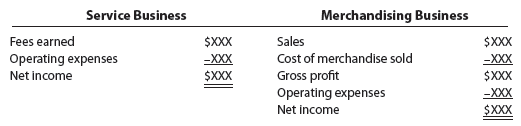

The activities of a service business differ from those of a merchandising business. These differences are illustrated in the following condensed income statements:

The revenue activities of a service business involve providing services to customers. On the income statement for a service business, the revenues from services are reported as fees earned. The operating expenses incurred in providing the services are subtracted from the fees earned to arrive at net income.

In contrast, the revenue activities of a merchandising business involve the buying and selling of merchandise. A merchandising business first purchases merchandise to sell to its customers. When this merchandise is sold, the revenue is reported as sales, and its cost is recognized as an expense. This expense is called the cost of merchandise sold. The cost of merchandise sold is subtracted from sales to arrive at gross profit. This amount is called gross profit because it is the profit before deducting operating expenses.

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

It is appropriate time to make a few plans for the longer term and it is time to be happy. I’ve read this submit and if I may just I wish to recommend you few interesting things or suggestions. Perhaps you can write subsequent articles relating to this article. I want to learn even more issues about it!