Most firms keep inventories of raw materials, work in process, or finished goods awaiting sale and shipment. But they are not obliged to do so. For example, they could buy materials day by day, as needed. But then they would pay higher prices for ordering in small lots, and they would risk production delays if the materials were not delivered on time. They can avoid that risk by ordering more than the firm’s immediate needs. Similarly, firms could do away with inventories of finished goods by producing only what they expect to sell tomorrow. But this too could be a dangerous strategy. A small inventory of finished goods may mean shorter and more costly production runs, and it may not be sufficient to meet an unexpected increase in demand.

There are also costs to holding inventories that must be set against these benefits. Money tied up in inventories does not earn interest, storage and insurance must be paid for, and there may be risk of spoilage or obsolescence. Firms need to strike a sensible balance between the benefits of holding inventory and the costs.

EXAMPLE 30.1 ● The Inventory Trade-Off

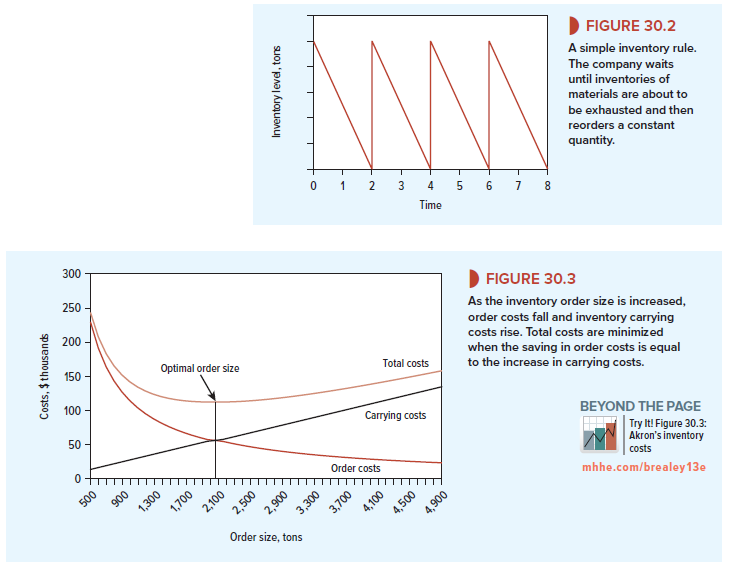

Akron Wire Products uses 255,000 tons a year of wire rod. Suppose that it orders Q tons at a time from the manufacturer. Just before delivery, Akron has effectively no inventories. Just after delivery it has an inventory of Q tons. Thus Akron’s inventory of wire rod roughly follows the sawtooth pattern in Figure 30.2.

There are two costs to this inventory. First, each order that Akron places involves a handling and delivery cost. Second, there are carrying costs, such as the cost of storage and the opportunity cost of the capital that is invested in inventory. Akron can reduce the order costs by placing fewer and larger orders. On the other hand, a larger order size increases the average quantity held in inventory, so that the carrying costs rise. Good inventory management requires a trade-off between these two types of cost.

This is illustrated in Figure 30.3.

We assume here that each order that Akron places involves a fixed order cost of $450, while the annual carrying cost of the inventory works out at about $55 a ton. You can see how a larger order size results in lower order costs but higher carrying costs.

The sum of the two costs is minimized when the size of each order is Q = 2,043 tons. The optimal order size (2,043 tons in our example) is termed the economic order quantity, or EOQ.

Our example was not wholly realistic. For instance, most firms do not use up their inventory of raw material at a constant rate, and they would not wait until stocks had completely run out before they were replenished. But this simple model does capture some essential features of inventory management:

- Optimal inventory levels involve a trade-off between carrying costs and order costs.

- Carrying costs include the cost of storing goods as well as the cost of capital tied up in inventory.

- A firm can manage its inventories by waiting until they reach some minimum level and then replenish them by ordering a predetermined quantity.[2]

- When carrying costs are high and order costs are low, it makes sense to place more frequent orders and maintain lower levels of inventory.

- Inventory levels do not rise in direct proportion to sales. As sales increase, the optimal inventory level rises, but less than proportionately.

Manufacturers today typically get by with slimmer inventories than they used to. Some have adopted a just-in-time strategy in which inventories of parts and subassemblies are nearly zero. Just-in-time was pioneered by Toyota. Suppliers deliver parts and subassemblies to Toyota’s assembly plants only as needed on the production line. Deliveries are made throughout the day at intervals as short as one hour. Toyota can operate successfully with minimal inventories only because it and its suppliers make sure that traffic snarl-ups, strikes, and other hazards do not interrupt the flow of components and bring production to a standstill. Thus a just-in-time inventory system has its costs. The company and its suppliers have to maintain systems and procedures to ensure that parts and subassemblies really do arrive just in time.

Just-in-time inventory management works when the flow of production is steady and predictable, so that no significant buffer is needed for unexpected changes or requirements. But in most circumstances inventory buffers are needed. For example, a gas-fired power plant may hold a supply of fuel oil for use in case gas supplies are cut short. (Some power plants in New England switch from natural gas to fuel oil in severe cold snaps, when the demand for gas for residential heating soars.) Department stores hold extra merchandise in case consumer demand is higher than expected. It’s better to bear the cost of holding inventory than to bear the risk of disgruntled customers staring at empty shelves. As a rough and general rule, the greater the uncertainty, the larger the inventory buffer should be.

Sometimes it may be possible to reduce inventories of finished goods by producing the goods to order. For example, Dell Computer discovered that it did not need to keep a large stock of finished machines. Its customers are able to use the Internet to specify what features they want on their PCs. The computer is then assembled to order and shipped to the customer.[3]

I’ve learn several just right stuff here. Certainly worth bookmarking for revisiting. I surprise how much attempt you put to create any such fantastic informative website.

It?¦s really a nice and helpful piece of information. I am glad that you just shared this useful info with us. Please stay us informed like this. Thank you for sharing.