The statement of cash flows reports a company’s cash inflows and outflows for a period.1 The statement of cash flows provides useful information about a company’s ability to do the following:

- Generate cash from operations

- Maintain and expand its operating capacity

- Meet its financial obligations

- Pay dividends

The statement of cash flows is used by managers in evaluating past operations and in planning future investing and financing activities. It is also used by external users such as investors and creditors to assess a company’s profit potential and ability to pay its debt and pay dividends.

The statement of cash flows reports three types of cash flow activities, as follows:

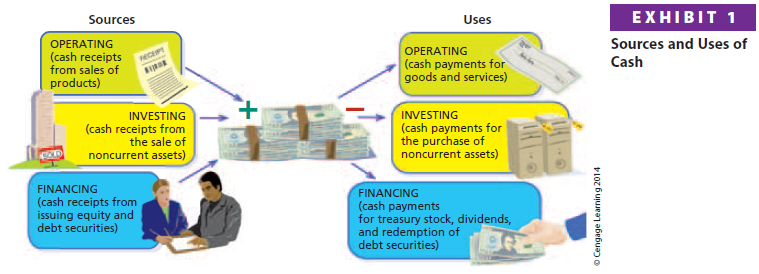

Cash flows from operating activities are the cash flows from transactions that affect the net income of the company.

Example: Purchase and sale of merchandise by a retailer.

Cash flows from investing activities are the cash flows from transactions that affect investments in the noncurrent assets of the company.

Example: Purchase and sale of fixed assets, such as equipment and buildings.

Cash flows from financing activities are the cash flows from transactions that affect the debt and equity of the company.

Example: Issuing or retiring equity and debt securities.

The cash flows are reported in the statement of cash flows as follows:

The ending cash on the statement of cash flows equals the cash reported on the company’s balance sheet at the end of the year.

Exhibit 1 illustrates the sources (increases) and uses (decreases) of cash by each of the three cash flow activities. A source of cash causes the cash flow to increase and is called a cash inflow. A use of cash causes cash flow to decrease and is called cash outflow.

1. Cash Flows from Operating Activities

Cash flows from operating activities reports the cash inflows and outflows from a company’s day-to-day operations. Companies may select one of two alternative methods for reporting cash flows from operating activities in the statement of cash flows:

- The direct method

- The indirect method

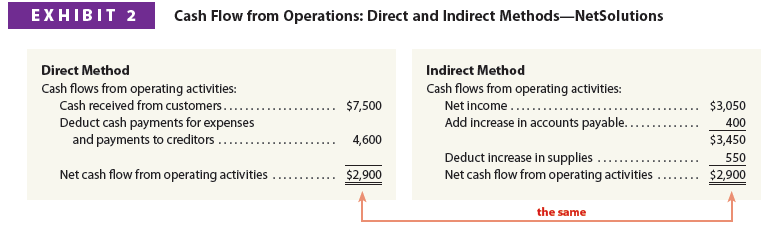

Both methods result in the same amount of cash flows from operating activities. They differ in the way they report cash flows from operating activities.

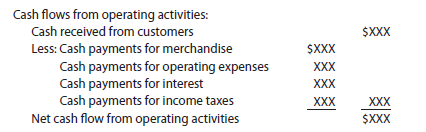

The direct method reports operating cash inflows (receipts) and cash outflows (payments) as follows:

The primary operating cash inflow is cash received from customers. The primary operating cash outflows are cash payments for merchandise, operating expenses, interest, and income tax payments. The cash received from operating activities less the cash payments for operating activities is the net cash flow from operating activities.

The primary advantage of the direct method is that it directly reports cash receipts and cash payments in the statement of cash flows. Its primary disadvantage is that these data may not be readily available in the accounting records. Thus, the direct method is normally more costly to prepare and, as a result, is used infrequently in practice.

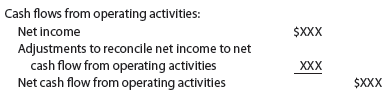

The indirect method reports cash flows from operating activities by beginning with net income and adjusting it for revenues and expenses that do not involve the receipt or payment of cash, as follows:

The adjustments to reconcile net income to net cash flow from operating activities include such items as depreciation and gains or losses on fixed assets. Changes in current operating assets and liabilities such as accounts receivable or accounts payable are also added or deducted, depending on their effect on cash flows. In effect, these additions and deductions adjust net income, which is reported on an accrual accounting basis, to cash flows from operating activities, which is a cash basis.

A primary advantage of the indirect method is that it reconciles the differences between net income and net cash flows from operations. In doing so, it shows how net income is related to the ending cash balance that is reported on the balance sheet.

Because the data are readily available, the indirect method is less costly to prepare than the direct method. As a result, the indirect method of reporting cash flows from operations is most commonly used in practice.

Exhibit 2 illustrates the Cash Flows from Operating Activities section of the statement of cash flows for NetSolutions. Exhibit 2 shows the direct and indirect methods using the NetSolutions data from Chapter 1. As Exhibit 2 illustrates, both methods report the same amount of net cash flow from operating activities, $2,900.

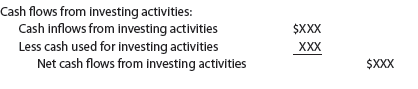

2. Cash Flows from Investing Activities

Cash flows from investing activities show the cash inflows and outflows related to changes in a company’s long-term assets. Cash flows from investing activities are reported on the statement of cash flows as follows:

Cash inflows from investing activities normally arise from selling fixed assets, investments, and intangible assets. Cash outflows normally include payments to purchase fixed assets, investments, and intangible assets.

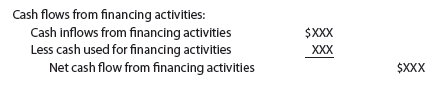

3. Cash Flows from Financing Activities

Cash flows from financing activities show the cash inflows and outflows related to changes in a company’s long-term liabilities and stockholders’ equity. Cash flows from financing activities are reported on the statement of cash flows as follows:

Cash inflows from financing activities normally arise from issuing long-term debt or equity securities. For example, issuing bonds, notes payable, preferred stock, and common stock creates cash inflows from financing activities. Cash outflows from financing activities include paying cash dividends, repaying long-term debt, and acquiring treasury stock.

4. Noncash Investing and Financing Activities

A company may enter into transactions involving investing and financing activities that do not directly affect cash. For example, a company may issue common stock to retire long-term debt. Although this transaction does not directly affect cash, it does eliminate future cash payments for interest and for paying the bonds when they mature. Because such transactions indirectly affect cash flows, they are reported in a separate section of the statement of cash flows. This section usually appears at the bottom of the statement of cash flows.

5. No Cash Flow per Share

Cash flow per share is sometimes reported in the financial press. As reported, cash flow per share is normally computed as cash flow from operations per share. However, such reporting may be misleading because of the following:

- Users may misinterpret cash flow per share as the per-share amount available for dividends. This would not be the case if the cash generated by operations is required for repaying loans or for reinvesting in the business.

- Users may misinterpret cash flow per share as equivalent to (or better than) earnings per share.

For these reasons, the financial statements, including the statement of cash flows, should not report cash flow per share.

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

Hello There. I found your blog using msn. This is a really well written article. I will be sure to bookmark it and come back to read more of your useful information. Thanks for the post. I will certainly return.