A major reason that companies use bank accounts is for internal control. Some of the control advantages of using bank accounts are as follows:

- Bank accounts reduce the amount of cash on hand.

- Bank accounts provide an independent recording of cash transactions. Reconciling the balance of the cash account in the company’s records with the cash balance according to the bank is an important control.

- Use of bank accounts facilitates the transfer of funds using EFT systems.

1. Bank Statement

Banks usually maintain a record of all checking account transactions. A summary of all transactions, called a bank statement, is mailed, usually each month, to the company (depositor) or made available online. The bank statement shows the beginning balance, additions, deductions, and the ending balance. A typical bank statement is shown in Exhibit 5.

Checks or copies of the checks listed in the order that they were paid by the bank may accompany the bank statement. If paid checks are returned, they are stamped “Paid,” together with the date of payment. Many banks no longer return checks or check copies. Instead, the check payment information is available online.

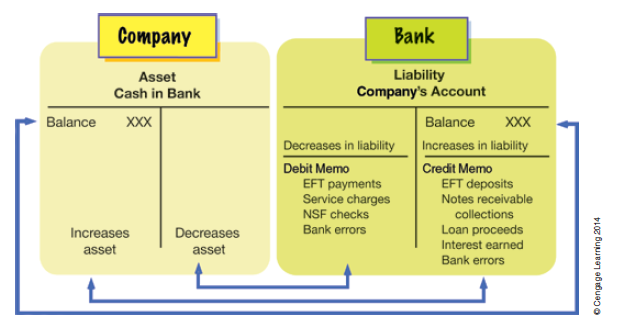

The company’s checking account balance in the bank records is a liability. Thus, in the bank’s records, the company’s account has a credit balance. Since the bank statement is prepared from the bank’s point of view, a credit memo entry on the bank statement indicates an increase (a credit) to the company’s account. Likewise, a debit memo entry on the bank statement indicates a decrease (a debit) in the company’s account. This relationship is shown below.

A bank makes credit entries (issues credit memos) for the following:

- Deposits made by electronic funds transfer (EFT)

- Collections of notes receivable for the company

- Proceeds for a loan made to the company by the bank

- Interest earned on the company’s account

- Correction (if any) of bank errors

A bank makes debit entries (issues debit memos) for the following:

- Payments made by electronic funds transfer (EFT)

- Service charges

- Customer checks returned for not sufficient funds

- Correction (if any) of bank errors

Customers’ checks returned for not sufficient funds, called NSF checks, are customer checks that were initially deposited, but were not paid by the customer’s bank. Since the company’s bank credited the customer’s check to the company’s account when it was deposited, the bank debits the company’s account (issues a debit memo) when the check is returned without payment.

The reason for a credit or debit memo entry is indicated on the bank statement. Exhibit 5 identifies the following types of credit and debit memo entries:

EC: Error correction to correct bank error

NSF: Not sufficient funds check

SC: Service charge

ACH: Automated clearing house entry for electronic funds transfer

MS: Miscellaneous item such as collection of a note receivable on behalf of the company or receipt of a loan by the company from the bank

The above list includes the notation “ACH” for electronic funds transfers. ACH is a network for clearing electronic funds transfers among individuals, companies, and banks.7 Because electronic funds transfers may be either deposits or payments, ACH entries may indicate either a debit or credit entry to the company’s account. Likewise, entries to correct bank errors and miscellaneous items may indicate a debit or credit entry to the company’s account.

2. Using the Bank Statement as a Control Over Cash

The bank statement is a primary control that a company uses over cash. A company uses the bank’s statement by comparing the company’s recording of cash transactions to those recorded by the bank.

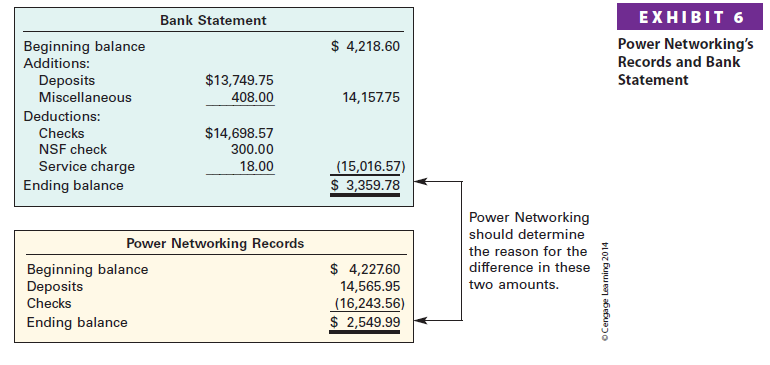

The cash balance shown by a bank statement is usually different from the company’s cash balance, as shown in Exhibit 6.

Differences between the company and bank balance may arise because of a delay by either the company or bank in recording transactions. For example, there is normally a time lag of one or more days between the date a check is written and the date that it is paid by the bank. Likewise, there is normally a time lag between when the company mails a deposit to the bank (or uses the night depository) and when the bank receives and records the deposit.

Differences may also arise because the bank has debited or credited the company’s account for transactions that the company will not know about until the bank statement is received. Finally, differences may arise from errors made by either the company or the bank. For example, the company may incorrectly post to Cash a check written for $4,500 as $450. Likewise, a bank may incorrectly record the amount of a check.

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

After all, what a great site and informative posts, I will upload inbound link – bookmark this web site? Regards, Reader.