Cash is normally listed as the first asset in the Current Assets section of the balance sheet. Most companies present only a single cash amount on the balance sheet by combining all their bank and cash fund accounts.

A company may temporarily have excess cash. In such cases, the company normally invests in highly liquid investments in order to earn interest. These investments are called cash equivalents.8 Examples of cash equivalents include U.S. Treasury bills, notes issued by major corporations (referred to as commercial paper), and money market funds. In such cases, companies usually report Cash and cash equivalents as one amount on the balance sheet.

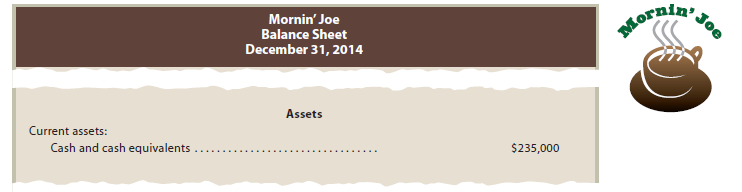

The balance sheet presentation for cash for Mornin’ Joe is shown below.

Banks may require that companies maintain minimum cash balances in their bank accounts. Such a balance is called a compensating balance. This is often required by the bank as part of a loan agreement or line of credit. A line of credit is a preapproved amount the bank is willing to lend to a customer upon request. Compensating balance requirements are normally disclosed in notes to the financial statements.

Source: Warren Carl S., Reeve James M., Duchac Jonathan (2013), Corporate Financial Accounting, South-Western College Pub; 12th edition.

I’m very happy to read this. This is the type of manual that needs to be given and not the accidental misinformation that’s at the other blogs. Appreciate your sharing this best doc.