Interest in technical analysis is resurging. The Efficient Markets Hypothesis (EMH) has been found to have a number of serious flaws, and stock price motion is being shown to be nonrandom. This new knowledge has cast doubt on the objections raised earlier about technical analysis, and academics are gradually beginning to perform serious studies on technical theory and indicators. Behavioral finance, a relatively new realm of study concerned with the psychology of market participants, has shown that investors do not necessarily act rationally, as is assumed in the EMH. They have found instances of predictable investor behavior and are beginning to explain some of the reasons for price patterns known by technical analysts over a hundred years. Studying even more deeply into the physiology of the human brain and how it operates, the science called “Neurofinance” investigates the effects of physical traits on memory and decision making. For example, through experiments with desk traders, it has been discovered that there is an inverse correlation between high trader emotional control and market volatility as well as a positive relationship between trader emotion and experience, suggesting that emotional regulation is important to trader expertise (Fenton-O’Creevy, November 2012).

During the equity market decline from 2000 to 2002 and from 2007 to 2009, many stocks declined severely before the damaging information causing their decline became public. In the earlier period, the names of Enron, WorldCom, Tyco, HealthSouth, Qwest, and others ring in the ears of those who suffered large losses by owning these stocks and by being fooled and lied to by their managements. Although this might not have been manipulation in the old style, it nevertheless again was the uninformed being duped by the informed. In the later period, the seriousness of the mortgage-debt implosion was kept from the public to prevent panic, yet the stocks affected by the crisis took terrible beatings. For example, Citigroup, a Dow Jones Industrial Average stock, declined from $57 to less than $1, and AIG, an institutional favorite, declined from over $1,400 to $8 during the same period.

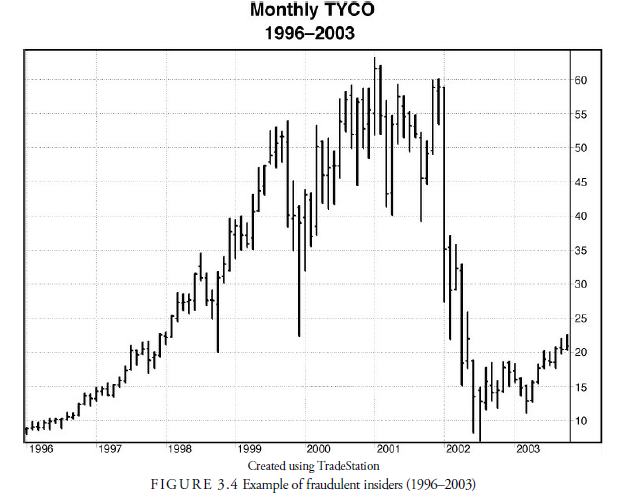

Figure 3.4 shows a monthly stock chart for Tyco. Technical analysis, if properly applied, would have protected an investor from large losses in this stock because it would have warned that the price action of these stocks was not consistent with what management was saying to the fundamental analysts. On January 9, 2002, a Prudential Securities analyst was the first large Wall Street analyst to downgrade the stock from a buy to a hold (New York Times). Figure 3.4 shows the price of Tyco falling while fundamental analysts were still recommending that investors buy the stock and while insiders of the company, such as the CFO, were claiming, “The more you know about our accounting, the more comfortable you will be” (Maremont, February 14, 2002).

In addition, falling commissions and maximum speed of communication have made technical analysis extremely useful to those who can spend the time studying it. Analysts developed trading rules that trade portfolios without human intervention. Futures markets in stock averages, currencies, and other markets have expanded and become more efficient, making competition extremely keen. Stock market trades have become almost instantaneous, and with the advent of computerized markets, intermediaries, with their delay and cost, have largely been eliminated.

Although hedge funds and other types of investment partnerships had been around since the 1950s, the series of large declines and poor performance in professionally managed portfolios in mutual funds, pension funds, and other investment pools convinced many individuals to split away from these entities and form their own hedge funds and investment advisory firms. This drain from the large firms into many specialized smaller firms that had the freedom and entrepreneurial spirit to experiment and follow nontraditional investment and trading methods created opportunity for technical analysts. Many of these new portfolio managers were closet or desk-drawer technicians themselves and hired others to assist them in their stock and futures decisions. They also hired PhDs in mathematics and computer engineering to assist in the use of the computer to screen for stocks and create trading and investment systems. These new additions to the research departments were called quants because they expanded quantitative research in the trading markets. Much of quant work was in fundamental correlations and signals, but a large proportion either combined price as part of their investigations or were technicians themselves. This activity bolstered technical analysis because many of these people were free from the academic stigma attached to it. Finally, the large ups and downs in the market from 2002 on discouraged fundamental research because those research advocates had no sense of market timing, and regardless of how attractive a stock might look under the fundamental scope, it invariably got clobbered in one of the large market declines. With its ability to minimize loss, technical analysis began to come back as a useful and viable method for reducing losses during these massive declines.

Computers are now so sophisticated that almost every possible technical calculation has been tried and tested. Market participants know, as they have long suspected, that no magic formula for riches exists. The reason is that people trading and investing in an imperfect, emotionally charged world determine prices. Because technical analysis deals only with price and some other incidental trading information, it has evolved into a study of more intangible information, concerned mostly with psychology and trading behavior. Modern computer technology has demonstrated that prices are not necessarily random, but they are not perfectly predictable either. The reason, of course, is that people buy and sell items based not only on what they believe are reasonable expectations but also on emotion, specifically fear and greed, inherent and learned bias, overconfidence, perception, and prejudice. Emotion has always been a large component in technical analysis studies.

Today, technical analysis covers many different periods of interest: long-term investing, short-term swing, intraday and high-frequency trading (in nanoseconds). The indicators and methods utilized for these horizons often have their own characteristics. In addition to time horizons, different investing or trading instruments exist. Commodities, for example, have their own technical information and peculiarities, as do currencies and financial instruments such as bonds and notes. The subject of technical analysis is complex. Because knowledge of all possibilities is impossible, individuals must decide on the period of interest, methods, and instruments best suited to their personality, ability, knowledge, and time available. Although the basic principles of technical analysis that we investigate in this book are common to all areas of markets, investors must learn by reading, studying, and experiencing the peculiarities of the markets in which they want to profit.

When you enter the stock market [or any other market], you are going into a competitive field in which your evaluations and opinions will be matched against some of the sharpest and toughest minds in the business. You are in a highly specialized industry in which there are many different sectors, all of which are under the intense study by men (and women) whose economic survival depends on their best judgment. You will certainly be exposed to advice, suggestions, and offers of help from all sides. Unless you are able to develop some market philosophy of your own, you will not be able to tell the good from the bad, the sound from the unsound.

—John Magee (Edwards and Magee, 2007)

Source: Kirkpatrick II Charles D., Dahlquist Julie R. (2015), Technical Analysis: The Complete Resource for Financial Market Technicians, FT Press; 3rd edition.

Some really superb information, Gladiola I noticed this.

Just wanna comment on few general things, The website design and style is perfect, the written content is real great : D.