1. Why Discounted Cash Flow Won’t Work for Options

For many years, economists searched for a practical formula to value options until Fischer Black and Myron Scholes finally hit upon the solution. Later we will show you what they found, but first we should explain why the search was so difficult.

Our standard procedure for valuing an asset is to (1) figure out expected cash flows and (2) discount them at the opportunity cost of capital. Unfortunately, this is not practical for options. The first step is messy but feasible, but finding the opportunity cost of capital is impossible because the risk of an option changes every time the stock price moves.

When you buy a call, you are taking a position in the stock but putting up less of your own money than if you had bought the stock directly. Thus, an option is always riskier than the underlying stock. It has a higher beta and a higher standard deviation of returns.

How much riskier the option is depends on the stock price relative to the exercise price. A call option that is in the money (stock price greater than exercise price) is safer than one that is out of the money (stock price less than exercise price). Thus a stock price increase raises the option’s expected payoff and reduces its risk. When the stock price falls, the option’s payoff falls and its risk increases. That is why the expected rate of return investors demand from an option changes day by day, or hour by hour, every time the stock price moves.

We repeat the general rule: The higher the stock price is relative to the exercise price, the safer is the call option, although the option is always riskier than the stock. The option’s risk changes every time the stock price changes.

2. Constructing Option Equivalents from Common Stocks and Borrowing

If you’ve digested what we’ve said so far, you can appreciate why options are hard to value by standard discounted-cash-flow formulas and why a rigorous option-valuation technique eluded economists for many years. The breakthrough came when Black and Scholes exclaimed, “Eureka! We have found it!1 The trick is to set up an option equivalent by combining common stock investment and borrowing. The net cost of buying the option equivalent must equal the value of the option.”

We’ll show you how this works with a simple numerical example. We’ll travel back to April 2017 and consider a six-month call option on Amazon stock with an exercise price of $900. We’ll pick a day when Amazon stock was also trading at $900, so that this option is at the money. The short-term, risk-free interest rate was r = 0.5% for 6 months, or about 1% a year.

To keep the example as simple as possible, we assume that Amazon stock can do only two things over the option’s six-month life. The price could rise by 20% to 900 X 1.2 = $1,080. Alternatively, it could fall by the same proportion to 900 f 1.2 = $750, which is equivalent to a decline of (900 – 750)/900 = 16.667%. The upward move is sometimes written as u = 1.2, and the downward move as d = 1/u = 1/1.2.

Warning: We will round some of our calculations slightly. So, if you are following along with your calculator, don’t worry if your answers differ in the last decimal place.

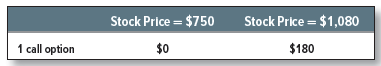

If Amazon’s stock price falls to $750, the call option will be worthless, but if the price rises to $1,080, the option will be worth $1,080 – 900 = $180. The possible payoffs to the option are therefore as follows:

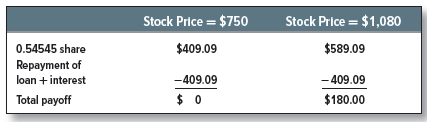

Now compare these payoffs with what you would get if you bought .54545 Amazon share and borrowed the present value of $409.09 from the bank:[1]

Notice that the payoffs from the levered investment in the stock are identical to the payoffs from the call option. Therefore, the law of one price tells us that both investments must have the same value:

Value o f call = value of .54545 shares – value of bank loan = .54545 x $900 – 409.09/1.005 = $83.85

Presto! You’ve valued a call option.

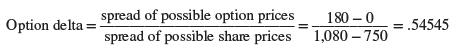

To value the Amazon option, we borrowed money and bought stock in such a way that we exactly replicated the payoff from a call option. This is called a replicating portfolio. The number of shares needed to replicate one call is called the hedge ratio or option delta. In our Amazon example, one call is replicated by a levered position in .54545 share. The option delta is, therefore, .54545.

How did we know that Amazon’s call option was equivalent to a levered position in .54545 share? We used a simple formula that says:

You have learned not only to value a simple option but also learned that you can replicate an investment in the option by a levered investment in the underlying asset. Thus, if you can’t buy or sell a call option on an asset, you can create a homemade option by a replicating strategy—that is, you buy or sell delta shares and borrow or lend the balance.

Risk-Neutral Valuation Notice why the Amazon call option should sell for $83.85. If the option price is higher than $83.85, you could make a certain profit by buying .54545 share of stock, selling a call option, and borrowing the present value of $409.09. Similarly, if the option price is less than $83.85, you could make an equally certain profit by selling .54545 share, buying a call, and lending the balance. In either case, there would be an arbitrage opportunity.[2]

If there’s a possible arbitrage profit, everyone scurries to take advantage of it. So when we said that the option price had to be $83.85 or there would be an arbitrage opportunity, we did not need to know anything about investor attitudes to risk. High-rolling speculators and total wimps would all jostle each other in the rush to realize a possible arbitrage profit. Thus, the option price cannot depend on whether investors detest risk or do not care a jot.

