1. Indirect and Direct Export

Export describes business activities where goods and/or services are sold outside the country in which the major value-added activities took place. Export allows a fast and relatively less risky foreign market entry. The exporter’s major risk is a financial risk (importer does not pay for the cargo) that can be reduced by asking for pre-payment before delivery or by using a letter of credit or export credit insurance. By developing the service or manufacturing the products at home and exporting them abroad, the organization is able to realize substantial economies of scale effects from its expanded sales volumes in the foreign markets in addition to its sales in the local market (Hitt, Ireland, & Hoskisson 2015). Exports help to develop the firm’s international business competence and innovative capabilities due to the firm’s access to information located in foreign markets. According to Love and Ganotakis (2013), knowledge-intensive service-sector firms are able to gain earlier benefits from their expansion to export markets than manufacturing firms.

Basically, we distinguish between direct and indirect exports. Indirect exports and direct exports describe transactions in which the firm delivers products and/or services to an importing company based on a con

tractual agreement. Having no, or very little, experience in the business of foreign trade, it is desirable for the firm to initiate its first foreign engagement through indirect exports. This market entry mode is called indirect export because an intermediary, with a commission, searches for potential customers (importers) in the target foreign country. The commission is subject to negotiation between the exporter and the intermediary and usually ranges from two to fifteen percent of the contract value. The commission is due after a contract is signed by the exporter and importer. Because the intermediary searches for pre-negotiated agreements with potential importing customers, the exporting firm is not confronted with challenging socio-cultural conditions, such as unfamiliar negotiation behaviors or language barriers. However, intermediaries who run their business based on a commission often carry the products of competing firms and, therefore, tend to have divided loyalties (Hill 2012).

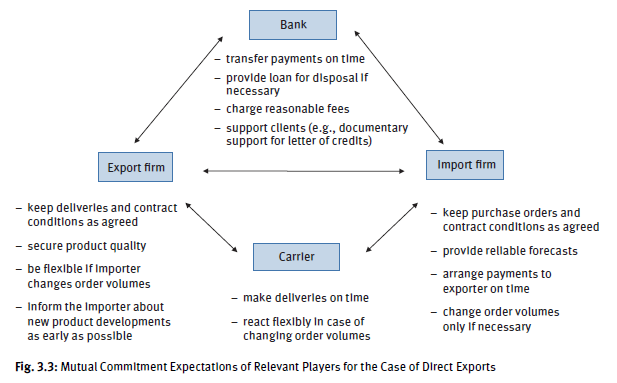

In the case of direct exports, the firm undertakes personal relationships with the importing customer abroad. Direct export requires more resources relative to indirect business because of traveling as well as actively managing the negotiations and contracts. The advantages from direct market access and the benefits from gaining valuable first-hand customer information may easily exceed the costs of active export management. Carriers and banks are important participants in the exporter’s business-to-business network. The carrier’s willingness and degree of resource commitment influence the performance of on-time delivery of the cargo from the exporter to the importer. The bank, through its transfer of timely payments and its fee and loan policy (which is also a result of the bank’s resource commitment), has further significant impacts on the importer’s and exporter’s degree of satisfaction. The mutual resource commitments of the exporting firm, the importer, the bank, and the carrier for a direct export contract are illustrated in Figure 3.3. A particular form of export without the involvement of a bank is called barter. With barters, products and services are mutually exchanged between exporter and importer without financial payments. The volume of the products exchanged may differ depending on the unit value of each product. Barter businesses come about with firms located in rather fragile regions in terms of the economy, infrastructure, and finance.

The major challenges for a firm doing export business are cross-border trade barriers. Because of liberalized trade patterns as a result of the General Agreement on Tariffs and Trade (GATT), which became effective in 1948 and was replaced in 1995 by the World Trade Organization (WTO), the average customs import tariffs are lower or for some cases disappeared compared to the past. However, nontariff barriers (e.g. quotas, bureaucratic import documentation), which are more difficult to gain evidence about, may remain a threat for the exporting firm, especially in volatile export target markets where the government of the host country tends to make use of barriers in order to accommodate the domestic industry lobby.

