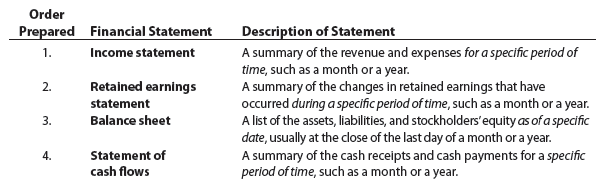

After transactions have been recorded and summarized, reports are prepared for users. The accounting reports providing this information are called financial statements. The primary financial statements of a corporation are the income statement, the retained earnings statement, the balance sheet, and the statement of cash flows. The order in which the financial statements are prepared and the nature of each statement are described as follows.

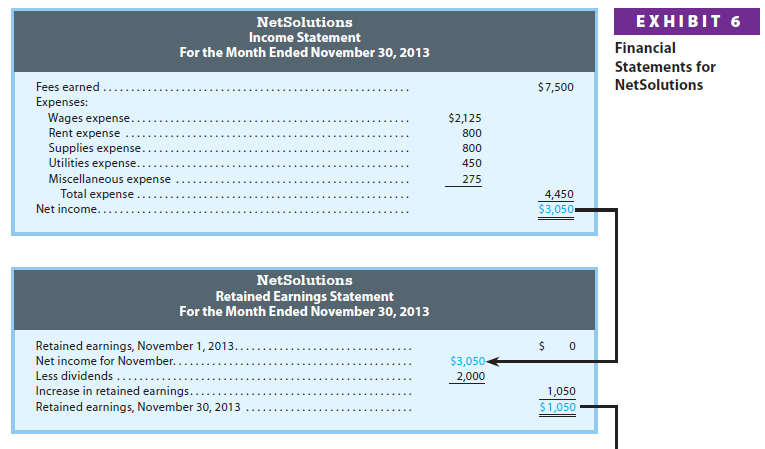

The four financial statements and their interrelationships are illustrated in Exhibit 6, on page 17. The data for the statements are taken from the summary of transactions of NetSolutions on page 13.

All financial statements are identified by the name of the business, the title of the statement, and the date or period of time. The data presented in the income statement, the retained earnings statement, and the statement of cash flows are for a period of

time. The data presented in the balance sheet are for a specific date.

1. Income Statement

The income statement reports the revenues and expenses for a period of time, based on the matching concept. This concept is applied by matching the expenses incurred during a period with the revenue that those expenses generated. The excess of the

revenue over the expenses is called net income, net profit, or earnings. If the expenses exceed the revenue, the excess is a net loss.

The revenue and expenses for NetSolutions were shown in the equation as separate increases and decreases. Net income for a period increases the stockholders’ equity (retained earnings) for the period. A net loss decreases the stockholders’ equity (retained earnings) for the period.

The revenue, expenses, and the net income of $3,050 for NetSolutions are reported in the income statement in Exhibit 6. The order in which the expenses are listed in the income statement varies among businesses. Most businesses list expenses in order

of size, beginning with the larger items. Miscellaneous expense is usually shown as the last item, regardless of the amount.

2. Retained Earnings Statement

The retained earnings statement reports the changes in the retained earnings for a period of time. It is prepared after the income statement because the net income or net loss for the period must be reported in this statement. Similarly, it is prepared before the balance sheet, since the amount of retained earnings at the end of the period must be reported on the balance sheet. Because of this, the retained earnings statement is often viewed as the connecting link between the income statement and balance sheet.

The following two types of transactions affected NetSolutions’ retained earnings during November:

- Revenues and expenses, which resulted in net income of $3,050.

- Dividends of $2,000 paid to stockholders (Chris Clark).

These transactions are summarized in the retained earnings statement for NetSolutions shown in Exhibit 6.

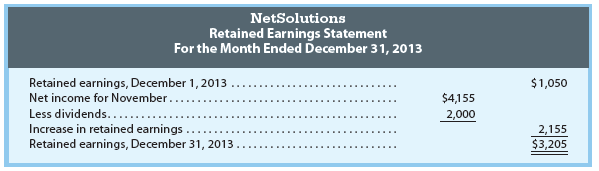

Since NetSolutions has been in operation for only one month, it has no retained earnings at the beginning of November. For December, however, there is a beginning balance—the balance at the end of November. This balance of $1,050 is reported on the retained earnings statement.

To illustrate, assume that NetSolutions earned net income of $4,155 and paid dividends of $2,000 during December. The retained earnings statement for NetSolutions for December is shown below.

3. Balance Sheet

The balance sheet in Exhibit 6 reports the amounts of NetSolutions’ assets, liabilities, and stockholders’ equity as of November 30, 2013. The asset and liability amounts are taken from the last line of the summary of transactions on page 13.

