Cash includes coins, currency (paper money), checks, and money orders. Money on deposit with a bank or other financial institution that is available for withdrawal is also considered cash. Normally, you can think of cash as anything that a bank would accept for deposit in your account. For example, a check made payable to you could normally be deposited in a bank and, thus, is considered cash.

Businesses usually have several bank accounts. For example, a business might have one bank account for general cash payments and another for payroll. A separate ledger account is normally used for each bank account. For example, a bank account at City Bank could be identified in the ledger as Cash in Bank—City Bank. To simplify, this chapter assumes that a company has only one bank account, which is identified in the ledger as Cash.

Cash is the asset most likely to be stolen or used improperly in a business. For this reason, businesses must carefully control cash and cash transactions.

1. Control of Cash Receipts

To protect cash from theft and misuse, a business must control cash from the time it is received until it is deposited in a bank. Businesses normally receive cash from two main sources.

- Customers purchasing products or services

- Customers making payments on account

Cash Received from Cash Sales An important control to protect cash received in over- the-counter sales is a cash register. The use of a cash register to control cash is shown below.

A cash register controls cash as follows:

- At the beginning of every work shift, each cash register clerk is given a cash drawer containing a predetermined amount of cash. This amount is used for making change for customers and is sometimes called a change fund.

- When a salesperson enters the amount of a sale, the cash register displays the amount to the customer. This allows the customer to verify that the clerk has charged the correct amount. The customer also receives a cash receipt.

- At the end of the shift, the clerk and the supervisor count the cash in the clerk’s cash drawer. The amount of cash in each drawer should equal the beginning amount of cash plus the cash sales for the day.

- The supervisor takes the cash to the Cashier’s Department where it is placed in a safe.

- The supervisor forwards the clerk’s cash register receipts to the Accounting Department.

- The cashier prepares a bank deposit ticket.

- The cashier deposits the cash in the bank, or the cash is picked up by an armored car service, such as Wells Fargo.

- The Accounting Department summarizes the cash receipts and records the day’s cash sales.

- When cash is deposited in the bank, the bank normally stamps a duplicate copy of the deposit ticket with the amount received. This bank receipt is returned to the Accounting Department, where it is compared to the total amount that should have been deposited. This control helps ensure that all the cash is deposited and that no cash is lost or stolen on the way to the bank. Any shortages are thus promptly detected.

Salespersons may make errors in making change for customers or in ringing up cash sales. As a result, the amount of cash on hand may differ from the amount of cash sales. Such differences are recorded in a cash short and over account.

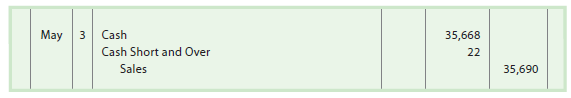

To illustrate, assume the following cash register data for May 3:

Cash register total for cash sales $35,690

Cash receipts from cash sales 35,668

The cash sales, receipts, and shortage of $22 ($35,690 – $35,668) would be recorded as follows:

If there had been cash over, Cash Short and Over would have been credited for the overage. At the end of the accounting period, a debit balance in Cash Short and Over is included in miscellaneous expense on the income statement. A credit balance is included in the Other Income section. If a salesperson consistently has large cash short and over amounts, the supervisor may require the clerk to take additional training.

Cash Received in the Mail Cash is received in the mail when customers pay their bills. This cash is usually in the form of checks and money orders. Most companies design their invoices so that customers return a portion of the invoice, called a remittance advice, with their payment. Remittance advices may be used to control cash received in the mail as follows:

- An employee opens the incoming mail and compares the amount of cash received with the amount shown on the remittance advice. If a customer does not return a remittance advice, the employee prepares one. The remittance advice serves as a record of the cash initially received. It also helps ensure that the posting to the customer’s account is for the amount of cash received.

- The employee opening the mail stamps checks and money orders “For Deposit Only” in the bank account of the business.

- The remittance advices and their summary totals are delivered to the Accounting Department.

- All cash and money orders are delivered to the Cashier’s Department.

- The cashier prepares a bank deposit ticket.

- The cashier deposits the cash in the bank, or the cash is picked up by an armored car service, such as Wells Fargo.

- An accounting clerk records the cash received and posts the amounts to the customer accounts.

- When cash is deposited in the bank, the bank normally stamps a duplicate copy of the deposit ticket with the amount received. This bank receipt is returned to the Accounting Department, where it is compared to the total amount that should have been deposited. This control helps ensure that all cash is deposited and that no cash is lost or stolen on the way to the bank. Any shortages are thus promptly detected.

Separating the duties of the Cashier’s Department, which handles cash, and the Accounting Department, which records cash, is a control. If Accounting Department employees both handle and record cash, an employee could steal cash and change the accounting records to hide the theft.

Cash Received by EFT Cash may also be received from customers through electronic funds transfer (EFT). For example, customers may authorize automatic electronic transfers from their checking accounts to pay monthly bills for such items as cell phone, Internet, and electric services. In such cases, the company sends the customer’s bank a signed form from the customer authorizing the monthly electronic transfers. Each month, the company notifies the customer’s bank of the amount of the transfer and the date the transfer should take place. On the due date, the company records the electronic transfer as a receipt of cash to its bank account and posts the amount paid to the customer’s account. Companies encourage customers to use EFT for the following reasons:

- EFTs cost less than receiving cash payments through the mail.

- EFTs enhance internal controls over cash, since the cash is received directly by the bank without any employees handling cash.

- EFTs reduce late payments from customers and speed up the processing of cash receipts.

2. Control of Cash Payments

The control of cash payments should provide reasonable assurance that:

- Payments are made for only authorized transactions.

- Cash is used effectively and efficiently. For example, controls should ensure that all available purchase discounts are taken.

In a small business, an owner/manager may authorize payments based on personal knowledge. In a large business, however, purchasing goods, inspecting the goods received, and verifying the invoices are usually performed by different employees. These duties must be coordinated to ensure that proper payments are made to creditors. One system used for this purpose is the voucher system.

Voucher System A voucher system is a set of procedures for authorizing and recording liabilities and cash payments. A voucher is any document that serves as proof of authority to pay cash or issue an electronic funds transfer. An invoice that has been approved for payment could be considered a voucher. In many businesses, however, a voucher is a special form used to record data about a liability and the details of its payment.

In a manual system, a voucher is normally prepared after all necessary supporting documents have been received. For the purchase of goods, a voucher is supported by the supplier’s invoice, a purchase order, and a receiving report. After a voucher is prepared, it is submitted for approval. Once approved, the voucher is recorded in the accounts and filed by due date. Upon payment, the voucher is recorded in the same manner as the payment of an account payable.

In a computerized system, data from the supporting documents (such as purchase orders, receiving reports, and suppliers’ invoices) are entered directly into computer files. At the due date, the checks are automatically generated and mailed to creditors. At that time, the voucher is electronically transferred to a paid voucher file.

Cash Paid by EFT Cash can also be paid by electronic funds transfer (EFT) systems. For example, you can withdraw cash from your bank account using an ATM machine. Your withdrawal is a type of EFT transfer.

Companies also use EFT transfers. For example, many companies pay their employees via EFT. Under such a system, employees authorize the deposit of their payroll checks directly into their checking accounts. Each pay period, the company transfers the employees’ net pay to their checking accounts through the use of EFT. Many companies also use EFT systems to pay their suppliers and other vendors.

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

1 Jul 2021

1 Jul 2021

1 Jul 2021

1 Jul 2021

1 Jul 2021

1 Jul 2021