Bonds may be issued at their face amount, a discount, or a premium. When bonds are issued at less or more than their face amount, the discount or premium must be amortized over the life of the bonds. At the maturity date, the face amount must be repaid. In some situations, a corporation may redeem bonds before their maturity date by repurchasing them from investors.

1. Bonds Issued at Face Amount

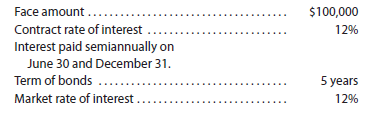

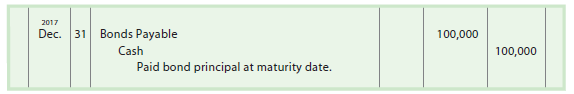

If the market rate of interest is equal to the contract rate of interest, the bonds will sell for their face amount or at a price of 100. To illustrate, assume that on January 1, 2013, Eastern Montana Communications Inc. issued the following bonds:

Since the contract rate of interest and the market rate of interest are the same, the bonds will sell at their face amount. The entry to record the issuance of the bonds is as follows:

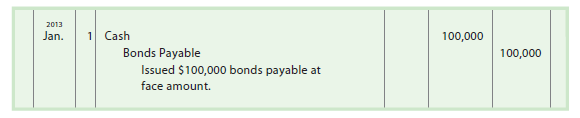

Every six months (on June 30 and December 31) after the bonds are issued, interest of $6,000 ($100,000 X 12% X !%) is paid. The first interest payment on June 30, 2013, is recorded as follows:

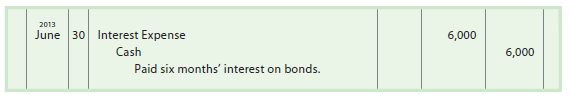

At the maturity date, the payment of the principal of $100,000 is recorded as follows:

2. Bonds Issued at a Discount

If the market rate of interest is greater than the contract rate of interest, the bonds will sell for less than their face amount. This is because investors are not willing to pay the full face amount for bonds that pay a lower contract rate of interest than the rate they could earn on similar bonds (market rate). The difference between the face amount and the selling price of the bonds is the bond discount.3

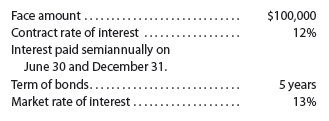

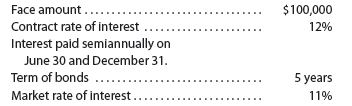

To illustrate, assume that on January 1, 2013, Western Wyoming Distribution Inc. issued the following bonds:

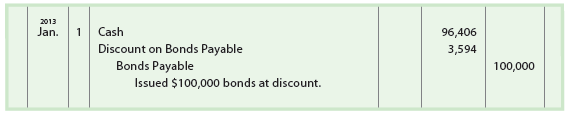

Since the contract rate of interest is less than the market rate of interest, the bonds will sell at less than their face amount. Assuming the bonds sell for $96,406, the entry to record the issuance of the bonds is as follows:

The $96,406 is the amount investors are willing to pay for bonds that have a lower contract rate of interest (12%) than the market rate (13%). The discount is the market’s way of adjusting the contract rate of interest to the higher market rate of interest.

The account, Discount on Bonds Payable, is a contra account to Bonds Payable and has a normal debit balance. It is subtracted from Bonds Payable to determine the carrying amount (or book value) of the bonds payable. Thus, after the preceding entry, the carrying amount of the bonds payable is $96,406 ($100,000 – $3,594).

3. Amortizing a Bond Discount

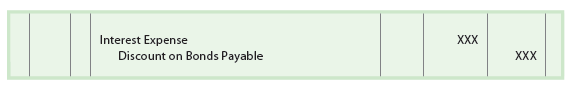

A bond discount must be amortized to interest expense over the life of the bond. The entry to amortize a bond discount is shown below.

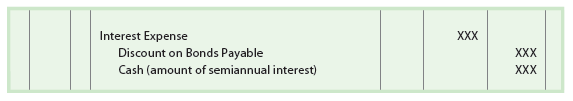

The preceding entry may be made annually as an adjusting entry, or it may be combined with the semiannual interest payment. In the latter case, the entry would be as follows:

The two methods of computing the amortization of a bond discount are:

- Straight-line method

- Effective interest rate method, sometimes called the interest method

The effective interest rate method is required by generally accepted accounting principles. However, the straight-line method may be used if the results do not differ significantly from the interest method. The straight-line method is used in this chapter. The effective interest rate method is described and illustrated in Appendix 2 at the end of this chapter.

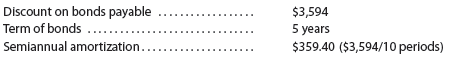

The straight-line method provides equal amounts of amortization each period. To illustrate, amortization of the Western Wyoming Distribution bond discount of $3,594 is computed below.

The combined entry to record the first interest payment and the amortization of the discount is as follows:

The preceding entry is made on each interest payment date. Thus, the amount of the semiannual interest expense on the bonds ($6,359.40) remains the same over the life of the bonds.

The effect of the discount amortization is to increase the interest expense from $6,000.00 to $6,359.40 on every semiannual interest payment date. In effect, this increases the contract rate of interest from 12% to a rate of interest that approximates the market rate of 13%. In addition, as the discount is amortized, the carrying amount of the bonds increases until it equals the face amount of the bonds on the maturity date.

