All businesses use what is called the double-entry accounting system. This system is based on the accounting equation and requires:

- Every business transaction to be recorded in at least two accounts.

- The total debits recorded for each transaction to be equal to the total credits recorded.

The double-entry accounting system also has specific rules of debit and credit for recording transactions in the accounts.

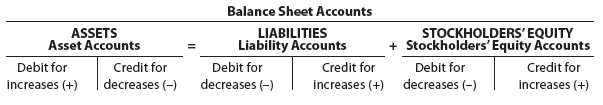

1. Balance Sheet Accounts

The debit and credit rules for balance sheet accounts are as follows:

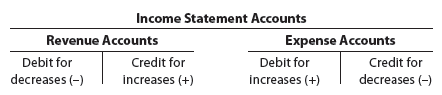

2. Income Statement Accounts

The debit and credit rules for income statement accounts are based on their relationship with stockholders’ equity. As shown on page 55, stockholders’ equity accounts are increased by credits. Since revenues increase stockholders’ equity (retained earnings), revenue accounts are increased by credits and decreased by debits. Since stockholders’ equity (retained earnings) accounts are decreased by debits, expense accounts are increased by debits and decreased by credits. Thus, the rules of debit and credit for revenue and expense accounts are as follows:

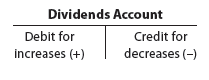

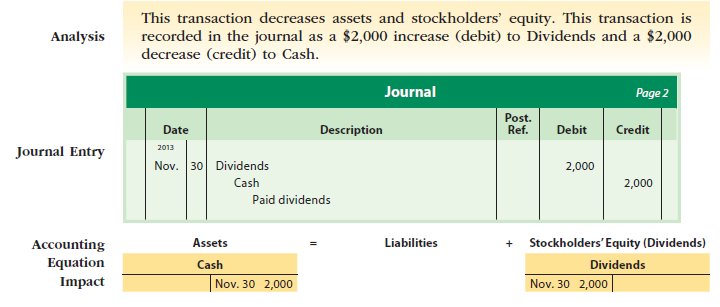

3. Dividends

The debit and credit rules for recording dividends are based on the effect of dividends on stockholders’ equity (retained earnings). Since dividends decrease stockholders’ equity (retained earnings), the dividends account is increased by debits. Likewise, the dividends account is decreased by credits. Thus, the rules of debit and credit for the dividends account are as follows:

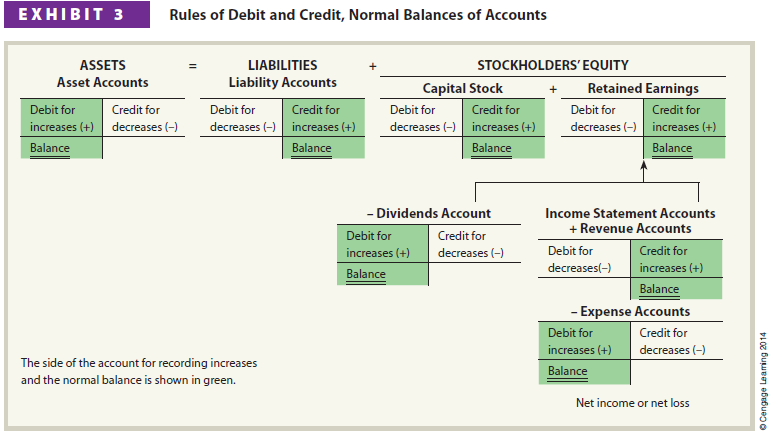

4. Normal Balances

The sum of the increases in an account is usually equal to or greater than the sum of the decreases in the account. Thus, the normal balance of an account is either a debit or credit depending on whether increases in the account are recorded as debits or credits. For example, since asset accounts are increased with debits, asset accounts normally have debit balances. Likewise, liability accounts normally have credit balances.

The rules of debit and credit and the normal balances of the various types of accounts are summarized in Exhibit 3. Debits and credits are sometimes abbreviated as Dr. for debit and Cr. for credit.

When an account normally having a debit balance has a credit balance, or vice versa, an error may have occurred or an unusual situation may exist. For example, a credit balance in the office equipment account could result only from an error. This is because a business cannot have more decreases than increases of office equipment. On the other hand, a debit balance in an accounts payable account could result from an overpayment.

