A bank reconciliation is an analysis of the items and amounts that result in the cash balance reported in the bank statement to differ from the balance of the cash account in the ledger. The adjusted cash balance determined in the bank reconciliation is reported on the balance sheet.

A bank reconciliation is usually divided into two sections as follows:

- The bank section begins with the cash balance according to the bank statement and ends with the adjusted balance.

- The company section begins with the cash balance according to the company’s records and ends with the adjusted balance.

The adjusted balance from bank and company sections must be equal. The format of the bank reconciliation is shown below.

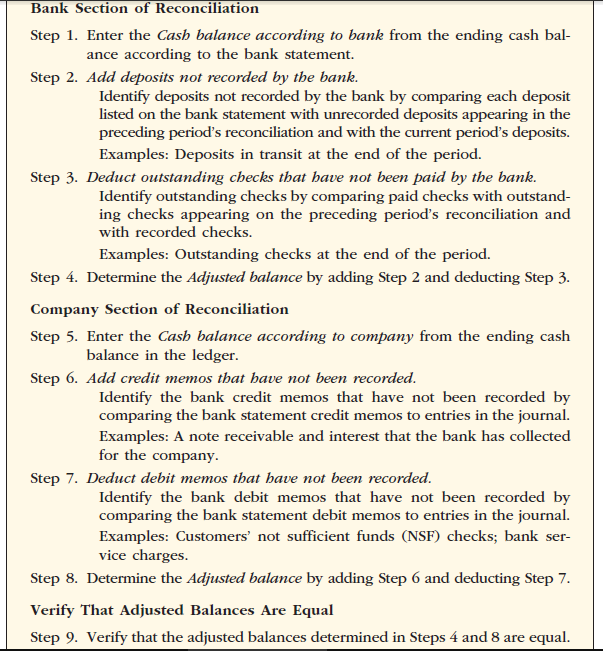

A bank reconciliation is prepared using the following steps:

The adjusted balances in the bank and company sections of the reconciliation must be equal. If the balances are not equal, an item has been overlooked and must be found.

Sometimes, the adjusted balances are not equal because either the company or the bank has made an error. In such cases, the error is often discovered by comparing the amount of each item (deposit and check) on the bank statement with that in the company’s records.

Any bank or company errors discovered should be added to or deducted from the bank or company section of the reconciliation, depending on the nature of the error. For example, assume that the bank incorrectly recorded a company check for $50 as $500. This bank error of $450 ($500 – $50) would be added to the bank balance in the bank section of the reconciliation. In addition, the bank would be notified of the error so that it could be corrected. On the other hand, assume that the company recorded a deposit of $1,200 as $2,100. This company error of $900 ($2,100 – $1,200) would be deducted from the cash balance in the company section of the bank reconciliation. The company would later correct the error using a journal entry.

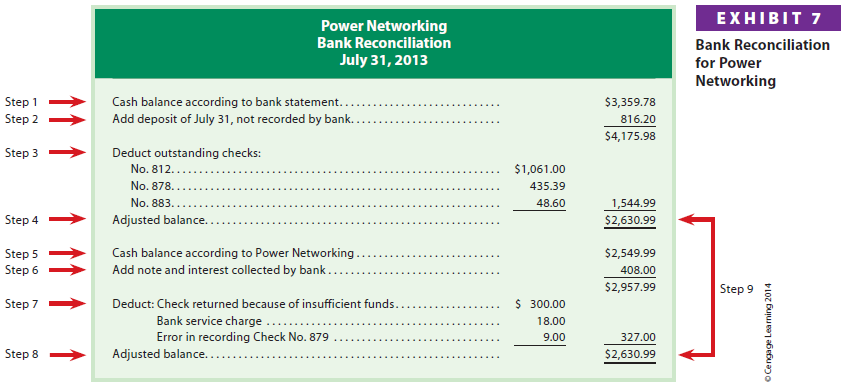

To illustrate, the bank statement for Power Networking in Exhibit 5 on page 329 is used. This bank statement shows a balance of $3,359.78 as of July 31. The cash balance in Power Networking’s ledger on the same date is $2,549.99. Using the preceding steps, the following reconciling items were identified:

Step 2. Deposit of July 31, not recorded on bank statement: $816.20

Step 3. Outstanding checks:

Step 6. Note receivable of $400 plus interest of $8 collected by bank not recorded in the journal as indicated by a credit memo of $408.

Step 7. Check from customer (Thomas Ivey) for $300 returned by bank because of insufficient funds (NSF) as indicated by a debit memo of $300.00. Bank service charges of $18, not recorded in the journal as indicated by a debit memo of $18.00.

In addition, an error of $9 was discovered. This error occurred when Check No. 879 for $732.26 to Taylor Co., on account, was recorded in the company’s journal as $723.26.

The bank reconciliation, based on the Exhibit 5 bank statement and the preceding reconciling items, is shown in Exhibit 7.

The company’s records do not need to be updated for any items in the bank section of the reconciliation. This section begins with the cash balance according to the bank statement. However, the bank should be notified of any errors that need to be corrected.

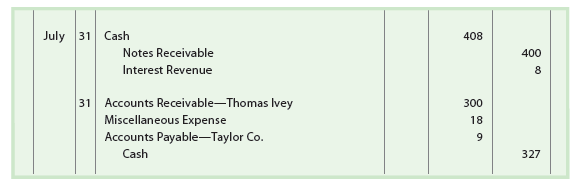

The company’s records do need to be updated for any items in the company section of the bank reconciliation. The company’s records are updated using journal entries. For example, journal entries should be made for any unrecorded bank memos and any company errors.

The journal entries for Power Networking, based on the bank reconciliation shown in Exhibit 7, are as follows:

After the preceding journal entries are recorded and posted, the cash account will have a debit balance of $2,630.99. This cash balance agrees with the adjusted balance shown on the bank reconciliation. This is the amount of cash on July 31 and is the amount that is reported on Power Networking’s July 31 balance sheet.

Businesses may reconcile their bank accounts in a slightly different format from that shown in Exhibit 7. Regardless, the objective is to control cash by reconciling the company’s records with the bank statement. In doing so, any errors or misuse of cash may be detected.

To enhance internal control, the bank reconciliation should be prepared by an employee who does not take part in or record cash transactions. Otherwise, mistakes may occur, and it is more likely that cash will be stolen or misapplied. For example, an employee who handles cash and also reconciles the bank statement could steal a cash deposit, omit the deposit from the accounts, and omit it from the reconciliation.

Bank reconciliations are also an important part of computerized systems where deposits and checks are stored in electronic files and records. Some systems use computer software to determine the difference between the bank statement and company cash balances. The software then adjusts for deposits in transit and outstanding checks. Any remaining differences are reported for further analysis.

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

I am sure this paragraph has touched all the internet viewers,

its really really fastidious paragraph on building up new weblog.

There’s certainly a lot to learn about this issue.

I love all the points you made.

It’s very simple to find out any topic on net as compared to

books, as I found this article at this site.

It’s hard to find well-informed people for this topic, however, you seem like you know what you’re talking

about! Thanks