Ocean shipping is the least expensive and the dominant mode of transportation in foreign trade. It is especially suitable for moving bulk freight such as commodities and other raw materials. Today, an increasing part of ocean freight travels by containers, which results in minimal handling at ports. In terms of value, containerized cargo accounts for the largest share of global trade (more than 50 percent), followed by tanker trade (25 percent) and general and dry cargo (20 percent). If a full-container-load cargo is to be shipped, a freight forwarder arranges for the container to be delivered to the shipper’s premises. Once the container is fully loaded, it is moved by truck to a port to be loaded onto a vessel. Less-than-container-load freight is usually delivered at the port for consolidation with other shipments (Tables 9.3 and 9.4).

Important Developments in International Maritime Trade

- Continued growth in world seaborne trade: International seaborne trade grew by 4 percent in 2011 due to strong growth in container and dry bulk trades. The total volume of goods loaded worldwide reached 8.7 billion tons (United Nations Conference on Trade and Development [UNCTAD], 2012).

- Growth in world shipping fleet: The world fleet continued to expand reaching more than 1.5 billion deadweight tons (dwt) in 2012, an increase of more than 37 percent in just four years. However, new orders for ships are much lower than previous years due to uncertainty in the global economy and continuing unrest in the Middle East. China, Japan, and South Korea built more than 93 percent of the tonnage delivered in 2011 (UNCTAD, 2012). Oversupply of ships poses a serious challenge for profitability of shipping companies while benefiting importers and exporters.

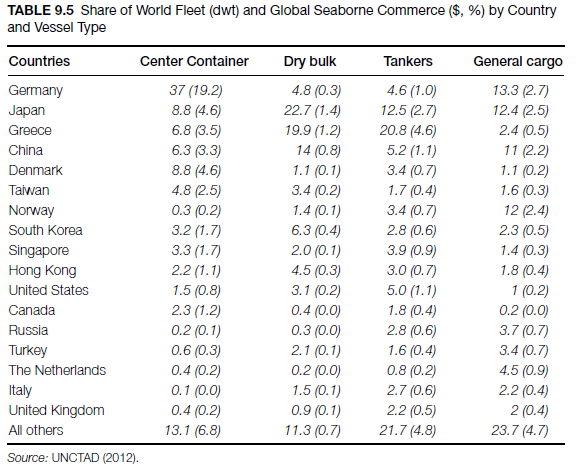

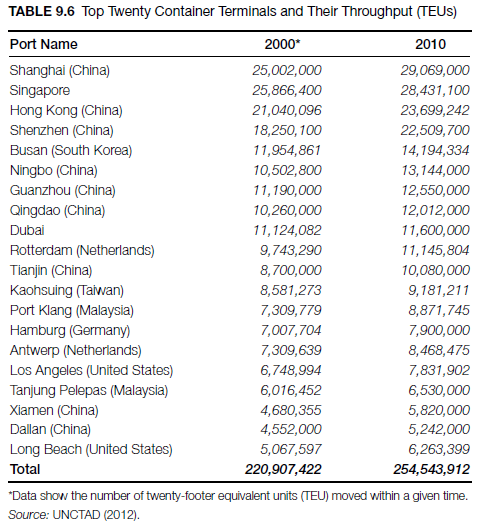

- Developing nations in the maritime sector: One third of the world fleet is owned by ship owners in developing nations, and twelve of the top twenty container operators are from developing nations. The top twenty container ports accounted for about 52 percent of world container throughput in 2011. The leading role of Asian countries shows the importance of the region as a center of international trade and the subsequent demand and growth for container ports (Tables 9.5 and 9.6)

- Freight rates and transportation costs: Freight rates declined during 2011 and 2012 mainly due to vessel oversupply. Such declines are prominent in three segments: dry bulk, liquid bulk, and containerized cargo. For many developing nations of Asia and the Americas, shipping costs (as a percentage of the value of goods imported) continue to drop. Rates for African countries have not declined due to port congestion, low productivity, and high charges.

