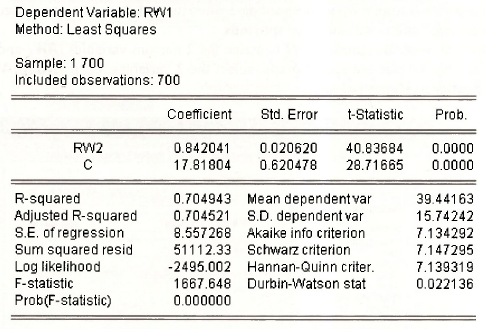

Although the series (RW1 and RW2) were generated independently and, in truth, have no relation to one another, the scatter plot suggests a positive relationship between them. The spurious regression of series one (RW1) on series two (RW2) is shown in the EViews ouput below.

3. UNIT ROOT TESTS FOR STATIONARITY

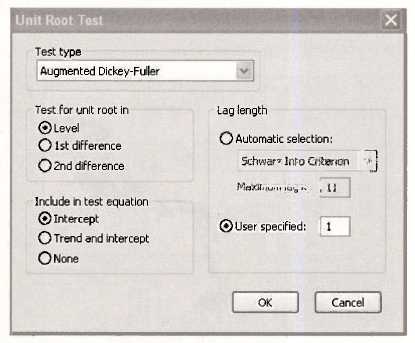

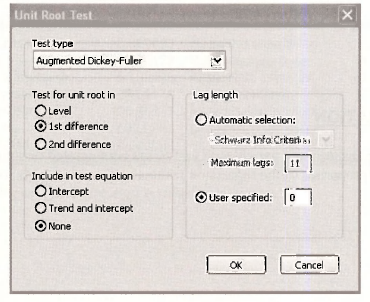

To obtain the unit root test for the variable F, select the variable then click on View /Unit Root Test/ and select the options shown below.

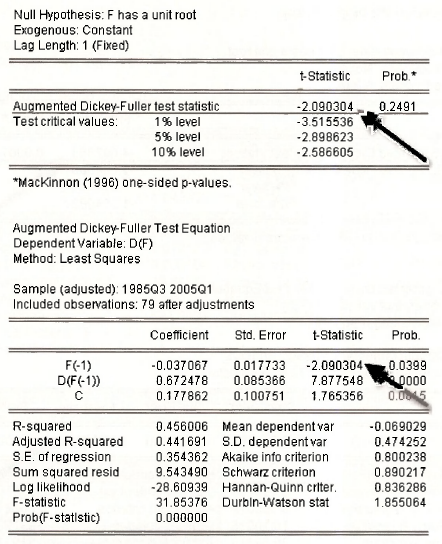

Clicking on OK, will produce the Dickey-Fuller test with an intercept and with one lag term.

Since the calculated Dickey-Fuller test statistic (-2.090) is greater than the 5% critical value of (-2.899), do not reject the null of nonstationarity. In other words, the variable F is a nonstationary series.

To perform the test for the first-difference of F, select the options shown below:

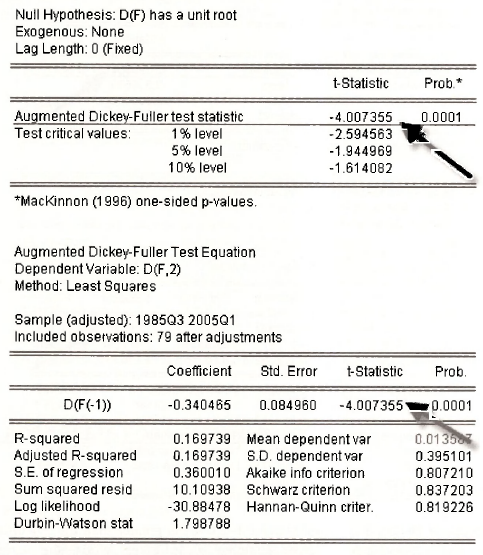

Clicking on OK gives the output below.

Since the calculated Dickey-Fuller test statistic (-4.007) is less than the 5% critical value of (-1.945) we reject the null of nonstationarity. In other words, the variable d(f) = AF is a stationary series.

It follows that since F has to be differenced once to obtain stationarity, it is integrated of order 1.

4. COINTEGRATION

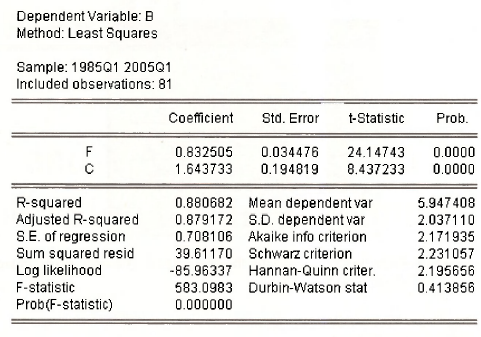

To test whether the nonstationary variables, B and F, are cointegrated or spuriously related, we need to examine the properties of the regression residuals. The first step is to estimate the least squares regression:

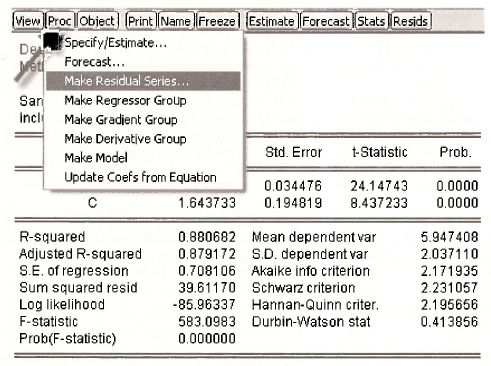

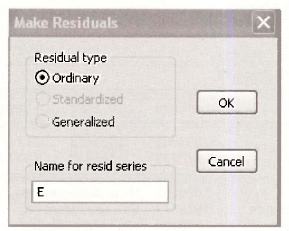

Next, to generate the residuals from the regression equation, click on Proc and select Make Residual Series from the drop-down menu.

To conform to the text, call the regression residuals E.

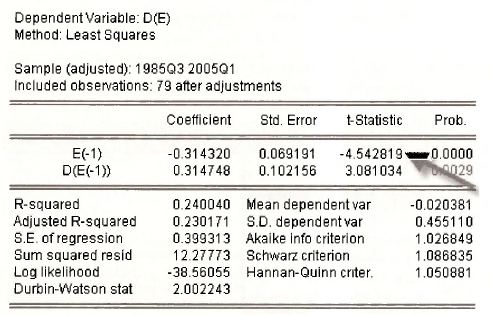

Next perform a Dickey-Fuller test by regressing the change of E, (namely, d(e)) on lagged E (namely e(-1)) and the lagged term d(e(-1)).

Since the calculated Dickey-Fuller test statistic (-4.543) is less than the 5% critical value of (-3.37) we reject the null of no cointegration. Recall that the critical values are those from Table and it is for the case where the regression model includes an intercept term.

Source: Griffiths William E., Hill R. Carter, Lim Mark Andrew (2008), Using EViews for Principles of Econometrics, John Wiley & Sons; 3rd Edition.

20 Sep 2021

20 Sep 2021

20 Sep 2021

20 Sep 2021

20 Sep 2021

20 Sep 2021