4. Bonds Issued at a Premium

If the market rate of interest is less than the contract rate of interest, the bonds will sell for more than their face amount. This is because investors are willing to pay more for bonds that pay a higher contract rate of interest than the rate they could earn on similar bonds (market rate).

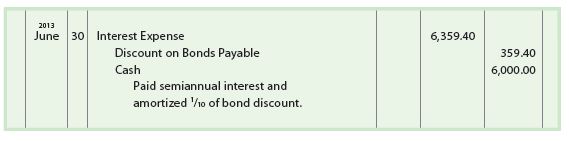

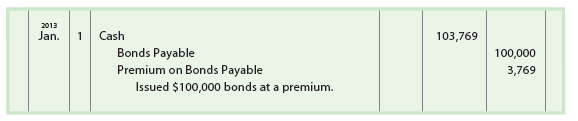

To illustrate, assume that on January 1, 2013, Northern Idaho Transportation Inc. issued the following bonds:

Since the contract rate of interest is more than the market rate of interest, the bonds will sell for more than their face amount. Assuming the bonds sell for $103,769, the entry to record the issuance of the bonds is as follows:

The $3,769 premium is the extra amount investors are willing to pay for bonds that have a higher contract rate of interest (12%) than the market rate (11%). The premium is the market’s way of adjusting the contract rate of interest to the lower market rate of interest.

The account, Premium on Bonds Payable, has a normal credit balance. It is added to Bonds Payable to determine the carrying amount (or book value) of the bonds payable. Thus, after the preceding entry, the carrying amount of the bonds payable is $103,769 ($100,000 1 $3,769).

5. Amortizing a Bond Premium

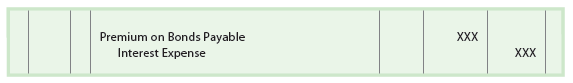

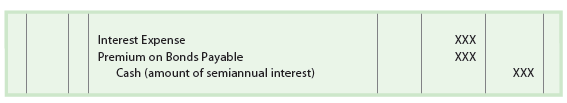

Like bond discounts, a bond premium must be amortized over the life of the bond. The amortization can be computed using either the straight-line or the effective interest rate method. The entry to amortize a bond premium is shown below.

The preceding entry may be made annually as an adjusting entry, or it may be combined with the semiannual interest payment. In the latter case, it would be:

To illustrate, amortization of the preceding premium of $3,769 is computed using the straight-line method as shown below.

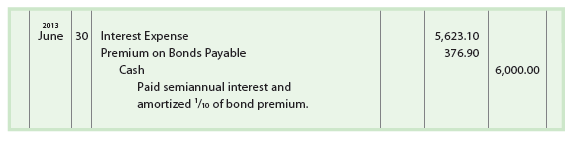

The combined entry to record the first interest payment and the amortization of the premium is as follows:

The preceding entry is made on each interest payment date. Thus, the amount of the semiannual interest expense ($5,623.10) on the bonds remains the same over the life of the bonds.

The effect of the premium amortization is to decrease the interest expense from $6,000.00 to $5,623.10. In effect, this decreases the rate of interest from 12% to a rate of interest that approximates the market rate of 11%. In addition, as the premium is amortized, the carrying amount of the bonds decreases until it equals the face amount of bonds on the maturity date.

6. Bond Redemption

A corporation may redeem or call bonds before they mature. This is often done when the market rate of interest declines below the contract rate of interest. In such cases, the corporation may issue new bonds at a lower interest rate and use the proceeds to redeem the original bond issue.

Callable bonds can be redeemed by the issuing corporation within the period of time and at the price stated in the bond indenture. Normally, the call price is above the face value. A corporation may also redeem its bonds by purchasing them on the open market.4

A corporation usually redeems its bonds at a price different from the carrying amount (or book value) of the bonds. The carrying amount of bonds payable is the face amount of the bonds less any unamortized discount or plus any unamortized premium. A gain or loss may be realized on a bond redemption as follows:

- A gain is recorded if the price paid for redemption is below the bond carrying amount.

- A loss is recorded if the price paid for the redemption is above the carrying amount.

Gains and losses on the redemption of bonds are reported in the Other income (loss) section of the income statement.

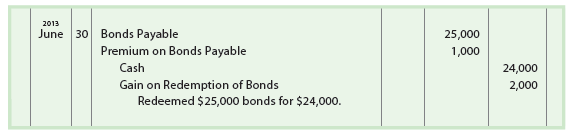

To illustrate, assume that on June 30, 2013, a corporation has the following bond issue:

Face amount of bonds $100,000

Premium on bonds payable 4,000

On June 30, 2013, the corporation redeemed one-fourth ($25,000) of these bonds in the market for $24,000. The entry to record the redemption is as follows:

In the preceding entry, only the portion of the premium related to the redeemed bonds ($4,000 x 25% = $1,000) is written off. The difference between the carrying amount of the bonds redeemed, $26,000 ($25,000 + $1,000), and the redemption price, $24,000, is recorded as a gain.

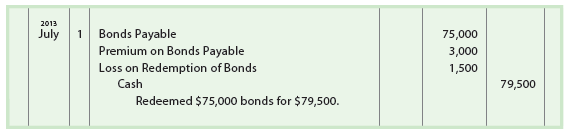

Assume that the corporation calls the remaining $75,000 of outstanding bonds, which are held by a private investor, for $79,500 on July 1, 2013. The entry to record the redemption is as follows:

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

Some truly interesting points you have written.Helped me a lot, just what I was looking for : D.