- Environmental initiatives: A set of measures to increase energy efficiency and reduce greenhouse gas emissions from international shipping was adopted in 2011 and entered into force in 2013. Members include the USA, UK, Japan, Germany, and several developing nations.

1. Types of Ocean Carriers

The following are the three major types of ocean carriers. (See also International Perspective 9.2.)

Private fleets. These are large fleets of specialized ships owned and managed by merchants and manufacturers to carry their own goods. Apart from its cost advantages, ownership of a private fleet ensures the availability of carriage that meets the firm’s special needs. Such ships can occasionally be leased to other firms at times of limited activity. Some firms in certain industries, such as oil, sugar, or lumber, own their own fleets.

Tramps (chartered or leased vessels): Tramps are vessels usually leased to transport large quantities of bulk cargo (e.g., oil, coal, grain, sugar) that fill the entire ship (vessel). Chartered vessels do not operate on a regular route or schedule. Charter arrangement can be made on the basis of a trip or voyage between origin and destination or for an agreed time period, usually several months to a year. The vessel could be leased with or without a crew (bareboat charter). The major factors behind the continued existence of tramp shipping are that (1) it provides indispensable ocean transportation at the lowest possible cost, and (2) it is adaptable to changing and/or unanticipated requirements for transportation. When charter rates are low, commodity traders tend to move materials in advance of actual delivery time to take advantage of low transportation costs (Wood et al., 1995). The just-in-time system that delivers products when they are needed is not often feasible in cases in which transport and distribution could be impeded by severe winter weather. A commodity trader’s decision to purchase and export a product is influenced by the spread between the export and purchase price, the charter rate, and any warehousing or storage cost. This means that an exporter can purchase and export a product even before delivery time if the charter rate and storage cost are substantially less than the spread and allow for a reasonable profit margin.

Conference lines: A shipping conference line is a voluntary association of ocean carriers operating on a particular trade route between two or more countries. Shipping conferences date back to the nineteenth century when such associations were established for trade between England and its colonies. One of the distinguishing features of a liner service is that sailings are regular and repeated from and to designated ports on a trade route at intervals established in response to the quantity of cargo generated along that route. Even though the sailing schedule is related to the amount of business available, it is general practice to dispatch at least one ship each month (Kendall, 1983). The purpose of a shipping conference is the self-regulation of price competition, primarily through the establishment of uniform freight rates and terms and conditions of service among the member shipping lines. In spite of their cartel-like structure, these conferences are considered a necessary evil to ensure the stability and growth of international trade by setting rate levels that are stable and predictable and by reducing predatory price competition.

Unless rejected, conference agreements become effective between carriers on the forty- fifth day after filing with the Federal Maritime Commission (FMC) or on the thirtieth day after publication of notice of filing in the Federal Register, whichever day is later.

Conferences serving U.S. ports must be “open,’’ that is, they must admit any common carrier willing to serve the particular trade or route under reasonable and equal terms and conditions. This is generally intended to preclude conferences from using membership limitations as a means of discriminating against other U.S. carriers. Conferences are also allowed to form an exclusive patronage contract with a shipper, allowing the latter to obtain lower rates by committing all or a fixed portion of its cargo to conference members. Vessels engaged in liner service may be owned or leased. Conferences compete with independent lines, chartered vessels, and each other, although the same carrier could belong to several conferences.

Example: An exporter in Taiwan intends to arrange for shipment of its textiles by a conference carrier to New York. A case for a lower (tariff) rate for large shipments can be made to a conference rate-making committee that consists of member lines. If the conference elects to reject the application for a lower rate, several options are available to the exporter: (1) the exporter may request a member of the conference to establish the rate independent of the conference; (2) the product could be shipped through nonconference carriers (independent or other conference lines) that offer a reasonably low tariff; (3) the product could be shipped through other ports using other conference carriers; or (4) the shipper could consider nonvessel-operating common carriers (NVOCC) or tramp vessels, depending on the amount of cargo. NVOCCs take possession of smaller shipments from several shippers and consolidate them into full-container loads for shipment by an ocean carrier. NVOCCs charge their own tariff rates and obtain a bill of lading as the shipper of the consolidated merchandise.

