Mornin’ Joe is planning to expand operations to various places around the world. Financing for this expansion will come from foreign banks. While financial statements prepared under U.S. GAAP may be appropriate for U.S. operations, financial statements prepared for foreign bankers should be prepared using international accounting standards.

The European Union (EU) has developed accounting standards similar in structure to U.S. standards. Its accounting standards board is called the International Accounting Standards Board (IASB). The IASB issues accounting standards that are termed International Financial Reporting Standards (IFRS). The intent of the IASB is to create a set of financial standards that can be used by public companies worldwide, not just in the EU.

Currently, the EU countries and over 100 other countries around the world have adopted or are planning to adopt IFRS. As a result, there are efforts under way to converge U.S. GAAP with IFRS so as to harmonize accounting standards around the world.

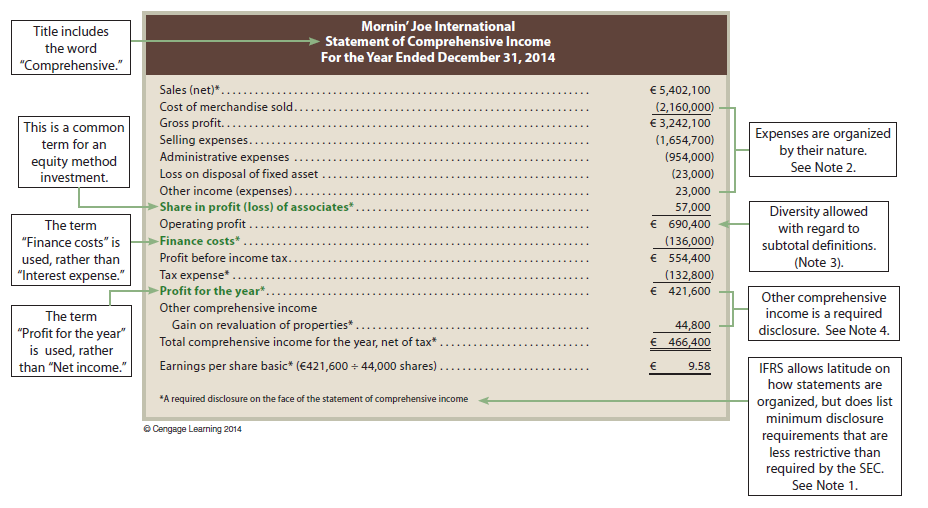

The following pages illustrate the financial statements of Mornin’ Joe International using IFRS. This illustration highlights reporting and terminology differences between IFRS and U.S. GAAP. Differences in recording transactions under IFRS and U.S. GAAP are discussed in Appendix C and in various International Connection boxes throughout the text.

The following Mornin’ Joe International financial statements are simplified and illustrate only portions of IFRS that are appropriate for introductory accounting. The financial statements are presented in euros (€) for demonstration purposes only. The euro is the standard currency of the European Union. The euro is translated at a 1:1 ratio from the dollar to simplify comparisons. Throughout the illustration, callouts and end notes to each statement are used to highlight the differences between financial statements prepared under IFRS and under U.S. GAAP.

- IFRS statements are often more summarized than U.S. GAAP statements. To compensate, IFRS requires specific disclosures on the face of the financial statements (denoted *) and additional disclosures in the notes to the financial statements. Since additions and subtractions are grouped together in sections of IFRS statements, parentheses are used to indicate subtractions.

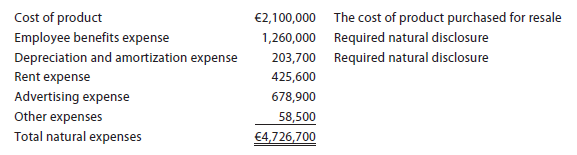

- Expenses in an IFRS income statement are classified by either their nature or function. The nature of an expense is how the expense would naturally be recorded in a journal entry reflecting the economic benefit received for that expense. Examples include salaries, depreciation, advertising, and utilities. The function of an expense identifies the purpose of the expense, such as a selling expense or an administrative expense. IFRS does not permit the natural and functional classifications to be mixed together on the same statement. That is, all expenses must be classified by either nature or function. However, if a functional classification of expenses is used, a note to the income statement must show the natural classification of expenses. To illustrate, because Mornin’ Joe International uses the functional classification of expenses in its income statement, it must also show the following natural classification of expenses in a note:

- IFRS provides flexibility with regard to line items, headings, and subtotals on the income statement. There is less flexibility under U.S. GAAP for public companies.

- IFRS requires the reporting of other comprehensive income (see appendix to Chapter 13) either on the income statement (illustrated) or in a separate statement. U.S. GAAP has a similar disclosure treatment. For Mornin’ Joe International, other comprehensive income consists of the restatement of cafe locations to fair value (see Note 6 for more details).