This suggests an alternative way to value the option. We can pretend that all investors are indifferent about risk, work out the expected future value of the option in such a world, and discount it back at the risk-free interest rate to give the current value. Let us check that this method gives the same answer.

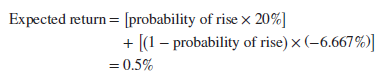

If investors are indifferent to risk, the expected return on the stock must be equal to the risk-free rate of interest:

Expected return on Amazon stock = 0.5% per six months

We know that Amazon stock can either rise by 20% to $1,080 or fall by 16.667% to $750. We can, therefore, calculate the probability of a price rise in our hypothetical risk-neutral world:

Therefore,

Probability of rise = .46815 or 46.815%

Notice that this is not the true probability that Amazon stock will rise. Since investors dislike risk, they will almost surely require a higher expected return than the risk-free interest rate from Amazon stock. Therefore, the true probability is greater than .46815.

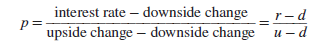

The general formula for calculating the risk-neutral probability of a rise in value is

In the case of Amazon:

![]()

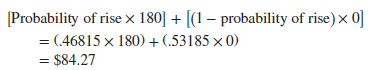

We know that if the stock price rises, the call option will be worth $180; if it falls, the call will be worth nothing. Therefore, if investors are risk-neutral, the expected value of the call option is

And the current value of the call is

Exactly the same answer that we got earlier!

We now have two ways to calculate the value of an option:

- Find the combination of stock and loan that replicates an investment in the option. Since the two strategies give identical payoffs in the future, they must sell for the same price today.

- Pretend that investors do not care about risk so that the expected return on the stock is equal to the interest rate. Calculate the expected future value of the option in this

hypothetical risk-neutral world, and discount it at the risk-free interest rate. This idea may seem familiar to you. In Chapter 9, we showed how you can value an investment either by discounting the expected cash flows at a risk-adjusted discount rate or by adjusting the expected cash flows for risk and then discounting these certainty- equivalent flows at the risk-free interest rate. We have just used this second method to value the Amazon option. The certainty-equivalent cash flows on the stock and option are the cash flows that would be expected in a risk-neutral world.

3. Valuing the Amazon Put Option

Valuing the Amazon call option may well have seemed like pulling a rabbit out of a hat. To give you a second chance to watch how it is done, we will use the same method to value another option—this time, the six-month Amazon put option with a $900 exercise price.[3] We continue to assume that the stock price will either rise to $1,080 or fall to $750.

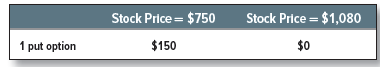

If Amazon’s stock price rises to $1,080, the option to sell for $900 will be worthless. If the price falls to $750, the put option will be worth $900 – 750 = $150. Thus, the payoffs to the put are

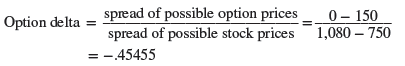

We start by calculating the option delta using the formula that we presented previously:[4]

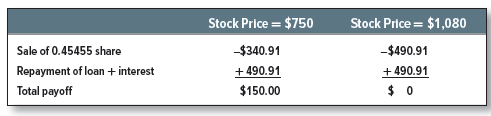

Notice that the delta of a put option is always negative; that is, you need to sell delta shares of stock to replicate the put. In the case of the Amazon put you can replicate the option payoffs by selling .45455 Amazon share and lending the present value of $490.91. Since you have sold the share short, you will need to lay out money at the end of six months to buy it back, but you will have money coming in from the loan. Your net payoffs are exactly the same as the payoffs you would get if you bought the put option:

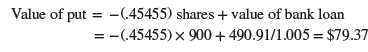

Since the two investments have the same payoffs, they must have the same value:

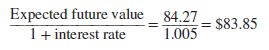

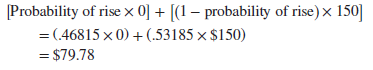

Valuing the Put Option by the Risk-Neutral Method Valuing the Amazon put option with the risk-neutral method is a cinch. We already know that the probability of a rise in the stock price is .46815. Therefore, the expected value of the put option in a risk-neutral world is

And therefore the current value of the put is

![]()

Apart from a minor rounding error, the two methods give the same answer.

The Relationship between Call and Put Prices We pointed out earlier that for European options there is a simple relationship between the values of the call and the put.6

Value of put = value of call + present value of exercise price – share price

Since we had already calculated the value of the Amazon call, we could also have used this relationship to find the value of the put:

![]()

Everything checks.

Have you ever considered creating an e-book or guest

authoring on other blogs? I have a blog based upon on the same subjects you discuss and

would love to have you share some stories/information. I know my audience would appreciate

your work. If you’re even remotely interested, feel free to

shoot me an e mail.

Thanks for sharing your thoughts about website. Regards