Export easily becomes uneconomical for bulky products and/or long-distance markets, which entail relatively high transportation costs. Furthermore, in light of globalization, firms face the challenges of supply flexibility and efficient management of demand changes in order to gain competitive advantage (Vollmann, Berry, Why- bark, & Jacobs 2005). Exports from geographically distant markets result in a longer transportation lead time, thus reducing the delivery forecast change response time. The after-sales service becomes more difficult and expensive when the manufacturing location is far away from the export sales market. Domestic production and export may not be appropriate if lower cost locations or highly skilled staff for manufacturing and selling the product or service is available abroad or if local manufacturing is supported by infrastructure incentives granted by the local government (Hill 2012).

In the past, products with a relatively high degree of tangibility and a low demand for interaction between producer and final customer were usually exported. In recent years, we have witnessed export activities for products with a high degree of intangibility, such as software development or accounting services. An example is India, known as an exporting country (Blomstermo, Sharma, & Sallis 2006). E-commerce-based communication, sales, and distribution channels make it possible for an exporter to neither require an intermediary nor be permanently physically present in the target foreign markets. However, the biggest threat for exporting firms comes along with recently emerging protectionism in some countries (for example, compare the case of increasing tariffs between the United States and China).

2. Contract Manufacturing

In highly competitive and technologically fast changing industrial environments, manufacturers often consider establishing production capacities in a foreign market. The major reasons for market entry through contract manufacturing (synonymous term: original equipment manufacturing) are the following: a firm takes advantage of lower-cost locations and is able to save logistics costs due to local manufacturing in the target foreign market. The original equipment manufacturing (OEM) strategy allows the brand manufacturer a faster market entry abroad via the contracted firm than through foreign direct investments. This is particularly the case in high-technology industries where product innovations, simultaneously launched on a global scale, are of vital importance in order to gain competitive advantage. While the original equipment contractor (OEC) firm concentrates on the production, the brand manufacturer can bundle the resources in its core competencies, such as research and development or marketing. In other words, contract manufacturing is linked to the ‘make-or-buy’ question (Morschett 2005). The OEC can combine production for several OEMs and thus realize economies of scale (Plambeck & Taylor 2005). Further incentives for contract manufacturing from the OEM’s perspective are improved sensitivity to local customer needs and avoidance of host country import taxes or quota restrictions (Hollensen 2014).

How does the OEM system work in practice? The OEM (brand manufacturer) searches for a potential firm in the foreign target market that is able to manufacture, based on the OEM’s desired cost structure, the technical specification and quality standards of the OEM’s products. When the OEM has found a suitable and capable firm, a contract is signed; and the OEC starts production of quantities of the OEM’s product. It is important to mention that the OEC puts the OEM’s brand name on the product at the end of the assembly process. Because the brand is visible on the product, consumers do not realize the product is assembled by the OEC. However, consumers are usually charged at the same price level (market goodwill of the OEM’s brand) they were used to paying when it was manufactured by the OEM. The lower unit manufacturing costs (because the product is manufactured by the OEC) but higher sales price (as though it was manufactured by the OEM) finally generates higher OEM margins.