Retained earnings as of November 30, 2013, is taken from the retained earnings statement. The form of balance sheet shown in Exhibit 6 is called the account form. This is because it resembles the basic format of the accounting equation, with assets on the left side and the liabilities and stockholders’ equity sections on the right side.[1]

The assets section of the balance sheet presents assets in the order that they will be converted into cash or used in operations. Cash is presented first, followed by receivables, supplies, prepaid insurance, and other assets. The assets of a more permanent nature are shown next, such as land, buildings, and equipment.

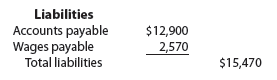

In the liabilities section of the balance sheet in Exhibit 6, accounts payable is the only liability. When there are two or more liabilities, each should be listed and the total amount of liabilities presented as follows:

4. Statement of Cash Flows

The statement of cash flows consists of the following three sections, as shown in Exhibit 6:

- operating activities

- investing activities

- financing activities

Each of these sections is briefly described below.

Cash Flows from Operating Activities This section reports a summary of cash re-ceipts and cash payments from operations. The net cash flow from operating activities normally differs from the amount of net income for the period. In Exhibit 6, NetSolutions reported net cash flows from operating activities of $2,900 and net income of $3,050. This difference occurs because revenues and expenses may not be recorded at the same time that cash is received from customers or paid to creditors.

Cash Flows from Investing Activities This section reports the cash transactions for the acquisition and sale of relatively permanent assets. Exhibit 6 reports that NetSolutions paid $20,000 for the purchase of land during November.

Cash Flows from Financing Activities This section reports the cash transactions related to cash investments by stockholders, borrowings, and cash dividends. Exhibit 6 shows that Chris Clark invested $25,000 in exchange for capital stock and dividends of $2,000 were paid during November.

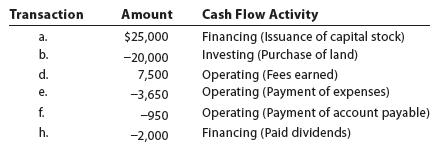

Preparing the statement of cash flows requires that each of the November cash transactions for NetSolutions be classified as an operating, investing, or financing activity. Using the summary of transactions shown on page 13, the November cash transactions for NetSolutions are classified as follows:

Transactions (c) and (g) are not listed above since they did not involve a cash receipt or payment. In addition, the payment of accounts payable in transaction (f) is classified as an operating activity since the account payable arose from the purchase of supplies, which are used in operations. Using the preceding classifications of November cash transactions, the statement of cash flows is prepared as shown in Exhibit 6.[2]

The ending cash balance shown on the statement of cash flows is also reported on the balance sheet as of the end of the period. To illustrate, the ending cash of $5,900 reported on the November statement of cash flows in Exhibit 6 is also reported as the amount of cash on hand in the November 30, 2013, balance sheet.

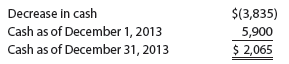

Since November is NetSolutions’ first period of operations, the net cash flow for November and the November 30, 2013, cash balance are the same amount, $5,900, as shown in Exhibit 6. In later periods, NetSolutions will report in its statement of cash flows a beginning cash balance, an increase or a decrease in cash for the period, and an ending cash balance. For example, assume that for December NetSolutions has a decrease in cash of $3,835. The last three lines of NetSolutions’ statement of cash flows for December would be as follows:

5. Interrelationships Among Financial Statements

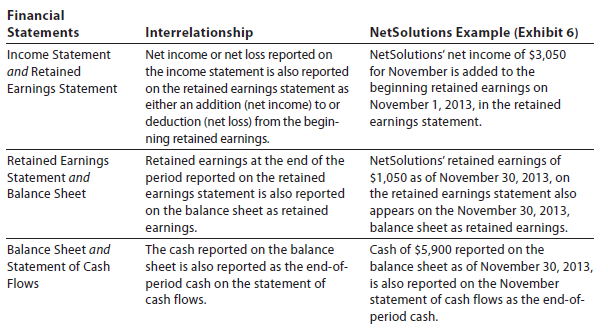

Financial statements are prepared in the order of the income statement, retained earnings statement, balance sheet, and statement of cash flows. This order is important because the financial statements are interrelated. These interrelationships for NetSolutions are shown in Exhibit 6 and are described below.[3]

The preceding interrelationships are important in analyzing financial statements and the impact of transactions on a business. In addition, these interrelationships serve as a check on whether the financial statements are prepared correctly. For example, if the ending cash on the statement of cash flows does not agree with the balance sheet cash, then an error has occurred.

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

Really nice style and excellent articles, hardly anything else we require : D.