Because financing and funding are difficult to obtain, particularly for start- ups, entrepreneurs often use creative ways to obtain financial resources. Even for firms that have financing or funding available, it is prudent to search for sources of capital that are less expensive than traditional ones. The following sections discuss four of the more common creative sources of financing and funding for entrepreneurial firms.

1. Crowdfunding

A popular creative source of funding for new businesses is crowdfunding. Crowdfunding is the practice of funding a project or new venture by raising monetary contributions from a large number of people, typically via the Internet.

There are two types of crowdfunding sites: rewards-based crowdfunding and equity-based crowdfunding. Rewards-based crowdfunding allows entre- preneurs to raise money in exchange for some type of amenity or reward. The most popular rewards-based crowdfunding sites are Kickstarter, Indiegogo, and RocketHub. These sites allow entrepreneurs to create a profile, list their fund-raising goals, and provide an explanation (typically via video) of how the funds will be used. Individuals then pledge money in exchange for some type of amenity, like being one of the first 100 people to obtain the company’s product. The site takes a small percentage of the funds raised by the individuals for their service. Once a novelty, rewards-based crowdfunding has become a major source of start-up funds. Two of the student start-ups profiled in this book, LuminAid (Chapter 3) and Roominate (in this chapter), raised money via crowd- funding. In 2014, COOLEST, the subject of the You Be the VC 11.2 feature, raised $13.2 million from 62,642 donors on Kickstarter, which at the time was the all-time crowdfunding record. There are currently over 450 crowdfunding platforms. Some, such as Kickstarter, help fund a wide range of creative projects and business start-ups. Others are narrow in scope. If you’re not familiar with how crowdfunding works, go to www.kickstarter.com and type “COOLEST Cooler” into the search engine. Although the campaign is over, Kickstarter leaves the campaign profiles up on its site indefinitely. Looking at COOLEST’s campaign will provide you a good sense of how rewards-based crowdfunding campaigns work.

The second type of crowdfunding is equity-based crowdfunding. Equity- based crowdfunding helps businesses raise money by tapping individuals who provide funding in exchange for equity in the business. Three of the more popular equity-based crowdfunding sites are FundersClub, Crowdfunder.com, and Circle Up. The catalyst for the advent of equity-based crowdfunding was the JOBS Act, which was passed in April of 2012. The act is still going into effect, so the full set of rules and regulations that will govern equity-based crowdfunding sites are unknown. As of the time this chapter was written (September 2014), it appears that equity-based crowdfunding will be confined to entrepreneurs raising money from accredited investors. An accredited in- vestor is a person who is permitted to invest in higher-risk investments such as business start-ups. In the United States, a person must have a net worth of at least $1 million (not including the value of their house) or have an income of at least $200,000 each year for the past two years (or $300,000 together with their spouse if married) and have the expectation to make the same amount in the current year. Still, there is substantial enthusiasm surrounding the poten- tial for equity-based crowdfunding in the future.

2. Leasing

A lease is a written agreement in which the owner of a piece of property allows an individual or business to use the property for a specified period of time in exchange for payments. The major advantage of leasing is that it enables a company to acquire the use of assets with very little or no down payment. Leases for facilities and leases for equipment are the two most common types of leases that entrepreneurial ventures undertake.44 For example, many new businesses lease computers from Dell Inc. or other PC manufacturers. The advantage for the new business is that it can gain access to the computers it needs with very little money invested up-front.

There are many different players in the leasing business. Some vendors, such as Dell, lease directly to businesses. As with banks, the vendors look for lease clients with good credit backgrounds and the ability to make the lease payments. There are also venture-leasing firms that act as brokers, bring- ing the parties involved in a lease together. These firms are acquainted with the producers of specialized equipment and match these producers with new ventures that are in need of the equipment. One of the responsibilities of these firms is conducting due diligence to make sure that the new ventures involved will be able to keep up with their lease payments.

Most leases involve a modest down payment and monthly payments during the duration of the lease. At the end of an equipment lease, the new venture typically has the option to stop using the equipment, purchase it at fair mar- ket value, or renew the lease. Lease deals that involve a substantial amount of money should be negotiated and entered into with the same amount of scrutiny as when getting financing or funding. Leasing is almost always more expensive than paying cash for an item, so most entrepreneurs think of leas- ing as an alternative to equity or debt financing. Although the down payment is typically lower, the primary disadvantage is that at the end of the lease, the lessee doesn’t own the property or equipment.45 Of course, this may be an advantage if a company is leasing equipment, such as computers or copy ma- chines, which can rather quickly become technologically obsolete.

3. SBir and sttr grant programs

The Small Business Innovation Research (SBIR) and the Small Business Technology Transfer (STTR) programs are two important sources of early-stage funding for technology firms. These programs provide cash grants to entre- preneurs who are working on projects in specific areas. The main difference between the SBIR and the STTR programs is that the STTR program requires the participation of researchers working at universities or other research in- stitutions. For the purpose of the program, the term small business is defined as an American-owned for-profit business with fewer than 500 employees. The principle researcher must also be employed by the business.46