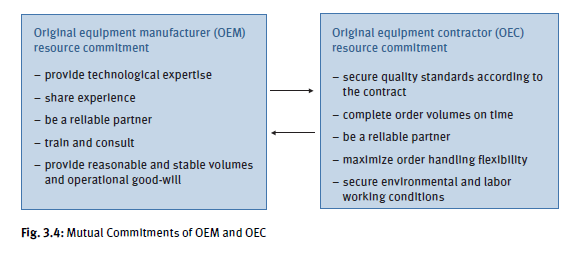

According to the conditions, which are negotiated between the contracting parties, the OEC may launch individual component assembly operations (semi-products) or manufacture complete products including services (full operations). Payments by the OEM to the OEC are generally calculated on a per unit basis. In many cases, the OEM contracts with different OECs located at different places around the globe. Thus, the OEM benefits from each OEC’s proximity to the market, which results in an increased flexibility to balance the production capacities of each OEC, if necessary (Hollensen 2014). This close proximity helps to accelerate the OEM’s time-to-market responses in case of fluctuating order volumes. Additionally, contract manufacturing enables the OEM to undertake foreign operations without making a final investment commitment in the foreign target market. As a result, the OEM reduces its investment risk through its contractual agreement with the OEC (instead of establishing its own operations). The contract between the OEM and OEC can be terminated at any time – for example, if sales volumes in the target foreign markets shrink (Cole, Mason, Hau, & Yan 2001). The mutual resource commitments of the OEM and OEC when aiming to realize a successful and sustainable contractual relationship are illustrated in Figure 3.4.

How about the potential drawbacks of contract manufacturing? Disadvantages for the OEM can derive from the OEM’s loss of direct hierarchical control of the manufacturing and administrative (such as quality control) processes. The ongoing fulfillment of quality, based on the technical specification set by the OEM, is of vital importance. In case the OEC does not meet the quality or working condition standards as agreed upon in the contract, this failure may cause serious damage to the OEM’s reputation in the markets. Thus, partner selection, contract negotiation, and quality control procedures have great importance (Hollensen 2014).

Furthermore, there is a risk for the OEM that the cost and desired benefits become unbalanced because of transaction costs related to the contract partner’s selection process and negotiation procedures (ex-ante costs) and ex-post costs, such as monitoring and control of delivery punctuality, assembly quantity, and assembly quality (Williamson 1991). The more OEM activities initiated by the original brand firm, the higher the complexity, which provokes expanded information and communication structures. The original brand manufacturer has to decide which value-added activities (products and services) are transferred to a contracting firm. There is another risk when the OEM outsources activities that contributed to the ability of the OEM in the past to differentiate itself from its competition (Kita 2001). In the worst case, core competencies of the brand manufacturer are transferred to the OEC. As a result, the OEC acquires knowledge through its absorptive capability, which helps to develop the overall manufacturing and business expertise of the OEC. Thus, after a certain period of time, the OEC may become a competitor to the OEM on the global markets by learning from its OEM contracting partner.

The terms ‘contract manufacturing’ and ‘outsourcing’ should be clearly separated. The first serves as a method for increasing the OEM’s manufacturing capacities at home by utilizing the OEC’s capacities in the foreign target market (manufacturing activities continue at the OEM).

If, however, the OEM decides to terminate the manufacturing of a certain product at its home base and, instead, shifts the entire production to another firm, this is called outsourcing. In contrast to internal sourcing of materials, components, or products and services within a firm, outsourcing is the process of employing an external provider to perform functions that could be performed in-house (Bertrand & Mol 2013; Potkany 2008).

Outsourcing enables a firm to flexibly handle its customer-order management. The firm’s manufacturing capacities are located outside the firm’s hierarchy as an alternative to owning the production facilities. The management is often better able to focus on its core competencies, such as marketing or research and development, to achieve competitive advantage (Cheng, Cantor, Dresner, & Grimm 2012). Experience curve effects and the specific manufacturing expertise of the contracted firm enables the company to perform tasks more effectively (Caruth, Pane Haden, & Caruth 2012). Outsourcing may help to reduce the fixed costs of the internal manufacturing facilities and thus lower the break-even point, which helps to improve a firm’s return on equity (ROE). Suppose a corporate executive’s performance is evaluated on the basis of the contribution to the firm’s ROE; the management tends to have a strong incentive to increase outsourcing (Kotabe & Murray 2004).

However, the more the brand manufacturer shifts value-added activities to contracted firms, the less the brand manufacturer is involved in value-added activities processes. The engineering expertise; technological knowledge; and, finally, the innovation capabilities and quality consciousness of the branded firm incrementally decrease over time. Further potential drawbacks of shifting value-added activities to outside firms are changes in employee morale and erosion of organizational loyalty. An organizational-cultural mismatch between the contract partners may lead to a lower product and service quality, which damages the brand manufacturer’s reputation (Caruth et al. 2012).