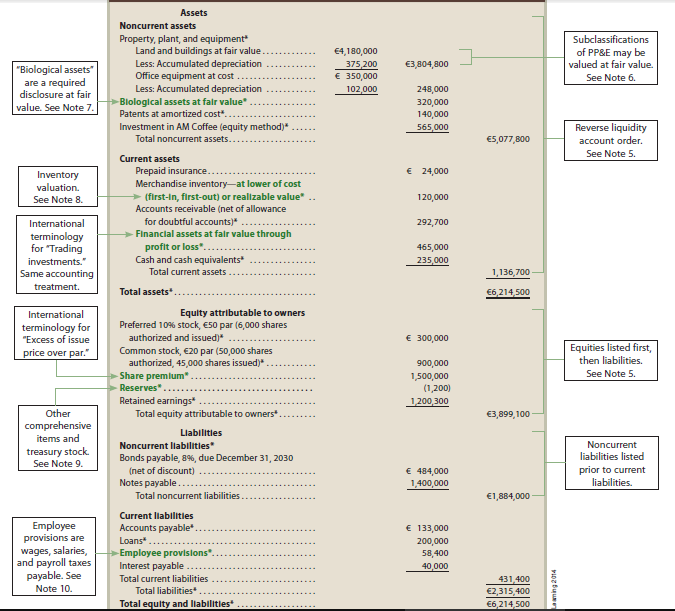

- Under IFRS, there is no standard format for the balance sheet (statement of financial position). A typical format for European Union companies is to begin the asset section of the balance sheet with noncurrent assets. This is followed by current assets listed in reverse order of liquidity. That is, the asset side of the balance sheet is reported in reverse order of liquidity from least liquid to most liquid. Listing noncurrent assets first emphasizes the going concern nature of the entity.

The liability and owners’ equity side of the balance sheet is also reported differently than under U.S. GAAP. Specifically, owners’ equity is reported first followed by noncurrent liabilities and current liabilities. Listing equity first emphasizes the going concern nature of the entity and the long-term financial interest of the owners in the business.

- Under IFRS, property, plant, and equipment (PP&E) may be measured at historical cost or fair value. If fair value is used, the revaluation must be for similar classifications of PP&E, but need not be for all PP&E. This departs from U.S. GAAP which requires PP&E to be measured at historical cost. Mornin’ Joe International restated its Land and Buildings to fair value, since the cafe sites have readily available real estate market prices. Land and buildings are included together because their fair values are not separable. The office equipment remains at historical cost, since it does not have a readily available market price. The increase in fair value is recorded by reducing accumulated depreciation and recognizing the gain as other comprehensive income. This element of other comprehensive income is accumulated in stockholders’ equity under the heading Property revaluation reserve.* This treatment is similar (with different titles) to the U.S. GAAP treatment of unrealized gains (losses) from available- for-sale securities. For Mornin’ Joe International, there is an increase in the property revaluation reserve of €44,800. This amount is the only difference between Mornin’ Joe’s U.S. GAAP net income, total assets, and total stockholders’ equity and Mornin’ Joe International’s IFRS total comprehensive income, total assets, and total stockholders’ equity.

- Mornin’ Joe International recently acquired a coffee plantation. This is an example of a biological asset. IFRS requires separate reporting of biological assets (principally agricultural assets) at fair value.

- Inventories are valued at lower of cost or market; however, “market” is defined as net realizable value under IFRS. U.S. GAAP defines “market” as replacement cost under most conditions. In addition, IFRS prohibits LIFO cost valuation.

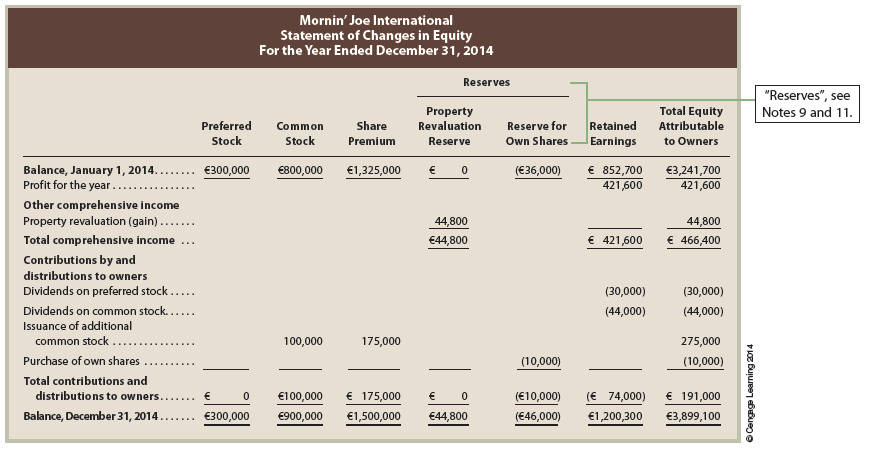

- Under IFRS, some elements of other comprehensive income and owner’s equity are often aggregated under the term “reserves.” In contrast, under U.S. GAAP, “reserve” is used to identify a liability. IFRS also does not require separate disclosure of treasury stock as does U.S. GAAP. Specifically, treasury stock may be reported as a reduction of a reserve, a reduction of a stock premium, or as a separate item.

- The term “provision” is used to denote a liability under IFRS, whereas this term often indicates an expense under U.S. GAAP. For example, “Provision for income taxes” means “Income tax expense” under U.S. GAAP, whereas it would mean “Income taxes payable” under IFRS.

- Under U.S. GAAP, other comprehensive income items must be included as changes in accumulated other comprehensive income in the statement of changes in stockholders’ equity. IFRS allows for similar treatment, with wider latitude for terminology, such as “Property Revaluation Reserve” illustrated by the column title here. In this illustration, treasury stock is included as part of a reserve (Reserve for Own Shares). As discussed in Note 9, under U.S. GAAP the term “reserve” denotes a liability.

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

1 Jul 2021

1 Jul 2021

1 Jul 2021

30 Jun 2021

1 Jul 2021

1 Jul 2021