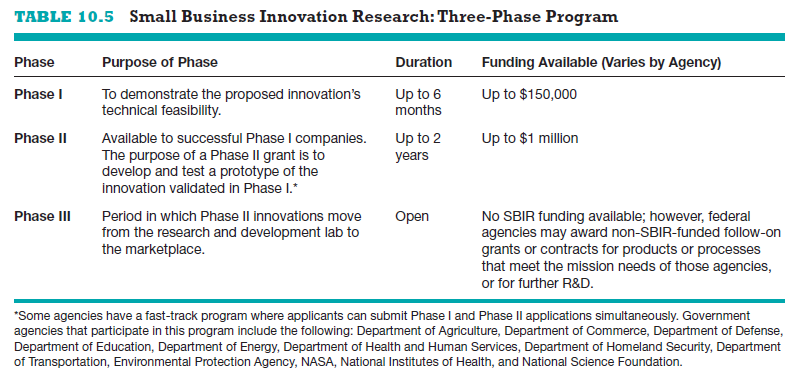

The SBIR Program is a competitive grant program that provides over $2.5 billion per year to small businesses for early-stage and development proj- ects. Each year, 11 federal departments and agencies are required by the SBIR to reserve a portion of their research and development funds for awards to small businesses. Table 10.5 shows the agencies that participate, along with the types of areas that are funded. Guidelines for how to apply for the grants are provided on each agency’s website, along with a description of the types of projects the agencies are interested in supporting. The SBIR is a three-phase program, meaning that firms that qualify have the potential to receive more than one grant to fund a particular proposal. These three phases, along with the amount of funding available for each phase, are as follows:

■ Phase I is a six-month feasibility study in which the business must demonstrate the technical feasibility of the proposed innovation. Funding available for Phase I research is for up to $150,000.

■ Phase II awards for up to $1 million are granted for as long as two years to successful Phase I companies. The purpose of a Phase II grant is to develop and test a prototype of Phase I innovations.

■ Phase III is the period during which Phase II innovations move from the research and development lab to the marketplace. No SBIR funds are in- volved. At this point, the business must find private funding or financing to commercialize the product or service. In some cases, such as with the Department of Defense, the government may be the primary customer for the product.

Historically, less than 15 percent of all Phase I proposals are funded, and about 30 percent of all Phase II proposals are funded. The payoff for successful proposals, however, is high. The money is essentially free. It is a grant, mean- ing that it doesn’t have to be paid back and no equity in the firm is at stake. The recipient of the grant also retains the rights to the intellectual property de- veloped while working with the support provided by the grant. The real payoff is in Phase III if the new venture can commercialize the research results.

The STTR Program is a variation of the SBIR for collaborative research projects that involve small businesses and research organizations, such as universities or federal laboratories. In 2010, over $100 million in grants were awarded through the program. More information about the SBIR and STTR programs can be obtained at www.sbir.gov.

4. Other grant programs

There are a limited number of other grant programs available to entrepreneurs. Obtaining a grant takes a little detective work. Granting agencies are, by nature, low-key, so they normally need to be sought out. A typical scenario of a small business that received a grant is provided by Rozalia Williams, the founder of Hidden Curriculum Education, a for-profit company that offers college life skills courses. To kick-start her business, Williams received a $72,500 grant from Miami-Dade Empowerment Trust, a granting agency in Dade County, Florida. The purpose of the Miami-Dade Empowerment Trust is to encourage the creation of businesses in disadvantaged neighborhoods of Dade County. The key to Williams’s success, which is true in most grant-awarding situations, is that her business fit nicely with the mission of the granting organization, and she was willing to take her business into the areas the granting agency was committed to improving. After being awarded the grant and conducting her college prep courses in four Dade County neighborhoods over a three-year period, Williams received an additional $100,000 loan from the Miami-Dade Empowerment Trust to expand her business.47 There are also private founda- tions that grant money to both existing and start-up firms. These grants are usually tied to specific objectives or a specific project, such as research and development in a specific area.

The federal government has grant programs beyond the SBIR and STTR programs described previously. The full spectrum of grants available is listed at www.grants.gov. State and local governments, private foundations, and philanthropic organizations also post grant announcements on their websites. Finding a grant that fits your business is the key. This is no small task. It is worth the effort, however, if you can obtain some or all of your start-up costs through a granting agency.

One thing to be careful of is grant-related scams. Business owners often re- ceive unsolicited letters or e-mail messages from individuals or organizations that assure them that for a fee they can help the business gain access to hundreds of business-related grants. The reality is that there aren’t hundreds of business- related grants that fit any one business. Most of these types of offers are a scam.

5. Strategic partners

Strategic partners are another source of capital for new ventures.48 Indeed, strategic partners often play a critical role in helping young firms fund their operations and round out their business models.

Biotechnology companies, for example, rely heavily on partners for finan- cial support, as illustrated in this chapter’s “Savvy Entrepreneurial Firm” boxed feature. As mentioned in the feature, a small biotech firm would rarely have access to sufficient financial capital and other resources to take a new discovery from the lab all the way to market. It just takes too much time, capital, and other resources to pull off. As a result, they rely on deep-pocketed strategic partners to perform parts of the process. Many strategic partnerships are also formed to gain access to a particular resource or to facilitate speed to market.49 In exchange for access to plant and equipment and established distribution channels, new ventures bring an entrepreneurial spirit and new ideas to these partnerships. These types of arrangements can help new ven- tures lessen the need for financing or funding.

Source: Barringer Bruce R, Ireland R Duane (2015), Entrepreneurship: successfully launching new ventures, Pearson; 5th edition.

I¦ve learn some excellent stuff here. Definitely worth bookmarking for revisiting. I wonder how a lot attempt you place to make any such wonderful informative website.

Hey, you used to write wonderful, but the last few posts have been kinda boring… I miss your super writings. Past few posts are just a bit out of track! come on!