In the case of Philips (the Netherlands), it became increasingly difficult to remain efficient and innovative concerning new product developments in the consumer electronics industry. In 2008, Philips announced that it would transfer more than 70 percent of its television set manufacturing orders to contract manufacturers such as TCL Corporation (China), TVP (Taiwan), Hon Hai Precisions (Taiwan), and Funai Electric (Japan). In parallel, these previously rather less-known Asian-based electronics firms strengthened their technological and manufacturing expertise through learning during contract manufacturing relationships with OEMs such as Philips, among other reasons (Digitimes.com 2008). Around five years later, in 2013, Philips sold the remnants of its audio, video, multimedia, and accessories activities to Japan’s Funai Electric for 150 million euros in cash and a brand-license fee. The Dutch group reported the management targets of becoming primarily a maker of healthcare, medical equipment, and lighting products and, thus, terminated its once-core business of consumer electronics (Van den Oever 2013). Other ‘international latecomers,’ such as Flextronics of Singapore and Hon Hai Precision Foxconn of Taiwan, successfully used contract manufacturing as a learning tool on their way to becoming major players in the electronics industries (Tung & Wan 2012).

3. Licensing

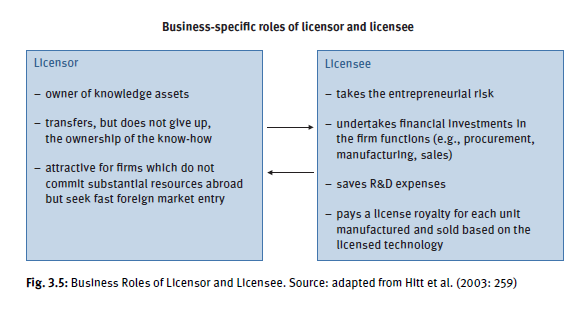

Contractual licensing relationships describe the transfer of knowledge between one licensor and usually various licensees. The licensor, as the owner of knowledge – for example, concerning a product technology – needs to have a registered patent or trademark, which legally protects the licensor from illegal use of its intellectual property. When applied as an international market entry mode, the licensor grants exclusive rights to a licensee located in the target foreign country to use the intellectual property for a defined purpose for a certain period of time as agreed to by both parties in the contract (Aulakh, Jiang, & Li 2013).

In other words, licensing describes contractual transactions in which the owner of knowledge-based resource assets sells to another organization or individual the right to use these intangible resources for a defined purpose. Under the licensing arrangement, the licensor transfers, but does not give up, this ownership of the knowledge in exchange for the payment of royalties by the licensee (Luostarinen & Welch 1997). The royalty to the licensor, agreed to and documented in the contract, is normally calculated and paid based on each product unit sold by the licensee. License agreements offer the advantage to the licensee of gaining access to advanced, but legally protected, intellectual knowledge. The licensee takes the entrepreneurial risk and undertakes financial investments in facilities for material procurement, manufacturing, marketing, sales, and distribution of the products and services in the target foreign markets where the licensed knowledge is used (compare Figure 3.5).

Licensing can be attractive for rather small firms that have limited financial resources because it allows them to build up operations outside their home country. Furthermore, licensing as an international market entry mode is desirable in industries characterized by relatively short product and technology life-cycles, such as high-technology industries.

Potential drawbacks for the licensor come along with the fact of having no control over the operations and quality of the products and services created by the licensee. Innovation can be commercialized quickly with little investment risk. However, the success of a technological innovation in the market is totally dependent on the commitment and effectiveness of the licensees (Grant 2013). Because of the licensee’s operational value-added activities, the licensor is unable to realize experience curve and economies of scale effects. The licensor’s reputation can be damaged if the licensee does not appropriately follow the quality, safety, or environmental protection standards agreed to in the contract. In parallel, depending on the licensee’s learning capabilities, there is a threat that a new competitor is built up, based on the licensor’s knowledge and expertise. Many firms have made the mistake of thinking they could maintain control over their knowhow within the framework of a licensing agreement. RCA Corporation, for example, once licensed its color television set technology to Japanese firms. The Japanese companies quickly assimilated the technology, improved on it, and used it to successfully enter worldwide markets, taking substantial market share from RCA (Hill 2012).