5. Journalizing

Using the rules of debit and credit, transactions are initially entered in a record called a journal. In this way, the journal serves as a record of when transactions occurred and were recorded. To illustrate, the November transactions of NetSolutions from Chapter 1 are used.

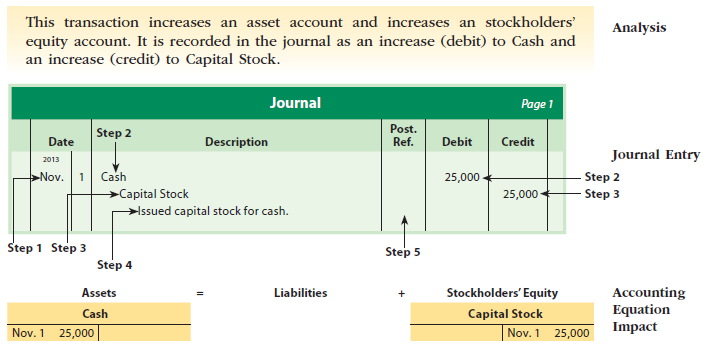

Transaction A Nov. 1 Chris Clark deposited $25,000 in a bank account in the name of NetSolutions in exchange for capital stock.

This transaction increases an asset account and increases an stockholders’ Analysis equity account. It is recorded in the journal as an increase (debit) to Cash and an increase (credit) to Capital Stock.

The transaction is recorded in the journal using the following steps:

Step 1. The date of the transaction is entered in the Date column.

Step 2. The title of the account to be debited is recorded in the left-hand margin under the Description column, and the amount to be debited is entered in the Debit column.

Step 3. The title of the account to be credited is listed below and to the right of the debited account title, and the amount to be credited is entered in the Credit column.

Step 4. A brief description may be entered below the credited account.

Step 5. The Post. Ref. (Posting Reference) column is left blank when the journal entry is initially recorded. This column is used later in this chapter when the journal entry amounts are transferred to the accounts in the ledger.

The process of recording a transaction in the journal is called journalizing. The entry in the journal is called a journal entry.

The following is a useful method for analyzing and journalizing transactions:

- Carefully read the description of the transaction to determine whether an asset, a liability, a stockholders’ equity, a revenue, an expense, or a dividends account is affected.

- For each account affected by the transaction, determine whether the account increases or decreases.

- Determine whether each increase or decrease should be recorded as a debit or a credit, following the rules of debit and credit shown in Exhibit 3.

- Record the transaction using a journal entry.

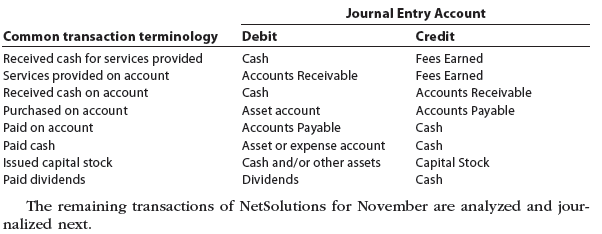

The following table summarizes terminology that is often used in describing a transaction along with the related accounts that would be debited and credited.

The remaining transactions of NetSolutions for November are analyzed and journalized next.

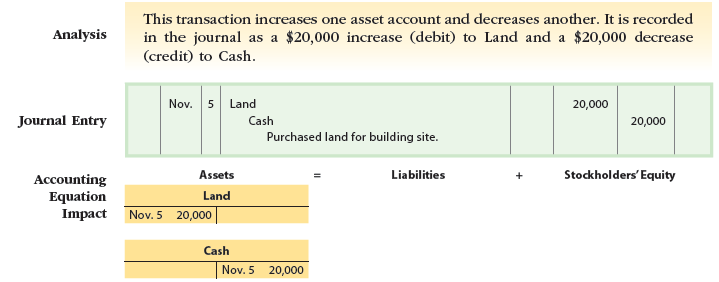

Transaction B Nov. 5 NetSolutions paid $20,000for the purchase of land as a future building site.