2. Carriage of Goods by Sea

International transportation of cargo by sea is governed by various conventions. The Hague Rules of 1924 have won a certain measure of global support. The U.S. law on the carriage of goods by sea is based on the Hague Rules. Subsequent modifications have been made to the Hague Rules (the Hague-Visby Rules, 1968), which are now in force in most of Western Europe, Japan, Singapore, Australia, and Canada. In 1978, the United Nations Commission on International Trade Law (UNCITRAL) was given the task of drafting a new conventionn to balance the interests of carriers and shippers. Although the Hague-Visby Rules were intended to rectify the pro-carrier inclination of the Hague Rules, many developing countries felt that the Hague-Visby rules did not go far enough in addressing the legitimate concerns of cargo owners or shippers. The commission’s deliberations led to an agreement in 1978 (the Hamburg Rules), which came into effect in 1991 and has limited impact due a small number of ratifications (20 countries by 2013). Unlike the Hague and Hague-Visby Rules, which have been ratified by many developed and developing nations, the Hamburg Rules are mostly followed by developing nations, except Austria (Flint and O’Keefe, 1997). In view of the widespread acceptance of the Hague Rules, it is important to briefly examine some of their central features (see International Perspective 9.3).

Scope of application: The application of the rules depends on the place of issuance of the bill of lading; that is, the rules apply to all bills of lading issued in any of the contracting states. If the parties agree to incorporate any one of the previous rules in their contract, these rules will govern the contract of carriage even when the countries where the parties reside subscribe to different rules. However, this will not be allowed if the parties are required to apply certain rules adopted by their countries. These rules apply only to bill of lading (B/L).

Carrier’s duties Under B/L: A carrier transporting goods under a B/L is required to exercise “due diligence’’ in (1) making the ship seaworthy; (2) properly manning, equipping, and supplying the ship; (3) making the ship (e.g., holds, refrigerating chambers) fit and safe for reception, carriage, and preservation of the goods; and (4) properly and carefully loading, handling, stowing, carrying, and discharging the goods. Whenever loss or damage occurs due to unseaworthiness, the burden of proving the exercise of due diligence falls on the carrier. When different modes of transportation are used, the issuer of the bill of lading undertakes to deliver the cargo to the final destination. In the event of loss or damage to merchandise, liability is determined according to the law relative to the mode of transportation at fault for the loss. If the means of loss is not determinable, it will be assumed to have occurred during the sea voyage (Schaffer et al., 2012).

Carrier’s liability and exemptions: The carrier’s liability applies to loss of or damage to the goods. It does not extend to delays in the delivery of the merchandise. The rules exempt carriers from liability that arises from actions of the servants of the carrier (e.g., master, pilot) in the management of the shipment, fire and accidents, acts of God, acts of war, civil war, insufficient packing, inherent defects in the goods, and other causes that are not the actual fault of the carrier. That loss or damage to the goods falls within one of these exemptions does not automatically absolve the carrier of liability if the damage or loss could have been prevented by the carrier’s exercise of due diligence in carrying out its duties (Carr, 2010; Yancey, 1983).

Period of responsibility: The period of responsibility begins at the time the goods are loaded and extends to the time they are discharged from the ship.

Limitations of action: All claims against the carrier must be brought within one year after the actual or supposed date of delivery of the goods. This means that lapse of time discharges the carrier and the ship from all liability in respect to loss or damage. The Hague Rules also stipulate that notice of claim must be made in writing before or at the time of removal of the goods.