4. Franchising

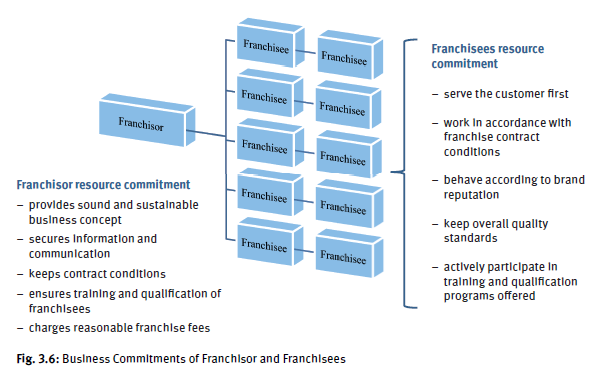

Franchising is a contractual agreement between a franchisor and usually many franchisees that are legally and financially separated (Hendrikse & Jiang 2007). Combs et al. (2004) describe the process of franchising as follows: the franchisor sells to the franchisees (typically small business owners) the right to commercialize goods or services under the franchisor’s established brand name (market goodwill) and a proven business concept. During the contractual relationship, the franchisor provides ongoing commercial, administrative, and technical assistance. In return, the franchisee typically pays an initial start-up fee, royalties based on the sales, and advertising fees – all of which depend on the conditions agreed to in the franchising contract. The franchise system combines the advantages of ongoing research and development activities, marketing, and economy of scale potentials offered by the franchisor with the regional market knowledge, cultural sensitivity, and entrepreneurial talents of the franchisee. The franchisees are most familiar with the local customer preferences and, thus, can better fine-tune their local sales behavior. From the perspective of the owner of the business concept, franchising allows a relatively fast entry into target foreign markets (Zentes, Morschett, & Schramm-Klein 2011). The responsibilities and expectations of the franchisor and franchisee are illustrated in Figure 3.6).

Potential drawbacks for a franchisor derive from the limited hierarchical control over the franchisee, which is an independent contractor, not an employee of the franchisor. Franchisees can harm the reputation of the franchisor and its business concept if they do not follow the quality, hygiene, and working condition standards specified in the contract. Moreover, the franchisor depends on the franchisee as an information source because the latter has direct contact with the customers. Therefore, market forecasts and necessary product and service modification, which may influence the business concept, depend on the franchisee’s information input. Having this in mind, the franchisor can lower the risk of franchisee dependence by simultaneously investing in financial and managerial assets, such as wholly owned operations in the target market (Dunning, Pak, & Beldona 2007).

Conflicts in the franchisor-franchisee relationship mainly arise from disagreements over objectives such as sales and profits, which may result from poor communication or failure. The potential for conflicts is reduced if franchisor and franchisee view each other as partners in running a business with common objectives and operating procedures. This approach requires a strong common culture with shared values established by means of intense communication between franchisor and franchisee. Another way of reducing disputes is to establish an efficient and transparent monitoring and reporting system between the franchisor and franchisee – for example, real-time access to computer-based inventory and accounting systems (Hollensen 2014).

However, the more the franchisee is monitored and controlled by the franchisor, the more questionable becomes the entrepreneurial freedom of the franchisee, which is usually claimed as one of the driving advantages when promoting franchise concepts. Because of the franchise start-up fee – which can easily reach, conditional to the business concept, more than one hundred thousand euros – the dependency of the franchisee on the franchisor seems to be incomparably higher than vice versa from the franchisor’s perspective. Thus, as in all contractual relationships, the right selection of a partner, which includes the careful evaluation of the business concept, is of vital importance for the involved parties.