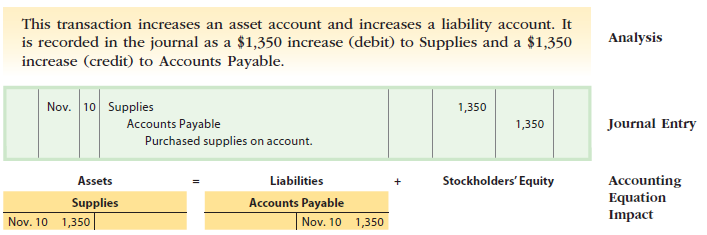

Transaction C Nov. 10 NetSolutions purchased supplies on account for $1,350.

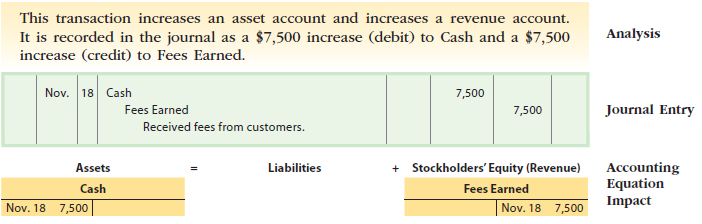

Transaction D Nov. 18 NetSolutions received cash of $7,500from customers for services provided.

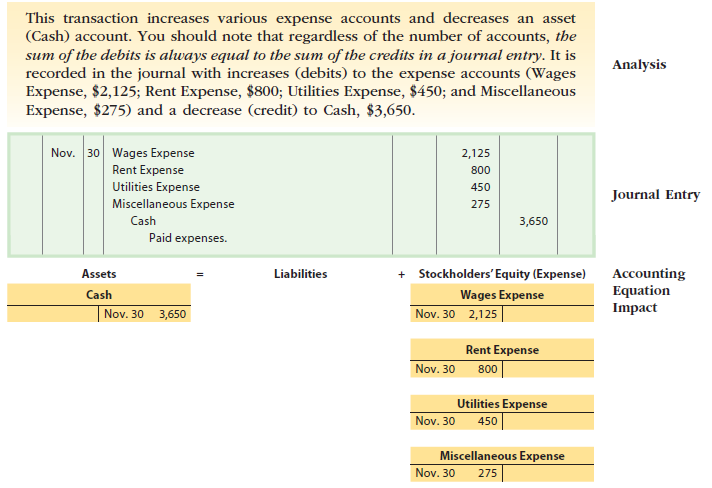

Transaction E Nov. 30 NetSolutions incurred the following expenses: wages, $2,125; rent, $800; utilities, $450; and miscellaneous, $275.

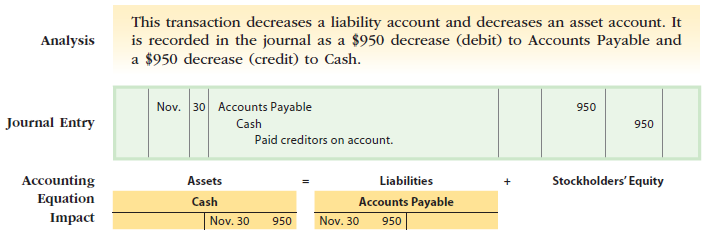

Transaction F Nov. 30 NetSolutions paid creditors on account, $950.

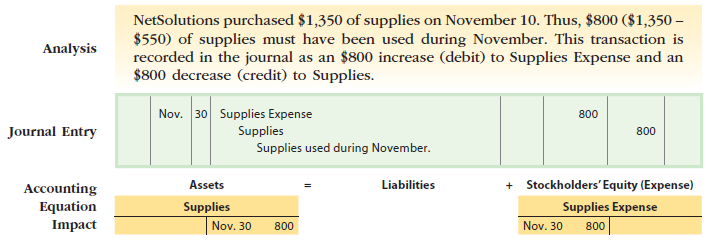

Transaction G Nov. 30 Chris Clark determined that the cost of supplies on hand at November 30 was $550.

Transaction H Nov. 30 NetSolutions paid $2,000 to stockholders (Chris Clark) as dividends.

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

It’s in point of fact a great and useful piece of information. I am satisfied that you simply shared this useful info with us. Please keep us up to date like this. Thanks for sharing.