So far, we have focused on the management of exchange rate risk, but managers also worry about political risk. By this they mean the threat that a government will change the rules of the game—that is, break a promise or understanding—after the investment is made. Of course political risks are not confined to overseas investments. Businesses in every country are exposed to the risk of unanticipated actions by governments or the courts. But in some parts of the world foreign companies are particularly vulnerable.

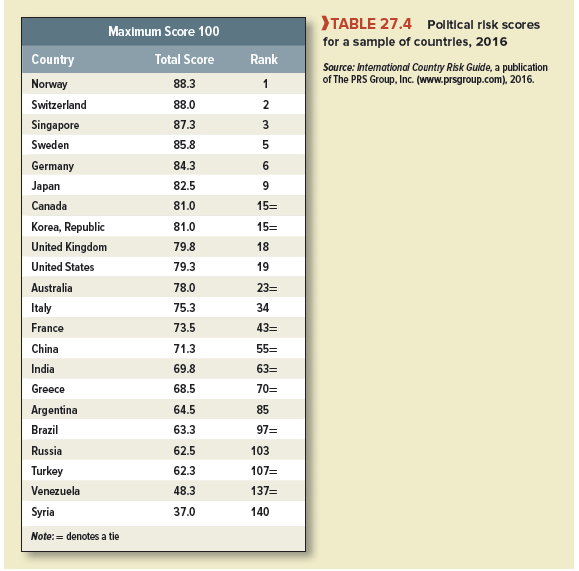

A number of consultancy services offer analyses of political and economic risks and draw up country rankings.[1] For example, Table 27.4 is an extract from the 2016 political risk rankings provided by the PRS Group. Each country is scored on 15 separate dimensions. You can see that Norway comes top of the class overall, while Syria languishes at the bottom.

Some managers dismiss political risk as an act of God, like a hurricane or earthquake. But the most successful multinational companies structure their business to reduce political risk. Foreign governments are not likely to expropriate a local business if it cannot operate without the support of its parent. For example, the foreign subsidiaries of American computer manufacturers or pharmaceutical companies would have relatively little value if they were cut off from the know-how of their parents. Such operations are much less likely to be expropriated than, say, a mining operation that can be operated as a stand-alone venture.

We are not recommending that you turn your silver mine into a pharmaceutical company, but you may be able to plan your overseas manufacturing operations to improve your bargaining position with foreign governments. For example, Ford has integrated its overseas operations so that the manufacture of components, subassemblies, and complete automobiles is spread across plants in a number of countries. None of these plants would have much value on its own, and Ford can switch production between plants if the political climate in one country deteriorates.

Multinational corporations have also devised financing arrangements to help keep foreign governments honest. For example, suppose your firm is contemplating an investment of $500 million to reopen the San Tome silver mine in Costaguana with modern machinery, smelting equipment, and shipping facilities.24 The Costaguanan government agrees to invest in roads and other infrastructure and to take 20% of the silver produced by the mine in lieu of taxes. The agreement is to run for 25 years.

The project’s NPV on these assumptions is quite attractive. But what happens if a new government comes into power five years from now and imposes a 50% tax on “any precious metals exported from the Republic of Costaguana”? Or changes the government’s share of output from 20% to 50%? Or simply takes over the mine “with fair compensation to be determined in due course by the Minister of Natural Resources of the Republic of Costaguana”?

No contract can absolutely restrain sovereign power. But you can arrange project financing to make these acts as painful as possible for the foreign government. For example, you might set up the mine as a subsidiary corporation, which then borrows a large fraction of the required investment from a consortium of major international banks. If your firm guarantees the loan, make sure the guarantee stands only if the Costaguanan government honors its contract. The government will be reluctant to break the contract if that causes a default on the loans and undercuts the country’s credit standing with the international banking system.

If possible, you should arrange for the World Bank (or one of its affiliates) to finance part of the project or to guarantee your loans against political risk.[2] Few governments have the guts to take on the World Bank. Here is another variation on the same theme. Arrange to borrow, say, $450 million through the Costaguanan Development Agency. In other words, the development agency borrows in international capital markets and relends to the San Tome mine. Your firm agrees to stand behind the loan as long as the government keeps its promises. If it does keep them, the loan is your liability. If not, the loan is its liability.

Political risk is not confined to the risk of expropriation. Multinational companies are always exposed to the criticism that they siphon funds out of countries in which they do business, and, therefore, governments are tempted to limit their freedom to repatriate profits. This is most likely to happen when there is considerable uncertainty about the rate of exchange, which is usually when you would most like to get your money out. Here, again, a little forethought can help. For example, there are often more onerous restrictions on the payment of dividends to the parent than on the payment of interest or principal on debt. Royalty payments and management fees are less sensitive than dividends, particularly if they are levied equally on all foreign operations.

Calculating NPVs for investment projects becomes exceptionally difficult when political risks are significant. You have to estimate cash flows and project life with extra caution. You may want to take a peek at the discounted payback period (see Chapter 5), on the theory that quick-payback projects are less exposed to political risks. But do not try to compensate for political risks by adding casual fudge factors to discount rates. Fudge factors spawn bias and confusion, as we explained in Chapter 9.

Wow, that’s what I was searching for, what a stuff!

existing here at this weblog, thanks admin of this site.

When someone writes an article he/she maintains the plan of a user in his/her mind that how a user can understand it.

Therefore that’s why this article is amazing. Thanks!

If you would like to get a good deal from this piece of writing then you have to apply

such methods to your won webpage.