The dividend yield measures the rate of return to stockholders, based on cash dividends. Dividend yield is most often computed for common stock because preferred stock has a stated dividend rate. In contrast, the cash dividends paid on common stock normally vary with the profitability of the corporation.

The dividend yield is computed as follows:

![]()

To illustrate, the market price of News Corporation was $16.98 on November 8, 2011. During the preceding year, News Corporation had paid dividends of $0.19 per share. Thus, the dividend yield of News Corporation’s common stock is computed as follows:

![]()

News Corporation pays a dividend yield of slightly more than 1%. The dividend yield is first a function of a company’s profitability, or ability to pay a dividend. For example, many banks nearly eliminated their dividends during the banking crisis of 2008 because they had significant losses. News Corporation has sufficient profitability to pay a dividend. Secondly, a company’s dividend yield is a function of management’s alternative use of funds. If a company has sufficient growth opportunities, funds may be directed toward internal investment, rather than toward paying dividends. This would explain News Corporation’s small dividend yield.

The dividend yield will vary from day to day, because the market price of a corporation’s stock varies day to day. Current dividend yields are provided with news service quotations of market prices, such as The Wall Street Journal or Yahoo! Finance.

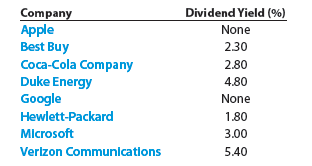

Recent dividend yields for some selected companies are as follows:

As can be seen, the dividend yield varies widely across firms. Growth firms tend to retain their earnings to fund future growth. Thus, Apple and Google pay no dividends, and Hewlett-Packard has a relatively small dividend. Common stockholders of these companies expect to earn most of their return from stock price appreciation. In contrast, Duke Energy and Verizon Communications are regulated utilities that provide a return to common stockholders mostly through dividends. Best Buy, Coca-Cola, and Microsoft provide a mix of dividends and expected stock price appreciation to their common stockholders.

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

It is really a great and helpful piece of info. I am satisfied that you simply shared this useful information with us. Please keep us up to date like this. Thanks for sharing.

Excellent read, I just passed this onto a friend who was doing a little research on that. And he actually bought me lunch because I found it for him smile Therefore let me rephrase that: Thanks for lunch! “Whenever you have an efficient government you have a dictatorship.” by Harry S Truman.