An investment in research and development (R&D) is really an investment in real options. When your research engineers invent a better mousetrap, they hand you an option to manufacture and sell it. New and improved mousetraps can be engineering triumphs but commercial failures. You will make the investment to manufacture and launch the better mousetrap only if the PV of expected cash inflows is greater than the required investment.

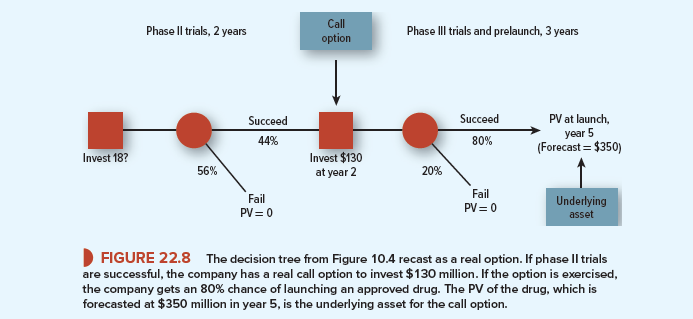

The pharmaceutical industry spends massive amounts for R&D to develop options to produce and sell new drugs. We described pharmaceutical R&D in Example 10.2 and in Figure 10.4, which is a simplified decision tree. After you have reviewed that example and figure, take a look at Figure 22.8, which recasts the decision tree as a real option.

The drug candidate in Figure 22.8 requires an immediate investment of $18 million. That investment buys a real option to invest $130 million at year 2 to pay for phase III trials and costs incurred during the prelaunch period. Of course the real option exists only if phase II trials are successful. There is a 56% probability of failure. So after we value the real option, we will have to multiply its value by the 44% probability of success.

The exercise price of the real option is $130 million. The underlying asset is the PV of the drug, assuming that it passes phase III successfully. Figure 10.4 forecasts the expected PV of the drug at launch at $350 million in year 5. We multiply this value by .8 because the decision whether to exercise the option must be taken in year 2, before the company knows whether the drug will succeed or fail in phase III and prelaunch. Then we must discount this value back to year 0, because the Black-Scholes formula calls for the value of the underlying asset on the date when the option is valued. The cost of capital is 9.6%, so the PV today is

PV at year 0, assuming success in phase II = .8 X 350/(1.096)5 = 177, or $177 million

To value the real option, we need a risk-free rate (assume 4%) and a volatility of the value of the drug once launched (assume 20%). With these inputs, the Black-Scholes value of a two-year call on an asset worth $177 million with an exercise price of $130 million is $58.4 million. (Refer to Section 21.3 if you need a refresher on how to use the Black- Scholes formula.)

But there’s only a 44% chance that the drug will pass phase II trials. So the company must compare an initial investment of $18 million with a 44% chance of receiving an option worth $58.4 million. The NPV of the drug at year 0 is

NPV = -18 + (.44 x 58.4) = $7.7 million

This NPV is less than the $19 million NPV computed from Figure 10.4.[1] Nevertheless, the R&D project is still a “go.”

Of course Figure 22.8 assumes only one decision point, and only one real option, between the start of phase II and the product launch. In practice, there would be other decision points, including a Go/No Go decision after phase III trials but before prelaunch investment. In this case, the payoff to the first option at the end of phase II is the value at that date of the second option. This is an example of a compound call.

With two sequential options, you could look up the formula for a compound call in an option pricing manual, or you could build a binomial tree for the R&D project. Suppose you take the binomial route. Once you set up the tree, using risk-neutral probabilities for changes in the value of the underlying asset, you solve the tree as you would solve any decision tree. You work back from the end of the tree, always choosing the decision that gives the highest value at each decision point. NPV is positive if the PV at the start of the tree is higher than the $18 million initial investment.

Despite its simplifying assumptions, our example explains why investors demand higher expected returns from R&D investments than from the products that the R&D may generate. R&D invests in real call options. A call option is always riskier (higher beta) than the underlying asset that is acquired when the option is exercised. Thus, the opportunity cost of capital for R&D is higher than for a new product after the product is launched successfully.

R&D is also risky because it may fail. But the risk of failure is not usually a market or macroeconomic risk. The drug’s beta or cost of capital does not depend on the probabilities that a drug will fail in phase II or III. If the drug fails, it will be because of medical or clinical problems, not because the stock market is down. We take account of medical or clinical risks by multiplying future outcomes by the probability of success, not by adding a fudge factor to the discount rate.

I like this weblog very much, Its a rattling nice office to read and incur info .

you are really a good webmaster. The site loading speed is amazing. It seems that you are doing any unique trick. In addition, The contents are masterwork. you’ve done a great job on this topic!