Limits of liability: The maximum limitation of liability is $500 per package. Under the Hague-Visby rules, it is $1,000 per package. In most cases, a container is considered one package, and the carrier’s liability is limited to $500. To ensure the application of liability limits to their agents and employees, carriers add the “Himalaya Clause” to their bills of lading. This clause brings such agents and employees under the protection of the Hague Rules. Exporters can, however, obtain full protection against loss or damage by paying an excess value charge or by taking out an insurance policy from an independent source (Force, 1996; Schaffer et al., 2012).

Proposed Rotterdam Rules

In 2008, a new treaty was adopted (Rotterdam Rules) that replaces the Hague Rules and that is currently awaiting ratification. As of 2013, it had been signed by more than twenty countries, including France, Sweden, Switzerland, and the United States but ratified only by Spain and Togo. Twenty countries have to ratify the treaty before it can enter into force. The Rotterdam Rules build upon the previous conventions and establish a modern and uniform legal regime governing the rights and obligations of shippers, carriers, and consignees under a contract for door-to-door carriage that includes an international maritime transportation. The rules provide a legal framework that takes into account commercial and technological developments such as containerization and electronic transport documents as well as door-to-door carriage under a single contract and carriage that involves multiple modes of transport.

3. Container Security

As part of its efforts to target high-risk cargo containers for inspection, U.S. Customs and Border Protection (CBP) uses various sources of information to screen containers in advance of their arrival in the United States (Figure 9.1).

- CBP’s twenty-four-hour rule: CBP’s twenty-four-hour rule requires that vessel carriers submit cargo manifest information to CBP twenty-four hours before U.S.-bound cargo is loaded onto a vessel.

- Automated Targeting System (ATS): The ATS is a mathematical model that uses weighted rules to assign a risk score to arriving cargo shipments on the basis of shipping information. CBP uses the Automated Targeting System as a decision support tool in targeting cargo containers for inspection.

- The 10+2 rule: The cargo information required by the 10+2 rule comprises ten data elements from importers, such as country of origin, and two data elements from vessel carriers, such as the position of each container transported on a vessel. All of this information must be provided to CBP in advance of the ship’s arrival at a U.S. port.

- Cargo Security Initiative (CSI): CBP temporarily assigns inspectors at foreign ports to inspect containers bound for the United States. In 2007, CBP reached its goal of operating CSI in fifty-eight foreign seaports, and, as of October 2011, these ports collectively accounted for more than 80 percent of the cargo containers shipped to the United States.

- Customs-Trade Partnership Against Terrorism (C-TPAT): The C-TPAT program is a government-to-business partnership program that provides benefits to supply-chain companies that comply with predetermined security measures. Under C-TPAT, CBP officials work with private companies to review their supply-chain security plans and improve members’ security measures. In return, C-TPAT members may receive benefits, such as reduced scrutiny or expedited processing of their shipments.

- International collaboration: CBP also partners with international trade and security groups to develop supply-chain security standards that can be implemented by the

international community. In 2005, the World Customs Organization (WCO) developed the Framework of Standards to Secure and Facilitate Global Trade for which the core concepts are based on components of CBP’s CSI and C-TPAT programs.

Freight Calculation

Ocean freight:

Volume: Multiply cargo measurements in centimeters, divide by 35.32 = cubic meters or

Multiply cargo measurements in inches, divide by 1,728, divide by 35.32 = cubic meters

Weight: Divide the cargo weight, in pounds, by 2.2046 = kilos

Sample shipment:

Medical equipment with dimensions of 45 x 45 x 60 inches/Weight: 1,500 lb. Actual weight: 1,500 lbs. / 2.2046 = 680 kilos

Volume: 45 x 45 x 60 = 121,500 cu. in. / 1728 = 70.3 cu. ft. / 35.32 = 1.99 cbm.

1,000 kilos is equivalent to one cubic meter

Freight charges would be assessed on the volume (measurement).

Source: Seyoum Belay (2014), Export-import theory, practices, and procedures, Routledge; 3rd edition.

Great post, you have pointed out some fantastic points, I also conceive this s a very superb website.