5. Management Contracts

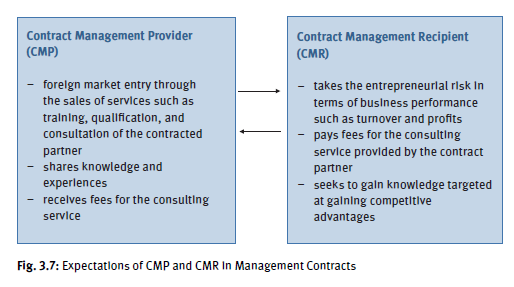

Management contracts offer a means through which a firm may use some of its personnel to assist a firm located in a target foreign country for a specified fee and period of time (Wheelen & Hunger 2010). The management (knowledge) transfer recipient is seeking a contractual partner that is able to run its enterprise and,

in parallel, qualifies and trains its staff by providing technical, commercial, and managerial knowledge. At the same time, the transferring firm enters new foreign markets, selling its managerial expertise and bringing in resources that help to improve the competitive positioning of the contract partner abroad, who in return pays fees for the consulting service (compare Figure 3.7). Through contractual relations with local governments, the firm is able to enter potential foreign markets where the local authorities may have a less than open attitude towards foreign investors (Foscht & Podmenik 2005).

While training the staff, including transfer of managerial and technological knowhow, there is a risk for the CMP that a new competitor is being fostered and developed. In addition, the management supplying firm needs to send qualified personnel, particularly those with cultural sensitivity and language skills. Such a qualified pool of employees is not always readily available. Personal and cultural conflict with locals may arise, depending on the expatriate’s characteristics and qualifications for carrying out the contract tasks. Opposing expectations regarding the management contracts between the contracting firm and the local firm may also provide the basis for conflicts. The local management may have divergent work ethics or show a less motivated learning behavior. Nevertheless, management contracts can be an interesting and profitable market entry mode. In order to successfully realize management contract projects, considerable effort needs to be made in terms of communication at the local level as well as back at the CMP headquarters (Luostarinen & Welch 1997).

6. Turnkey Contracts

Turnkey describes a market entry mode where a firm sells complete operations and supply and distribution chain services: material procurement, assembly, testing, and aftersales service, including warranty support (Henning 2013:18). Turnkey operations are usually used in large investment initiatives, such as the design, planning, construction, and building of a large manufacturing plant in a target foreign country. Market entry through turnkey usually includes the start-up of operations as well as necessary training, qualification, and consulting with the local personnel. The firm then ‘turns the key over’ to the local government in return for an agreed-upon payment of use fee (Deresky 2014). Turnkey operations are attractive for firms that have, for example, specific engineering and complex technological process knowhow.

The build, operate, transfer (BOT) concept is a variation of the turnkey operation. Instead of turning the facility (e.g., power plant or toll road) over to the host country when completed, the firm operates the facility for a fixed period of time. During this operating period, the company earns back the investment, plus a profit. At the end of the time period agreed upon with the foreign contract partner, the firm turns the facility over to the contract partner – for example, the local government at little or no cost to the host country (Naisbitt 1996; Wheelen & Hunger 2010).

Critical success factors for the turnkey selling firm usually derive from the availability of qualified personnel; a less developed infrastructure; security issues; and limited availability of local suppliers, logistics, and other service firm networks. There may also be a particular risk exposure if the turnkey contract is with the local government of the target foreign country, which is often the case in politically and economically rather fragile countries. The firm may face the threat of contract revocation initiated by the government if differences of opinion related to the project aims and targets arise between the contract partners, which may occur over time (Deresky 2014).

Source: Glowik Mario (2020), Market entry strategies: Internationalization theories, concepts and cases, De Gruyter Oldenbourg; 3rd edition.

Amazing! This blog looks exactly like my old one! It’s on a entirely different topic but it has pretty much the same layout and design. Excellent choice of colors!

There is apparently a bundle to realize about this. I think you made certain nice points in features also.