When structuring a supplier portfolio, firms have many options regarding whom to source from and where to source from. With regard to the “whom,” a company must decide on whether to produce in-house or outsource to a third party. The company must also decide whether the supply source will be cost efficient or responsive. With regard to the “where,” a company can choose among onshoring, near-shoring, and offshoring. Onshoring refers to producing the product in the market where it is sold, even when it is a high-cost location. Near-shoring refers to producing the product at a lower-cost location near the market. For the U.S. market, for example, producing in Mexico is near-shoring. For the market in Europe, producing in Eastern Europe is near-shoring. Offshoring refers to producing the product at a low-cost location that may be far from the market. In this section, we discuss a variety of factors that influence the design of the sourcing portfolio.

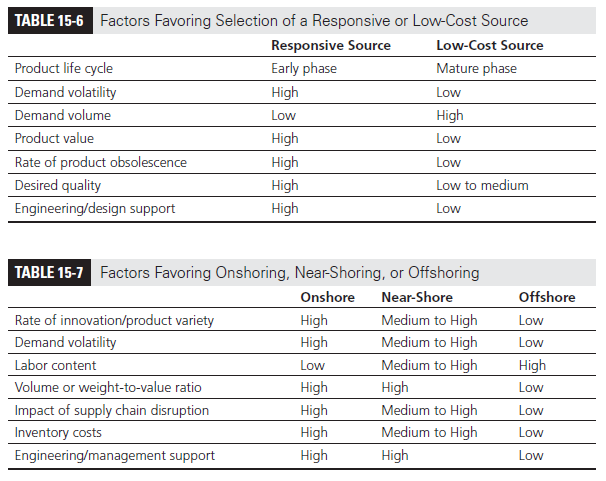

Most companies need to tailor their supplier portfolio based on a variety of product and market characteristics. For example, Zara uses responsive sources out of Europe to produce trendy products that must be in stores quickly to meet customer demand. In contrast, basics such as white T-shirts are sourced out of lower-cost facilities in Asia. Table 15-6 identifies factors that favor the selection of a responsive or low-cost source.

As with Zara, a tailored portfolio consists of a combination of responsive and low-cost suppliers. To use a tailored portfolio effectively, demand should be allocated among suppliers in a way that is consistent with their capabilities. Low-cost suppliers should be given large, steady orders of mature, low-value products that do not require significant engineering or design support. Responsive suppliers, in contrast, should be responsible for high-value, volatile products that are often early in their life cycle and need significant engineering/design support.

In general, responsive sources will tend to be located onshore or near-shore to facilitate a quick response. Low-cost sources could be located anywhere, but low cost is often the main reason for going offshore or near-shore. In Table 15-7, we identify some factors that influence the sourcing location decision.

Large, bulky items such as washing machines and refrigerators are best onshored or near- shored because they have high transportation costs relative to value. In contrast, small items like consumer electronics, especially those that sell in large amounts (say, the iPad), can be offshored. As transportation costs increase, the onshore and near-shore options become more attractive relative to offshoring. For instance, high-value routers with high demand volatility, high inventory costs, and the need for significant management support are outsourced by Cisco to an onshore supplier. Low-value routers with stable designs and low demand volatility, in contrast, are offshored to low-cost countries. As these examples illustrate, it is important for a firm to plan a tailored sourcing strategy in which the product and market characteristics match with the responsiveness and location of the source.

China and other parts of Asia were popular offshore sources for the two decades between 1990 and 2010. Some trends currently in place, however, are making American managers rethink their offshoring choices. One is the change in Chinese wages and the strengthening yuan, both of which diminish the labor cost advantage of China, especially when compared to near-shore locations such as Mexico. The other is the increase in oil prices and transportation costs that acts as a tariff barrier, making offshoring somewhat less attractive. Finally, the increase in volatility and the need to mitigate risk have also encouraged supply chain designers to include an onshore or near-shore source to complement a low-cost offshore source.

Key Point

Firms must consider a tailored sourcing strategy that couples responsive onshore or near-shore sources with low-cost offshore sources. The responsive onshore sources should focus on high-value products with high demand volatility, whereas the low-cost, offshore sources should focus on lower-value, high- volume products with high labor content.

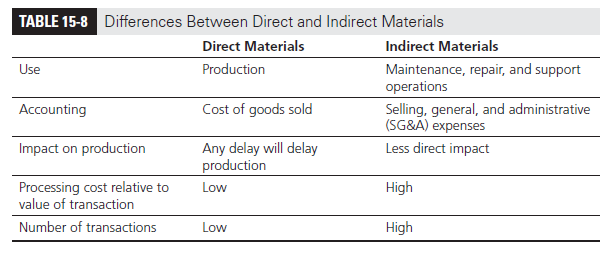

The tailoring of the supplier portfolio should also account for other characteristics of the product being sourced. A simple categorization of purchased goods is into direct and indirect materials. Direct materials are components used to make finished goods. For example, the processor is a direct material for a smartphone manufacturer. Indirect materials are goods used to support the operations of a firm. Office supplies are examples of indirect materials for an automotive manufacturer. Important differences between direct and indirect materials are shown in Table 15-8.

Given the direct link to production, suppliers for direct materials should be selected based on their ability to collaborate and coordinate across the supply chain. Collaboration is important at both the design and production phases. Collaboration during design can help reduce component costs, whereas collaboration during production can help improve coordination of the supply chain through improved planning and visibility. A good example of collaboration is the relationship between Johnson Controls and Chrysler for the 2002 Jeep Liberty. Johnson Controls integrated components from thirty-five suppliers and delivered the assembly to Chrysler as a cockpit module. As soon as Chrysler notified it of an order for a Jeep, Johnson Controls had 204 minutes in which to build and deliver the module. This was done 900 times every day for about 200 color and interior combinations. The strong collaboration between the two companies resulted in a significant reduction in inventory and a better matching of product supply with end customer demand.

Indirect materials are often a small fraction of the money spent by a firm but can represent a big headache for the procurement department. The purchase of indirect materials typically involves many transactions, with each transaction being small. Each transaction can be costly because of the difficulty of selecting goods (from many catalogs, which are often out of date), getting approval, and creating and sending a purchase order. Suppliers for indirect material should thus be selected based on their ability to simplify each transaction. As suppliers of maintenance and repair parts (typical indirect materials), McMaster-Carr and W.W. Grainger have worked hard to make it easy for their customers to transact with them.

In addition to the categorization of materials into direct and indirect, all products purchased may also be categorized as shown in Figure 15-1, based on their value/cost and how critical they are. Most indirect materials are included in general items. Direct materials can be further classified into bulk purchase, critical, and strategic items. For most bulk purchase items, such as packaging materials and bulk chemicals, suppliers tend to have the same selling price. It is thus important to make a distinction between suppliers based on the services they provide and their performance along all dimensions that affect the total cost of ownership. Critical items include specialty chemicals and components with long lead times. The key sourcing objective for critical items is not low price, but ensuring availability. The presence of a responsive, even if high-cost, supply source can be valuable for critical items. The last category, strategic items, includes examples such as electronics for an auto manufacturer. For strategic items, the buyer-supplier relationship is long term. Thus, suppliers should be evaluated based on the lifetime cost/value of the relationship. The goal should be to identify suppliers that can collaborate in the design phase and coordinate design and production activities with other players in the supply chain.

Source: Chopra Sunil, Meindl Peter (2014), Supply Chain Management: Strategy, Planning, and Operation, Pearson; 6th edition.

This web site is really a walk-through for all of the info you wanted about this and didn’t know who to ask. Glimpse here, and you’ll definitely discover it.