Most large businesses are organized as corporations. As a result, corporations generate more than 90% of the total business dollars in the United States. In contrast, most small businesses are organized as proprietorships, partnerships, or limited liability companies.

1. Characteristics of a Corporation

A corporation is a legal entity, distinct and separate from the individuals who create and operate it. As a legal entity, a corporation may acquire, own, and dispose of property in its own name. It may also incur liabilities and enter into contracts. Most importantly, it can sell shares of ownership, called stock. This characteristic gives corporations the ability to raise large amounts of capital.

The stockholders or shareholders who own the stock own the corporation. They can buy and sell stock without affecting the corporation’s operations or continued existence. Corporations whose shares of stock are traded in public markets are called public corporations. Corporations whose shares are not traded publicly are usually owned by a small group of investors and are called nonpublic or private corporations.

The stockholders of a corporation have limited liability. This means that creditors usually may not go beyond the assets of the corporation to satisfy their claims. Thus, the financial loss that a stockholder may suffer is limited to the amount invested.

The stockholders control a corporation by electing a board of directors. This board meets periodically to establish corporate policies. It also selects the chief executive officer (CEO) and other major officers to manage the corporation’s day-to-day affairs. Exhibit 1 shows the organizational structure of a corporation.

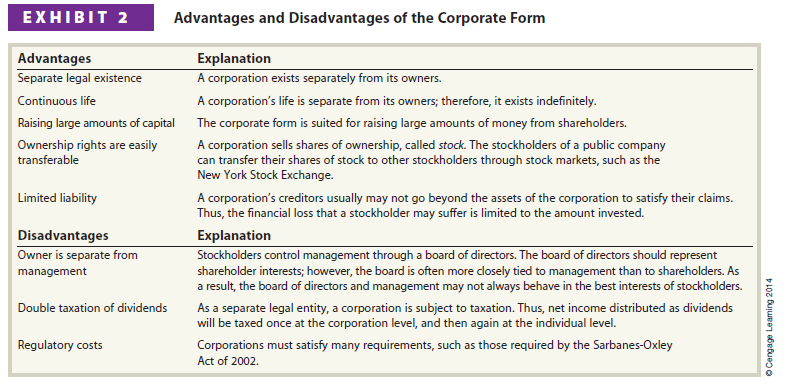

As a separate entity, a corporation is subject to taxes. For example, corporations must pay federal income taxes on their income. Thus, corporate income that is distributed to stockholders in the form of dividends has already been taxed. In turn, stockholders must pay income taxes on the dividends they receive. This double taxation of corporate earnings is a major disadvantage of the corporate form. The advantages and disadvantages of the corporate form are listed in Exhibit 2.

Forming a Corporation

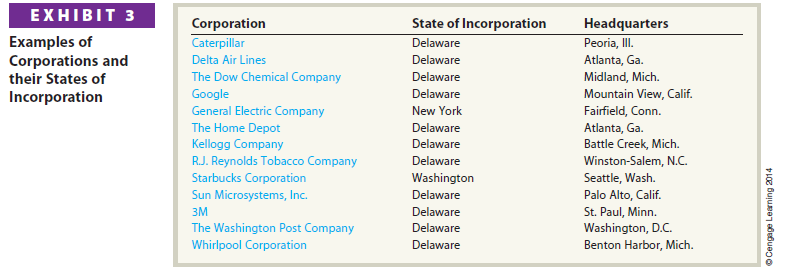

The first step in forming a corporation is to file an application of incorporation with the state. State incorporation laws differ, and corporations often organize in those states with the more favorable laws. For this reason, more than half of the largest companies are incorporated in Delaware. Exhibit 3 lists some corporations, their states of incorporation, and the location of their headquarters.

After the application of incorporation has been approved, the state grants a charter or articles of incorporation. The articles of incorporation formally create the corporation.

The corporate management and board of directors then prepare a set of bylaws, which are the rules and procedures for conducting the corporation’s affairs.

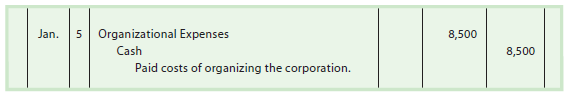

Costs may be incurred in organizing a corporation. These costs include legal fees, taxes, state incorporation fees, license fees, and promotional costs. Such costs are debited to an expense account entitled Organizational Expenses.

To illustrate, a corporation’s organizing costs of $8,500 on January 5 are recorded as shown below.

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

The crux of your writing while sounding reasonable initially, did not really sit properly with me after some time. Someplace throughout the paragraphs you actually managed to make me a believer unfortunately only for a short while. I however have got a problem with your jumps in logic and you might do well to help fill in all those breaks. When you actually can accomplish that, I will surely end up being amazed.

Valuable information. Lucky me I found your site by accident, and I’m shocked why this accident didn’t happened earlier! I bookmarked it.