The basic financial statements illustrated in this chapter are useful to bankers, creditors, stockholders, and others in analyzing and interpreting the financial performance and condition of a company. Throughout this text, various tools and techniques that are often used to analyze and interpret a company’s financial performance and condition are described and illustrated. The first such tool that is discussed is useful in analyzing the ability of a company to pay its creditors.

The relationship between liabilities and stockholders’ equity, expressed as a ratio of liabilities to stockholders’ equity, is computed as follows:

NetSolutions’ ratio of liabilities to stockholders’ equity at the end of November is

![]()

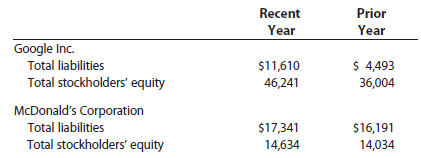

To illustrate, recent balance sheet data (in millions) for Google Inc. and McDonald’s Corporation are shown below.

The rights of creditors to a business’s assets come before the rights of the owners or stockholders. Thus, the lower the ratio of liabilities to stockholders’ equity, the better able the company is to withstand poor business conditions and to pay its obligations to creditors.

Google is unusual in that it has a very low amount of liabilities; thus, its ratio of liabilities to stockholders’ equity of 0.25 in the recent year and 0.12 in the prior year is low. In contrast, McDonald’s has more liabilities; its ratio of liabilities to stockholders’ equity is 1.18 in the recent year and 1.15 in the prior year. Since McDonald’s ratio of liabilities to stockholders’ equity increased slightly, its creditors are slightly more at risk at the end of the recent year. Also, McDonald’s creditors are more at risk than are Google’s creditors. The creditors of both companies are, however, well protected against the risk of nonpayment.

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

Very nice post. I just stumbled upon your blog and wished

to mention that I have really loved browsing your blog posts.

After all I will be subscribing in your rss feed and I

hope you write once more very soon!

Great article! That is the kind of info that are meant to

be shared around the net. Disgrace on the seek engines for no

longer positioning this post upper! Come on over and visit my

site . Thanks =)

I believe you have noted some very interesting details , thanks for the post.